In today’s world, credit plays a significant role in our financial lives. Whether you’re applying for a mortgage, car loan, or personal loan, lenders rely heavily on credit scores to assess your creditworthiness and determine the terms of your loan. Understanding the role of credit scores in loan applications is crucial if you want to navigate the lending landscape successfully. In this article, we’ll explore the importance of credit scores, how they are calculated, and steps you can take to improve yours.

What is a Credit Score?

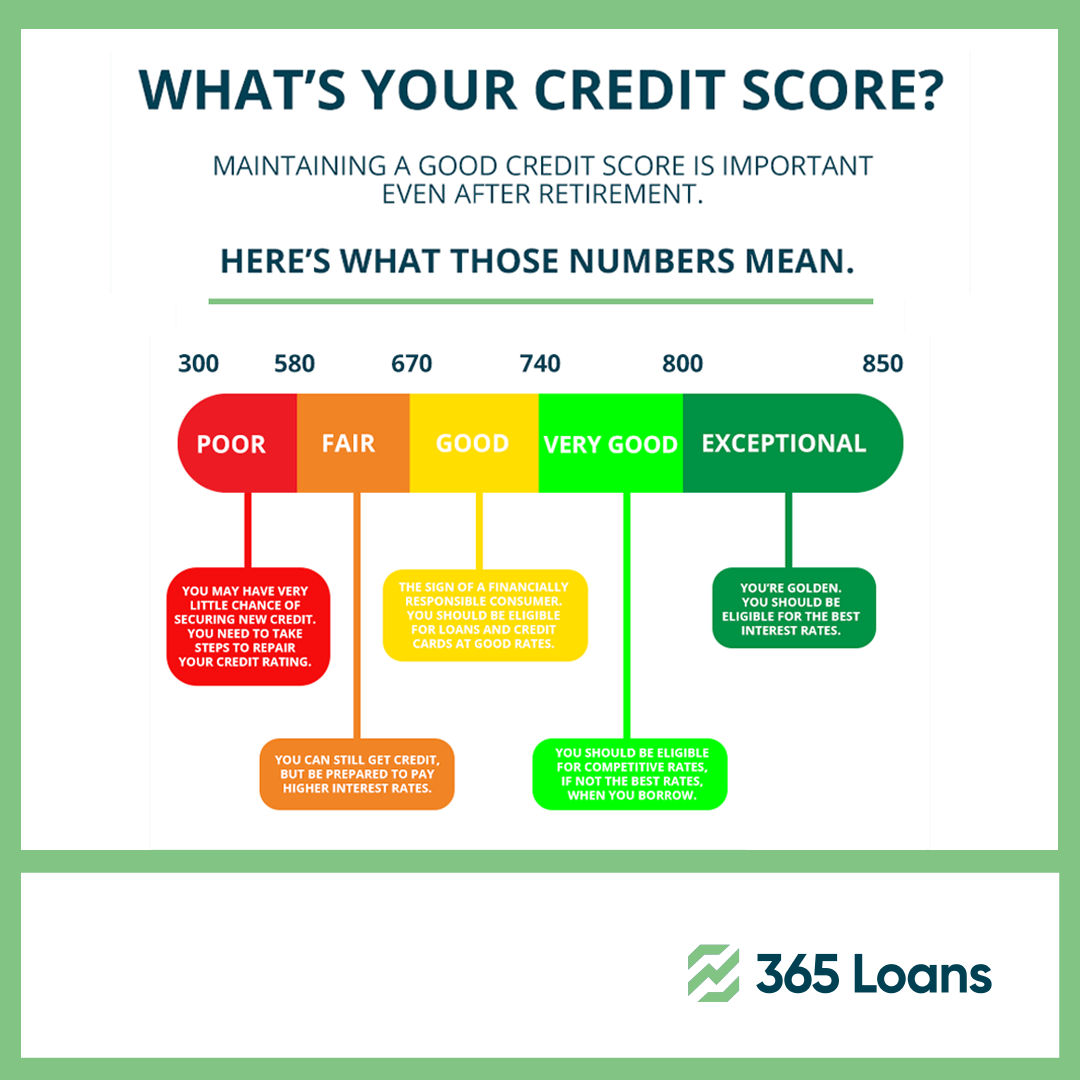

A credit score is a three-digit number that represents your creditworthiness based on your credit history. It provides lenders with an objective measure of your ability to repay borrowed money. The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. FICO scores range from 300 to 850, with higher scores indicating lower credit risk.

Why are Credit Scores Important?

Credit scores are crucial in loan applications because they give lenders insight into your financial responsibility. They provide a quick snapshot of your credit history and help lenders assess the risk involved in lending you money. A higher credit score suggests that you have a history of managing credit responsibly, making payments on time, and keeping debt levels under control. As a result, lenders are more likely to offer you favorable loan terms, such as lower interest rates and higher loan amounts.

How are Credit Scores Calculated?

While the exact formulas used to calculate credit scores are proprietary, certain factors commonly influence credit scores. Here are the key elements that impact your credit score:

- Payment History: This is the most significant factor affecting your credit score. Lenders want to see a consistent record of on-time payments, so late payments, delinquencies, or defaults can significantly lower your score.

- Credit Utilization: This refers to the percentage of your available credit that you’re currently using. Keeping your credit utilization below 30% is generally recommended for maintaining a good credit score.

- Length of Credit History: Lenders prefer borrowers with longer credit histories, as it provides more information about your financial habits. This factor considers the age of your oldest credit account, the average age of all accounts, and the length of time since your most recent activity.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly.

- New Credit Applications: Opening multiple new credit accounts within a short period may be seen as a red flag, as it can indicate financial instability. Each credit application typically triggers a hard inquiry, which temporarily lowers your credit score.

Improving Your Credit Score

If you’re planning to apply for a loan and your credit score is less than ideal, there are steps you can take to improve it:

- Pay your bills on time: Consistently making timely payments is one of the most effective ways to boost your credit score.

- Reduce credit card balances: Aim to keep your credit card balances below 30% of your available credit limit.

- Limit new credit applications: Be mindful of applying for new credit unless it’s necessary, as excessive inquiries can lower your score.

- Review your credit report: Regularly check your credit report for errors or inaccuracies that could be negatively impacting your score. If you find any, report them to the credit bureaus for correction.

- Maintain a long credit history: Avoid closing old credit accounts, especially if they’re in good standing. A longer credit history can have a positive influence on your credit score.

You Might Want to Check Out: How to Quickly Improve Your Credit Score

In conclusion, credit scores play a crucial role in loan applications. They provide lenders with a standardized measure of your creditworthiness, helping them assess the risk involved in lending you money. By understanding how credit scores are calculated and taking steps to improve your credit, you can increase your chances of securing favorable loan terms. Remember, maintaining a good credit score is a long-term commitment that requires responsible financial habits and consistent repayment practices.