As an instant similarity example in the Mutual Funds vs. ETFs comparison, mutual funds and exchange-traded funds (ETFs) can provide immediate diversification at a reasonable cost to your portfolio. However, there are some significant distinctions, including the cost of the funds. Overall, ETFs have an advantage because they are more likely to practice passive investing and offer tax benefits.

7 common traits and critical differences between Mutual Funds and ETFs

Mutual funds and ETFs are popular among investors, even newbies, because of the way they distribute money in the stock market. This reduces your risks and keeps you from investing in a single stock, which can backfire if the firm has a slump. You might want to glance at ETFs first before moving on to mutual funds if you are a beginner.

Imagine going to a restaurant and wanting to try a little of everything on the menu. Instead of purchasing an individual dish, you decide to buy the sampler plate. Mutual funds and ETFs are the sampler plates.

Rita-Soledad Fernandez Paulino, a financial educator at Wealth Para Todos

Let’s look at the pros and cons of mutual funds and ETFs in detail.

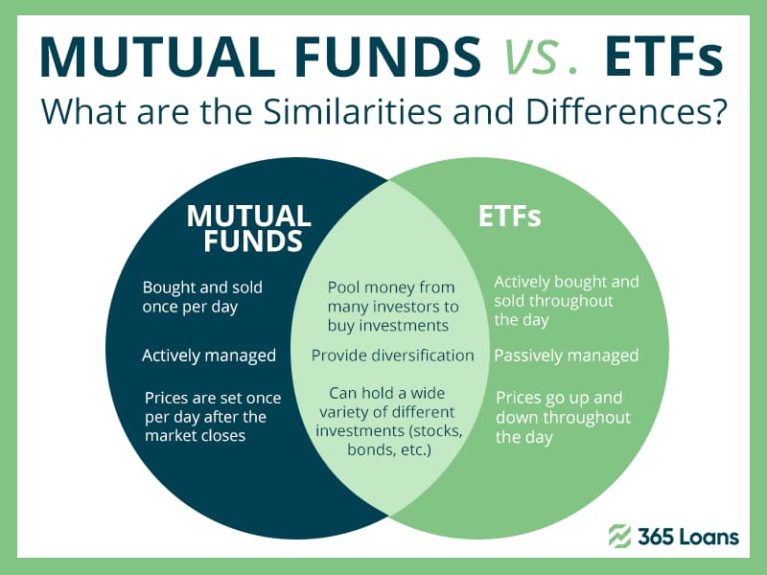

Mutual Funds vs. ETFs: similarities

- Low-risk investment: compared to hand-picked equities and bonds, both mutual funds and ETFs are low-risk investments. While investing, in general, entails some risk, mutual funds and exchange-traded funds (ETFs) have a similar level of risk. It depends on the mutual fund or exchange-traded fund (ETF) you invest in.

- Vast exposure to opportunities: Mutual funds and exchange-traded funds (ETFs) provide exposure to asset classes and specialist markets. They offer greater diversification than a single stock or bond, and investors can use them to build a diversified portfolio by combining funds from several asset types.

- Both mutual funds and exchange-traded funds (ETFs) can pay dividends.

- Structural resemblance: They’re both “pools” made up of numerous individual stocks, bonds, and other instruments that help spread your investments. Instead of picking personal assets by hand, you can utilize any fund to acquire hundreds, thousands, or tens of thousands of various stocks and bonds instantaneously.

- Fund experts oversee the management of ETFs and mutual funds. These professionals select and monitor the equities and bonds in which the funds invest, saving you time and effort.

Evident difference between Mutual Funds and ETFs

| Mutual Funds | ETFs | |

|---|---|---|

| Price oversight | You’ll get the same price as everyone else who bought and sold that day, regardless of when you place your order. That price isn’t determined until the end of the trading day. ✅ Better control over how you trade. | ETFs are traded like stocks and are bought and sold on a stock exchange, with daily price fluctuations. This means that the price you pay for an ETF will likely differ from what other investors pay. |

| Minimum investment | Mutual funds, unlike ETFs, can be bought in fractional shares or fixed dollar amounts. The minimum initial investments are typically a fixed cash amount, not dependent on the fund’s share price. Example: Think of a hypothetical purchase of 30 shares with a $100 net asset value (NAV). That means the minimum for this mutual fund would be $3,000. | A venture capitalist can purchase an ETF for one share’s worth, often known as the ETF’s market price. Depending on the ETF, that price might be as low as $50 or as much as a few hundred dollars. ✅ More suitable for lower investments. |

| Commissions & cost-efficiency | Mutual funds do not charge trading commissions, although they may charge other fees and operating expenses. ✅ A mutual fund could be a suitable investment if you’re looking for cost-efficiency. | Costs are both implicit and explicit in ETFs. So while your broker will disclose the cost of trading fees, and the ETF provider will disclose the operating expense ratio, don’t forget about the bid/ask spread and premium/discount to NAV. These are hidden costs that arise from buying or selling an ETF at a price that may differ from the underlying holding’s value. |

| Automated transactions | Depending on your preferences, you can set up automatic investments and withdrawals into and out of mutual funds. ✅ MFs allow for repeated automatic transactions. | ETFs do not allow you to make automatic investments or withdrawals. |

| Fund management: Active vs. Passive | Active and indexed mutual funds are available. However, most are actively managed. Fund managers oversee active mutual funds. | While fund managers can actively or passively manage ETFs, most are passive investments tied to the performance of a specific index. |

Do mutual funds outperform ETFs?

Even though it would be great to finish with a summary of whether one type of fund investment performs better than the other, it depends on your objectives and investment style.