Protecting your financial well-being is essential, and one aspect often overlooked is disability insurance. Life is unpredictable, and an unexpected injury or illness can have a significant impact on your ability to earn an income. Have you ever wondered what disability insurance covers and why it might be important for you? In this article, we’ll delve into the world of disability insurance, demystify its coverage, and explore the reasons why it could be a valuable asset in safeguarding your financial future. So, let’s dive in and discover the importance of disability insurance and how it can provide you with peace of mind during uncertain times.

Understanding Disability Insurance

Disability insurance is a financial safety net that provides income protection in the event that you are unable to work due to a disability. It is designed to replace a portion of your income, helping you meet your financial obligations and maintain your standard of living if you become unable to earn a paycheck.

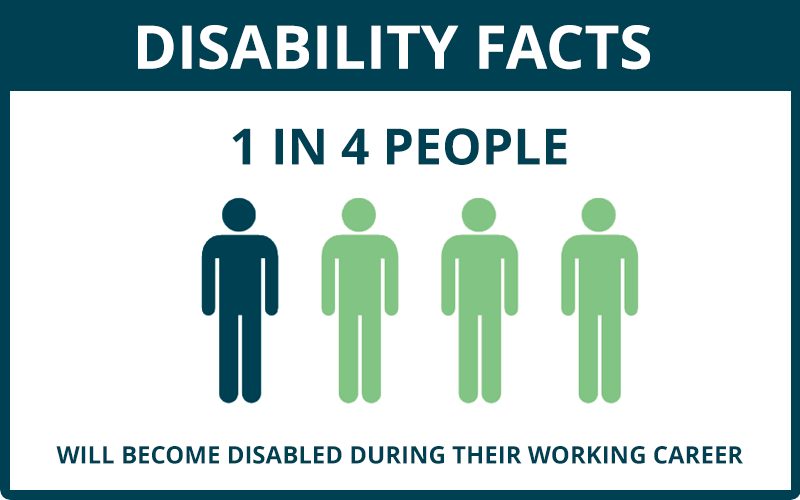

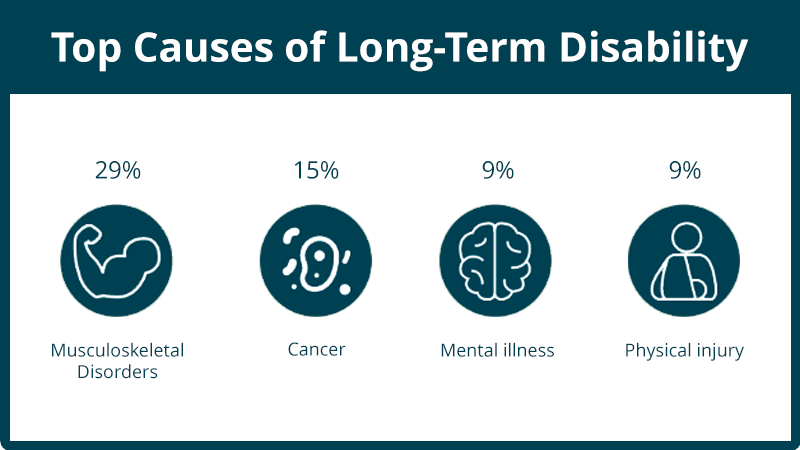

Disability can result from various factors, such as illness, injury, or a chronic condition. It can happen to anyone at any time, and the consequences can be far-reaching. Without the ability to work and earn an income, you may struggle to cover essential expenses like rent or mortgage payments, utilities, medical bills, and daily living costs.

That’s where disability insurance comes in. It acts as a safeguard, providing you with a source of income if you are unable to work due to a covered disability. It offers financial protection and peace of mind, ensuring that you can continue to meet your financial obligations and support yourself and your loved ones during challenging times.

Disability insurance policies typically have two main types of coverage: short-term disability insurance (STD) and long-term disability insurance (LTD). Short-term disability insurance provides coverage for a shorter duration, usually for a few months up to a year, while long-term disability insurance offers coverage for an extended period, which can be several years or even until retirement age.

Coverage of Disability Insurance

Disability insurance provides coverage for a range of disabilities that may prevent you from working and earning an income. The specific coverage details may vary depending on the policy and insurer, but here are some common aspects typically covered by disability insurance:

- Total Disability: Disability insurance typically covers total disability, which means you are unable to perform the duties of your occupation due to an injury, illness, or medical condition. It provides financial protection if you are completely unable to work.

- Partial Disability: Some disability insurance policies also offer coverage for partial disability. This means that if you experience a disability that restricts your ability to work in your occupation, the policy may provide a partial benefit to supplement your income.

