Many people consider estate planning a futile exercise unless you own a remarkable number of assets and liabilities. But estate planning is about taking proactive actions to provide for your family and relatives, preserving family wealth, or simply leaving your legacy to a charitable cause. It takes into account the management of any houses, cars, stocks, artwork, life insurance, pensions, and debt relating to you. So even if you feel like you don’t own as much as you aim to, at the very least, you should consider what you don’t want to leave behind as debt, including limiting potential taxes.

Fundamentals of Estate Planning

Usually, deciding what will happen to your properties and financial obligations if you suffer incapacitation or death is done with the help of an experienced attorney. The planning includes the bequest of assets to heirs and the settlement of estate taxes. The sooner you go through that process, the better, as predicting casualties is not in the scope of human capacity as a rule. You might visualize the process as an overwhelming event; however, it is pretty straightforward.

Here’s a list of 10 bases that will make the process go smoothly for you.

1. Understand Estate Planning

Simply put, it is the streak of actions that would take shape in case of your death or incapacitation. It involves the endowment of what you own, i.e., your assets, to your heirs and your estate tax settlement. Your assets will be distributed net of any liabilities, or the liabilities may transfer to your heirs. These are essential concepts that you should realize when starting with estate planning.

For example, your house will see a seizure if it isn’t paid off in full, in case there aren’t enough account balances to settle at the time of your demise.

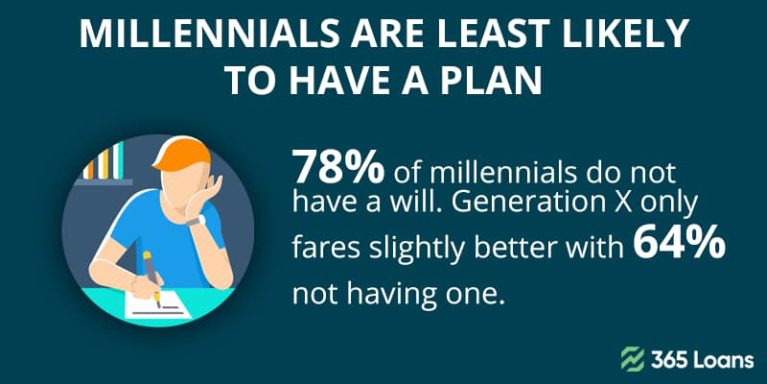

2. Decide Between Writing A Will Or Trust

A will is a document you will write about assets apportioning in case of demise. You can nominate a single heir or include anyone you want, including your ex-spouse or adopted children. The will on your passing will become the public and legal document to distribute your wealth.

On the other hand, a trust will act as a third party to act on your behalf to legally apportion the assets among your lawful heirs. The trustee will also work according to the trust document and what you mandate them to act upon.

3. Concisely Compile A List Of Your Assets

Think about intangible assets, even if you don’t have any physical assets. For example, your list of intangible assets may include your saving certificates, insurance and retirement funds, and other financial products.

Tangible assets include your house, vehicle, land, or investments in real estate. Your list must also include any future benefits. For example, your house under a mortgage contract may not be considered yours to account for as an asset, which is why you should be including the maturity date and terms of the agreement in your list.

4. Match Your Assets Against Liabilities

Calculating the net effects of your matching on your wealth is imperative. Your liabilities include bank loans, house mortgages, insurance premiums, retirement fund contributions, personal loans, and other similar debt. Once you list them all, it will be easier to allocate and apportion assets against these liabilities. Remember, your estate planning involves a future situation where, sadly, you wouldn’t be present or unable to contribute.

5. Calculate The Insurance And Retirement Benefits

Your employer will certainly be contributing to your retirement plans. Additionally, you may have applied for various health, permanent disability, or life insurance. List them all during the estate planning, if that’s your case. It’s also vital to calculate the future benefits arising from these accounts and to nominate or update your heirs to your employer and the insurance company.

6. Plan And Write Your Will

Planning is where you start writing about allocating your assets to your heirs. The first step is to include the heirs and any valuable person you wish to nominate in your will. For example, you can assign the designators for bank accounts and insurance plans here. After that, you should choose the executor of your will – an independent document or an estate agent that acts on your behalf.

7. Calculate The Estate Taxes

As with your assets and liabilities, the estate taxes will also be accounted for when your will is executed. When certain assets pass on to your heirs, the assets will bear the estate taxes. Incorporation of Trust is one way of handling the estate and inheritance taxes. Federal estate taxes usually apply for a large asset base, but inheritance taxes may apply to those receiving hereditary wealth.

8. Consider Your Family Needs

Consider your family’s financial needs carefully when planning your will. These would get harder to meet once you are no longer with your family. They may inherit some of your assets, but your unsettled liabilities may also pass on to them.

9. Seek Professional Help

Even if you do not plan to form a Trust to execute your will on your behalf, it’s crucial to seek expert help. Writing a will, allocating assets, and apportioning them can be a cumbersome job. In addition, in the case of divorce, remarriages, and adopted children, the legal complexities can be overwhelming. Consulting a financial advisor to manage your finances and an attorney to consult on legal matters can ease your burden.

10. Revise Your Estate Planning Regularly

As your financial stability will change according to wealth accumulation status, you must periodically revisit your estate planning documents. For example, you’ll have to occasionally update your will document with updated information about what you own and what you owe. Also, remember to update your inheritance or transfer on demise designators with banks and insurance companies.