Good finance management resides in investing, debt management, and wealth creation. For some people, it falls to managing expenses and earning extra money; for others, it is about wealth maximization. In both ways, finance is a number-crunching game that often seems a complicated concept for many people.

Finance management is a demanding task indeed. However, it follows the well-known methodology regarding financial literacy and learning. Reading in high volumes, that is. Of course, finance books cannot solve your financial problems, nor will they make your investment decisions, but you can learn how to do it yourself from one such book.

A typical path for many successful individuals in terms of financial success involves quality reading. The selection of good finance books can be overwhelming, however. In addition, depending on your interests and career level, the possible choices may reduce significantly in numbers.

This list will expose our top 10 best personal finance books of All Time.

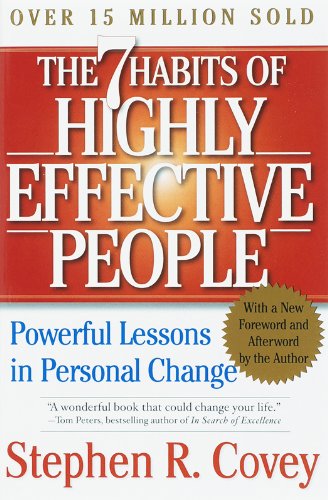

“The 7 Habits of Highly Effective People”

Author: Stephen R. Covey

Pages: 384 (in English)

Publication Year: 1990 (Updated 2004)

Best Book for examining the psychological factor in Finance

This book will teach you the way you look at a problem and inspire you to be proactive in your approach. One key takeaway from the book is to remain positive, regardless of your financial situation.

365loans’ favorite from the book:

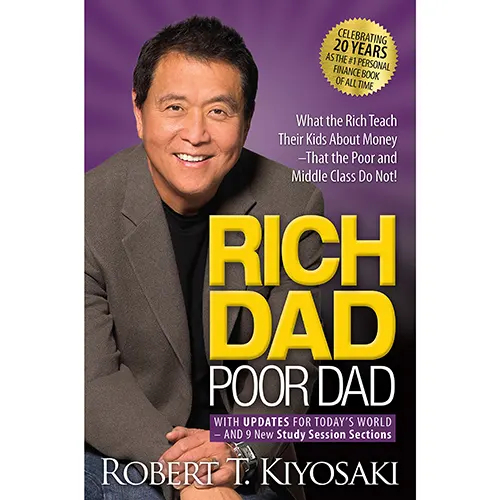

“Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not”

Author: Robert T. Kiyosaki

Pages: 336 (in English)

Publication Year: 2017

Best Memoir covering Finance

It is one of the finest books in personal finance, entrepreneurship, and business industry knowledge. If you are stuck with less income and need to know how you can generate extra income, this book is for you.

365loans’ favorite from the book:

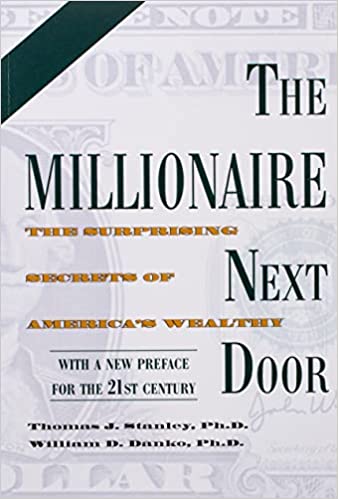

“The Millionaire Next Door: The Surprising Secrets of America’s Wealthy”

Author: Thomas J. Stanley, William D. Danko

Pages: 272 (in English)

Publication Year: 2010

Best Book for learning how to build wealth

You can come across many social media posts these days showing off the wisdom pieces on how wealthy people choose a disciplined approach over the poor. All those quotes come from this book; they will show you what being rich means and requires. It shuns the common notion of billionaires living lavish lifestyles and shows the contrary – a frugal life they live.

365loans’ favorite from the book:

“What Your Financial Advisor Isn’t Telling You: The 10 Essential Truths You Need to Know About Your Money”

Author: Liz Davidson

Pages: 261 (in English)

Publication Year: 2016

Best Book for enlightening how to better manage your money

If you think you can turn to a financial advisor or an estate planner anytime for advice, it can solve all your problems. However, this book will make you think twice about it; it sums up that selecting a financial advisor is as important as deciding.

365loans’ favorite from the book:

“The Total Money Makeover”

Author: Dave Ramsey

Pages: 272 (in English)

Publication Year: 2013

Best Book for debt management

The Total Money Makeover is one of the finest debt pay-off strategy books, because who does not fall into a debt trap? Sometimes, however, that debt burden may become too heavy to lay off.

This book by Dave Ramsey must be a sure starter on your finance bookshelf. It will inspire and lead you with practical suggestions like those Dave Ramsey shares on his radio shows.

365loans’ favorite from the book:

“The Intelligent Investor: The Classic Text on Value Investing”

Author: Benjamin Graham

Pages: 304 (in English)

Publication Year: 2005

Best Book for investing

As the name suggests, this book is about finding suitable investment ways. Although the book was published in the mid of 20th century, it still holds the best investment advice. In addition, this book will teach you how to deal with stock market investments.

365loans’ favorite from the book:

“Broke Millennial: Stop Scraping By and Get Your Financial Life Together”

Author: Erin Lowry

Pages: 288 (in English)

Publication Year: 2017

Best Book for young people and millennials

If the list is getting a bit overwhelming for you, and you still are in the beginner’s mode, this book might help you get started. The book’s title suggests the age group it appeals to – the young graduates, – who often find themselves in a position of both debt and investment dilemmas.

365loans’ favorite from the book:

“All Your Worth: The Ultimate Lifetime Money Plan”

Author: Elizabeth Warren, Amelia Warren Tyagi

Pages: 304 (in English)

Publication Year: 2006

Best Book for forming a budget plan

This book will help you simplify your cumbersome financial problems. It will ease up the tangling of economic theories of investment and budgeting in your mind. If you remember the 50-30-20 budgeting rule, then you remember the book’s main idea.

365loans’ favorite from the book:

“Nudge: Improving Decisions About Health, Wealth, and Happiness”

Author: Richard H. Thaler, Cass R. Sunstein

Pages: 293 (in English)

Publication Year: 2008

Best Book for behavioral economy

This book deals with one of the most common factors in our financial progress, the psychological and mental approach toward finance management. The basic concept is that economic well-being is all about our habits. You can do great once you start nurturing good habits.

365loans’ favorite from the book:

“Secrets of Six-Figure Women: Surprising Strategies to up Your Earnings and Change Your Life”

Author: Barbara Stanny

Pages: 288 (in English)

Publication Year: 2002

Best Book for achievement-oriented women

The book looks into the successful millionaire women’s lifestyles. This book will guide you on habits that make or break your financial well-being in the long term. In addition, the book inspires you with examples of millionaire women and the practices that made them successful.

365loans’ favorite from the book:

Key Takeaway

The most crucial step in regaining financial control is to begin right away.

You will be well on your way to financial independence if you increase your financial literacy, cut back on your spending, start saving, and invest. Whether you choose to read any of those books above or other titles related to personal finance, the important thing is to remember that reading means investing in yourself.

“An investment in knowledge pays the best interest.”

– Benjamin Franklin