- Own-Occupation or Any-Occupation Coverage: Disability policies may define disability based on your ability to work in your own occupation or any occupation. Own-occupation coverage provides benefits if you cannot perform the duties of your specific occupation, while any-occupation coverage requires that you cannot work in any occupation for which you are reasonably qualified.

- Short-Term Disability (STD): Short-term disability insurance policies offer coverage for a limited duration, typically up to a year. This coverage is designed to protect you during the initial period of disability, providing income replacement until you can return to work or transition to long-term disability coverage.

- Long-Term Disability (LTD): Long-term disability insurance provides coverage for an extended period, ranging from several years to until you reach retirement age. It offers income replacement for prolonged disabilities that prevent you from working in your occupation or any suitable occupation.

- Rehabilitation and Return-to-Work Assistance: Many disability insurance policies include support services to help you with rehabilitation and return-to-work efforts. This may include vocational training, job placement assistance, or workplace modifications to facilitate your return to gainful employment.

It’s important to note that disability insurance policies have specific terms, conditions, and exclusions. Pre-existing conditions, self-inflicted injuries, or disabilities resulting from certain activities may not be covered. It’s crucial to review the policy details carefully and understand the coverage limitations and exclusions before purchasing a disability insurance policy.

Features/Benefits of Disability Insurance

- Income replacement during disability:

Disability insurance offers the crucial benefit of income replacement during a period of disability. When an individual is unable to work due to a covered disability, disability insurance provides a portion of their pre-disability income. This helps maintain financial stability and ensures that ongoing expenses can be met, such as mortgage or rent payments, utility bills, and daily living costs.

- Coverage for medical expenses and rehabilitation services:

In addition to income replacement, disability insurance may provide coverage for medical expenses related to the disability. This can include doctor visits, hospitalization, surgeries, medications, and rehabilitation services. Having coverage for these expenses can alleviate the financial burden of necessary healthcare and rehabilitation, enabling individuals to focus on their recovery without worrying about excessive medical costs.

- Additional benefits and riders:

Disability insurance policies often offer additional benefits and optional riders to customize coverage. One common rider is the cost-of-living adjustment (COLA), which helps protect against inflation by adjusting the benefit amount over time. Other riders may include residual disability coverage, which provides benefits if the disability causes a partial loss of income. These additional benefits and riders allow individuals to tailor their coverage to better meet their specific needs.

- Coverage for partial or residual disabilities:

Disability insurance can also provide coverage for partial or residual disabilities. Even if an individual is able to work in a limited capacity due to their disability, they may experience a reduction in income. Disability insurance can bridge this income gap by providing benefits that make up for the shortfall, ensuring financial stability during the partial disability period. This feature is particularly valuable for individuals whose disabilities allow them to continue working but with decreased earning potential.

Why You Might Need Disability Insurance

Disability insurance is essential due to the financial risks associated with disabilities. It acts as a safeguard against the loss of income, ensuring that you can maintain financial stability during a period of disability. Whether you’re in the early stages of your career, raising a family, or planning for retirement, disability insurance provides crucial security. While government assistance programs exist, disability insurance offers additional benefits and customized coverage, filling potential gaps in financial protection. By having disability insurance, you can have peace of mind knowing that you are prepared for the unexpected and can continue to meet your financial obligations even if a disability prevents you from working.

How to Obtain Disability Insurance

To obtain disability insurance, follow these steps:

- Assess your needs: Evaluate your financial situation and determine the coverage amount and duration that suits your requirements.

- Research insurance providers: Look for reputable insurers and compare their coverage options, policy features, and terms.

- Understand policy details: Thoroughly review the policy, including definitions of disability, waiting periods, benefit periods, and any exclusions or limitations.

- Work with an agent or broker: Consider working with an experienced professional who specializes in disability insurance to guide you through the process.

- Complete the application: Fill out the application form accurately, providing information about your occupation, medical history, and any pre-existing conditions.

- Review and accept the policy: Carefully review the policy documents, including terms, conditions, coverage details, and premiums. Accept the policy and make the required payments.

- Maintain communication: Stay in touch with your insurer, informing them of any changes in your circumstances.

Conclusion

In conclusion, disability insurance is a vital safeguard for your financial well-being. It provides income replacement if you are unable to work due to a disability, ensuring that your essential expenses are covered. By understanding the coverage options and policy details, you can make an informed decision and choose a policy that suits your needs. Remember to assess your requirements, research reputable insurers, and work with professionals to navigate the process. Obtaining disability insurance offers peace of mind, knowing that you are protected in the face of unforeseen circumstances. Don’t overlook the importance of this valuable coverage – it can make a significant difference in maintaining your financial stability during challenging times.