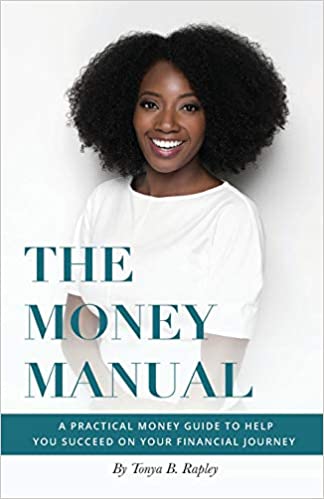

Whether you want to retire early, participate in the stock market, initiate financial dialogues with your family, or view money from a fresh perspective, we have put together a list of 9.5 books for every stage of life and every financial objective.

The 365loans team carefully selected these books, some of which are personal favorites, some of which we frequently discuss, and some of which have genuinely outstanding reviews and ratings.

Here are our top-choice 9.5 personal finance books for 2022, ranging from timeless guidance to in-depth budgeting breakdowns for millennials.

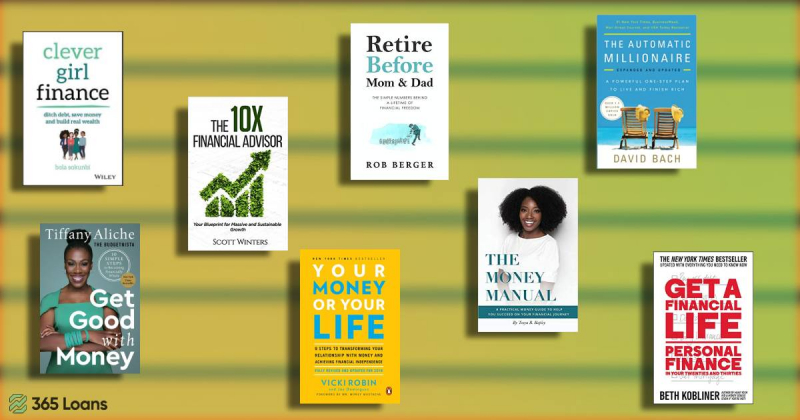

“Get Good with Money: Ten Simple Steps to Becoming Financially Whole”

Author: Tiffany ‘The Budgetnista‘ Aliche

Pages: 359 (in English)

Publication Year: 2021

Audience: General

Editorial Rating:

Get Good with Money is a priceless manual for developing wise financial practices and making your money work. It will assist you in creating a solid foundation for your life that is wealthy in all respects.

The Budgetnista, Tiffany Aliche, discusses her story of overcoming debt and other financial difficulties. Worksheets are also included in “Get Good With Money” to assist you in evaluating your financial wellness without feeling guilty or judged.

365loans’ takeaway:

“Get a Financial Life: Personal Finance in Your Twenties and Thirties”

Author: Beth Kobliner

Pages: 352 (in English)

Publication Year: 2017

Audience: Novice

Editorial Rating:

People in their twenties and thirties require financial assistance now more than ever. The New York Times best-selling book’s fourth edition has been edited and updated, and it is intended to help younger individuals navigate the world of personal finance.

Beth Kobliner provides a thorough foundation for anyone looking to start their own financial life, covering everything from filing taxes to debt repayment tactics.

365loans’ takeaway:

“The Money Manual: A Practical Money Guide to Help You Succeed On Your Financial Journey”

Author: Tonya B. Rapley

Pages: 147 (in English)

Publication Year: 2018

Audience: Novice

Editorial Rating:

The fundamentals of money management, from saving to credit creation, are covered in the book “The Money Manual.” This book, written by the writer behind MyFabFinance.com, is exciting and approachable, and it contains money lessons that anyone can use, regardless of their income.

With sections for questions and writing prompts, this book is more participatory than the majority. The book begins with a straightforward money check-in and offers practical guidance that might help you understand where you are and where you want to go from the outset.

365loans’ takeaway:

“How I Invest My Money: Finance experts reveal how they save, spend, and invest”

Author: Brian Portnoy, Joshua Brown

Pages: 192 (in English)

Publication Year: 2020

Audience: Knowledgeable

Editorial Rating:

Brian Portnoy and Joshua Brown have the answers if you have ever wondered how your financial counselor, a venture capitalist, or an online money expert invests their money.

This book develops on fundamental personal finance subjects and provides readers with suggestions to put into practice as they proceed with their financial journeys through succinct anecdotes from 25 financial gurus.

