In today’s digital landscape, businesses of all sizes face a significant threat from cybercrime. Data breaches, ransomware attacks, and other cyber threats can have devastating consequences, including financial loss, reputational damage, and legal liabilities. To mitigate these risks, more and more companies are turning to cyber insurance. In this article, we will explore the importance of cyber insurance and how it can protect your business from data breaches and cyber attacks.

Understanding Cyber Insurance:

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, is a specialized form of insurance designed to protect businesses against the financial losses resulting from cyber threats. It provides coverage for expenses related to data breaches, network security breaches, and cyber attacks.

Coverage Offered by Cyber Insurance Policies:

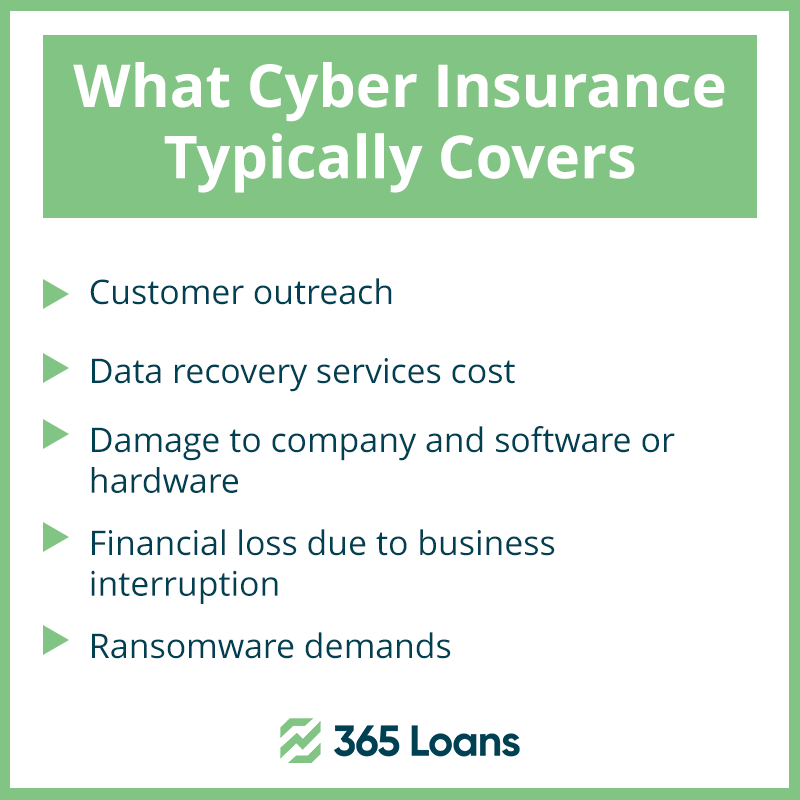

Cyber insurance policies typically offer coverage for several key areas:

a. Data Breach Response: This includes expenses related to investigating and managing a data breach, notifying affected individuals, credit monitoring services, public relations efforts, and legal counsel.

b. Business Interruption: Coverage for loss of income and extra expenses incurred as a result of a cyber attack that disrupts business operations.

c. Cyber Extortion: Protection against ransomware attacks, including ransom payments and associated expenses.

d. Network Security Liability: Coverage for legal expenses and damages in case of lawsuits resulting from a data breach or security incident.

e. Privacy Liability: Coverage for costs associated with claims related to the unauthorized disclosure of sensitive customer information.

f. Regulatory and Legal Compliance: Coverage for expenses related to fines, penalties, and legal costs arising from non-compliance with data protection regulations.

Assessing Your Cyber Insurance Needs:

Evaluate your business’s specific risks and vulnerabilities to determine the appropriate level of coverage needed. Consider factors such as the type and volume of data you handle, the industry you operate in, and your existing security measures. Engage with an experienced insurance professional to identify potential coverage gaps and tailor a policy that suits your business requirements.

Implementing Strong Cybersecurity Measures:

While cyber insurance is essential, it should not be a substitute for robust cybersecurity practices. Insurers often require businesses to implement specific security measures to qualify for coverage. Implementing practices such as strong password policies, data encryption, regular software updates, employee training, and conducting security audits will not only enhance your cybersecurity but also demonstrate your commitment to risk mitigation, potentially reducing insurance premiums.

Evaluating Insurance Providers:

When choosing a cyber insurance provider, consider their experience in the cyber insurance market, reputation, and financial stability. Look for insurers that offer comprehensive coverage, prompt claims handling, and access to risk management resources.

Cyber Insurance as Part of a Holistic Risk Management Strategy:

Cyber insurance should be viewed as a crucial component of a broader risk management strategy. It works alongside other preventive measures, such as robust IT security, employee training, and incident response planning. Regularly reassess and update your cyber insurance coverage to align with emerging threats and changes in your business environment.

Conclusion:

As cyber threats continue to evolve and grow, the importance of cyber insurance cannot be overstated. It provides financial protection, support, and resources to help businesses recover from data breaches and cyber attacks. By understanding your business’s unique risks, implementing strong cybersecurity measures, and selecting the right cyber insurance coverage, you can safeguard your organization’s financial well-being and reputation in an increasingly digital world.