Pet insurance has become an essential safety net for pet owners, providing much-needed coverage for veterinary expenses and offering peace of mind in uncertain times. Just like our own health insurance, pet insurance aims to manage the costs of medical care for our beloved furry friends. But before diving into the world of pet insurance, it’s important to weigh the pros and cons to make an informed decision. By understanding the benefits and drawbacks, pet owners can determine if pet insurance is a good fit for their financial situation and their pet’s unique needs.

How Pet Insurance Works

Pet insurance operates on a reimbursement-based system, which means that the pet owner pays the veterinary bills upfront and then submits a claim to the insurance company for reimbursement. Here’s a breakdown of key components:

- Reimbursement-based system:

When you have pet insurance, you pay the veterinarian directly for your pet’s treatment. Afterward, you submit a claim to the insurance company with the relevant documentation, such as itemized invoices and medical records. The insurance company then reviews the claim and reimburses you for the covered expenses, based on the policy’s terms and conditions.

- Premiums, deductibles, co-pays, and coverage limits:

Pet insurance policies require regular premium payments, usually on a monthly or annual basis. Premiums vary depending on factors like the pet’s age, breed, location, and the coverage options selected. Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Co-pays are a fixed percentage or amount that you contribute toward each veterinary visit or procedure, even after meeting the deductible. Policies also have coverage limits, which can be per incident, per year, or over the pet’s lifetime, capping the maximum amount the insurance company will reimburse.

- Waiting periods and pre-existing condition exclusions

Pet insurance policies typically have waiting periods before certain coverages become effective. These waiting periods can range from a few days to a few weeks, depending on the insurance provider and the specific coverage. Pre-existing conditions, which are illnesses or injuries that existed before the policy’s start date, are generally not covered by pet insurance. It is important to note that definitions and exclusions for pre-existing conditions may vary among insurance providers.

Types of pet insurance coverage

Pet insurance offers a range of coverage options to address various aspects of your pet’s healthcare needs. Understanding these coverage types can help you choose a policy that best suits your pet’s requirements. Here are the main types of coverage typically available:

- Accident coverage:

This type of coverage focuses on unexpected injuries resulting from accidents, such as fractures, cuts, or ingestion of foreign objects. It helps cover expenses related to emergency veterinary care, diagnostics, surgeries, hospitalization, medications, and rehabilitation..

- Illness coverage

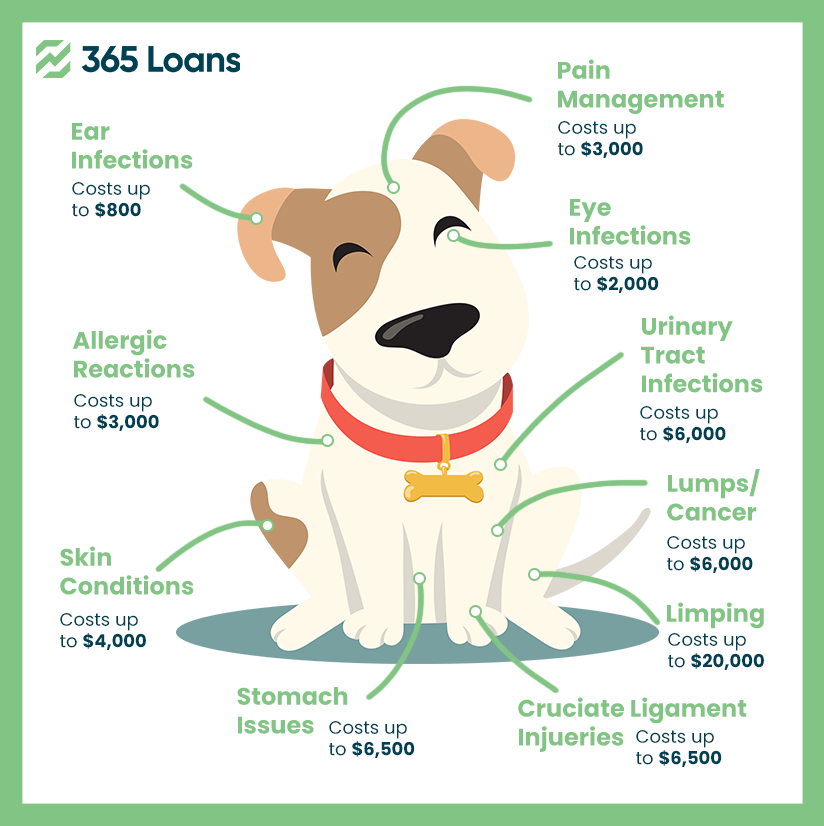

Illness coverage is designed to assist with the costs associated with illnesses that may affect your pet. This includes infections, allergies, digestive disorders, respiratory conditions, cancer, and chronic illnesses like diabetes or kidney disease. It covers veterinary consultations, diagnostic tests, treatments, medications, and ongoing management of the illness.

- Wellness and preventive care coverage:

some pet insurance plans offer optional coverage for routine wellness care and preventive treatments. This may include vaccinations, annual check-ups, dental cleanings, spaying or neutering, flea and tick prevention, heartworm medications, and nutritional supplements. Wellness coverage encourages proactive pet care and may help offset the costs of routine expenses.

- Hereditary and congenital condition coverage

These are health issues that are inherited or present at birth, often associated with specific breeds. Examples include hip dysplasia, heart defects, eye disorders, or certain genetic predispositions. Coverage for these conditions may involve additional premiums or specific endorsements, but it helps cover expenses related to diagnostics, treatments, surgeries, and ongoing management.

Pros and Cons of Insuring Your Furry Friend

Conclusion

Pet insurance offers financial protection and peace of mind by covering unexpected veterinary expenses and emergencies. It provides comprehensive coverage for accidents, illnesses, and preventive care, ensuring access to quality treatment options. However, it’s crucial to consider factors such as monthly premiums, exclusions, waiting periods, potential premium increases, and limitations on pre-existing conditions. Take the time to evaluate your pet’s needs, assess your finances, and make an informed decision based on individual circumstances. While pet insurance can be a valuable tool in managing veterinary costs, it’s important to carefully weigh the pros and cons before making a final decision.