It does not provide enough explanation of the fundamentals to be a stand-alone book, making it a poor pick for someone just starting with money management. However, this book will benefit readers prepared to make new financial decisions.

365loans’ takeaway:

You can easily finish the book in one sitting, but you would benefit more by reading it one chapter at a time and giving yourself time to process each. It is a secret treasure for wealth-building, saving, and retirement-related strategies and those seeking motivation to move forward with their finances. Yet, it is nothing close to rocket science explained. Instead, the book is a simple analysis of the Gen-X success of a few, mostly coming from below-the-average families.

“The Simple Path to Wealth: Your road map to financial independence and a rich, free life”

Author: J.L. Collins, Mr. Money Mustache (Foreword)

Pages: 286 (in English)

Publication Year: 2016

Audience: Knowledgeable

Editorial Rating:

There is no shortage of understandable and practical investment advice in “The Simple Path to Wealth,” which was first presented in a series of letters by the author to his daughter. It adopts a light and informal tone in several chapters but doesn’t hesitate to explain more challenging subjects. With almost 3,800 Amazon reviews and an overall rating of 4.8 stars, it has the greatest average rating of any personal finance book on the list.

365loans’ takeaway:

This book is intended for readers familiar with the ideas of financial independence, index funds, and the “4 percent rule.”

“The Automatic Millionaire, Expanded and Updated: A Powerful One-Step Plan to Live and Finish Rich”

Author: David Bach

Pages: 288 (in English)

Publication Year: 2016

Audience: General

Editorial Rating:

This book asserts that putting up your money to manage yourself could aid in growing wealth over a long period, from saving to debt repayment. One straightforward idea is taught in this book by financial journalist David Bach: automating your accounts.

365loans’ takeaway:

“Retire Before Mom and Dad: The Simple Numbers Behind A Lifetime of Financial Freedom”

Author: Rob Berger

Pages: 268 (in English)

Publication Year: 2019

Audience: General

Editorial Rating:

This book is a must-read introduction to the fundamentals of starting down the FIRE (Financially Independent, Retire Early) movement for anyone considering retiring early. However, even if early retirement is not on your to-do list, it also examines ideas that make financial independence and retirement achievable.

365loans’ takeaway:

The book is a great read for anyone looking to learn more about achieving financial independence.

“Clever Girl Finance: Ditch debt, save money, and build real wealth”

Author: Bola Sokunbi

Pages: 240 (in English)

Publication Year: 2019

Audience: Novice

Editorial Rating:

This simple financial manual starts with the fundamentals of accumulating wealth and expands on them rather than making assumptions.

This book uses true stories from the author’s own life to ground its lessons in reality. Additionally, no prior knowledge is necessary.

Financial planning and budgeting fundamentals are covered, followed by explanations of the credit system, debt, investment, and even how to request a raise. It is an excellent option for anyone who is just learning about personal finance or needs a refresher course.

365loans’ takeaway:

“The 10X Financial Advisor: Your Blueprint for Massive and Sustainable Growth”

Author: Scott Winters, Melissa Caudle

Pages: 172 (in English)

Publication Year: 2020

Audience: Experts

Editorial Rating:

Scott Winters’ “The 10X Financial Advisor” is perfect for financial advisors who want to expand their businesses but are unsure how to do it. It encourages financial professionals to manage their businesses like, well, businesses. His research is based on the Quantum Leap Success Model, a strategy that will assist financial advisors in expanding and maintaining their businesses’ growth.

The book examines how that one financial advisor at every firm who is 10 times more successful attained that growth—and maintained it—as the working title suggests.

365loans’ takeaway:

9½: “Your Money or Your Life”

Author: Vicki Robin, Joe Dominguez

Pages: 384 (in English)

Publication Year: 2008 (Updated 2018)

Audience: General

Editorial Rating:

At its essence, “Your Money or Your Life” outlines a strategy to achieve financial independence. Despite being somewhat lengthy, the book does offer advice on all facets of economic freedom, from the mindset needed to achieve it to the investment choices you should be making. In addition, it includes detailed suggestions you might use whether or not you want to retire early.

365loans’ takeaway:

The reason our team counts this book as a halfling is that you could quickly get the book’s essence by reading the last nine pages. But, unfortunately, the contents of this book have been beaten to death in 300+ pages in what could have been condensed into the epilogue.

Do you want to find out more books of this type?

Here are a few more recommendations for further reading:

- “The Millionaire Next Door” by Thomas J. Staley and William D. Danko

- “The Total Money Make Over” by Dave Ramsey

- “Broke Millennial” by Erin Lowry