Experiencing an unexpected event such as a car accident, natural disaster, or a sudden illness can be overwhelming. In these difficult times, insurance claims play a crucial role in helping individuals and businesses recover from their losses. However, navigating the insurance claims process can be confusing, especially if you’re unfamiliar with the steps involved. This comprehensive guide will walk you through the insurance claims process, providing you with a clear understanding of what to expect and how to ensure a smoother experience.

Step 1: Review Your Insurance Policy

Before you even need to file a claim, it’s essential to familiarize yourself with your insurance policy. Read through the policy document carefully and understand the coverage details, deductibles, limits, and any specific requirements or exclusions. This knowledge will empower you to make informed decisions when filing a claim and ensure that you don’t miss out on any entitled benefits.

Step 2: Assess the Damage and Gather Evidence

Once an incident occurs that may require an insurance claim, it’s crucial to assess the damage or loss as soon as possible. Take photographs or videos of the scene, documenting the extent of the damage or injuries. Collect any relevant documents, such as police reports, medical records, or receipts for damaged items.

Step 3: Notify Your Insurance Company

Promptly inform your insurance company about the incident and initiate the claims process. Most insurance policies have specific guidelines on how and when to report a claim, so make sure to adhere to them. Provide the necessary details about the incident, including the date, time, location, and a comprehensive description of what occurred. Be honest and accurate in your account, as any inconsistencies may lead to delays or complications.

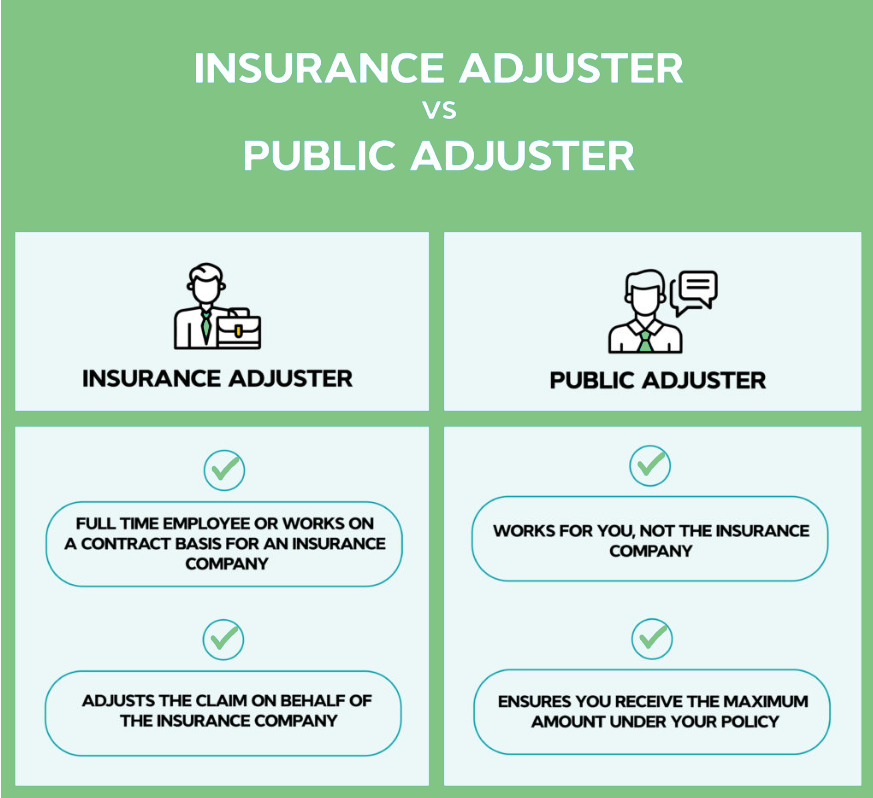

Step 4: Meet with an Adjuster

After filing your claim, your insurance company will assign an adjuster to assess the damage or losses. The adjuster may contact you to schedule an appointment and evaluate the situation. Cooperate fully during this process, and be prepared to present all the evidence you have gathered. The adjuster will investigate the claim, verify the information, and determine the coverage and amount eligible for reimbursement.

Step 5: Understand Your Rights and Responsibilities

As a policyholder, it’s crucial to understand your rights and responsibilities throughout the claims process. Familiarize yourself with the terms and conditions outlined in your policy, including the timeline for claim resolution, the right to appeal a decision, and any obligations you have, such as mitigating further damage or cooperating fully with the investigation. Knowing your rights will ensure that you are treated fairly and that the process remains transparent.

Step 6: Negotiate the Settlement

Once the adjuster completes their evaluation, they will present you with a settlement offer. Review the offer carefully and ensure that it covers all the losses you have incurred according to the terms of your policy. If you believe the settlement is inadequate, you have the right to negotiate. Provide additional evidence, such as expert opinions or quotes for repair costs, to support your case. Engage in open and respectful communication with your insurance company to reach a fair resolution.

Step 7: Finalize the Claim

If you and your insurance company agree on a settlement amount, finalize the claim by signing any necessary documents. Review the settlement agreement to ensure that it accurately reflects the terms you have negotiated. Once the paperwork is complete, your insurance company will issue the settlement payment according to their guidelines.

Step 8: Follow Up and Provide Feedback

After your claim is settled, it’s essential to follow up with your insurance company to ensure that all necessary actions are taken, such as canceling temporary repairs or closing any open files. Take the opportunity to provide feedback on your claims experience, highlighting both positive aspects and areas for improvement. Your input can help insurance companies enhance their processes and customer service.

Remember, the claims process may vary depending on the type of insurance and the complexity of the claim. Always refer to your specific policy and consult with your insurance agent or company if you have any questions or concerns. By following these steps and being proactive throughout the process, you can navigate insurance claims with greater confidence and achieve a smoother and more satisfactory resolution to your loss or damage.