You may have heard about the US dollar’s worldwide skyrocketing value on currency exchanges. You probably do not give it much thought unless you work as a foreign currency dealer. Maybe you ought to.

The dollar remains the standard worldwide exchange unit, regardless of what cryptocurrency dealers claim. For instance, crude oil price per barrel is in dollars, and some nations, like Saudi Arabia, tie their currencies to the greenback. Therefore, with the euro falling below parity with the dollar, perhaps you are, and you should be asking yourself…

Why is the USD getting stronger?

According to the World Bank, despite rising inflation and a declining stock market, along with the euro, the dollar has been rising to 20-year highs versus all of its main trading partners’ currencies. So, if we had to sum the current situation up, here is what it would look like:

- The United States continues to have the most outstanding economy in the world, with a gross domestic product (GDP) that is close to $23 trillion.

- The United States offers enticingly high returns compared to the rest of the globe, and investors flock to these high yields, increasing the dollar’s value.

- Last but not least, the US government’s complete faith and credit back the dollar, and the country has never experienced a debt default.

4 ways the rising dollar value affects your money

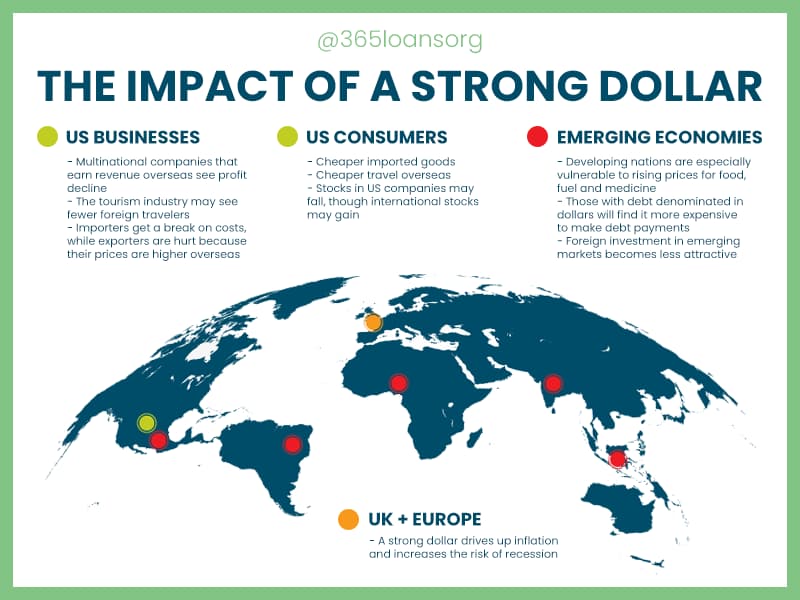

- International investment becomes riskier.

If you have a financial advisor, she has undoubtedly suggested that you diversify and incorporate mutual funds that invest in global markets in your retirement plans. Alternatively, you can have a 401(k) fund that does all the investing for you. It most likely has global holdings as well.

Unluckily, expanding internationally has only made a lousy market worse. For instance, the French stock market has declined 19.1% this year when measured in euros, according to MSCI, a company that monitors global markets. When converted to dollars, it is down 31%. Although investing abroad can help you diversify your assets, this year, it has only resulted in you losing more money than if you had invested in US stock funds, albeit with a little more panache.

- Overseas travel is more affordable.

Apart from soaking up the sun on the French Riviera or downing pints of beer in the UK, traveling has additional advantages. Only a year ago, the euro sold for $1.16 per unit. As of this week, the euro trades for .98 cents per unit dollar, meaning that a 100 euro purchase today is $18 less expensive than it was last year.

- Exports cost more money.

Most often than not, you do not care how much the Germans pay for American wheat or coal, but miners and farmers do. Exports from the United States are now more expensive than they were at this time last year due to the strengthening of the dollar, and some American businesses will likely face challenges from their regional rivals as a result.

Tourism suffers as well. A traveler from Italy may find that the cost of food, lodging, and other travel expenses in the United States is more than it was a year ago and may decide to take their vacation elsewhere due to the stronger dollar.

- The price of imports is lower.

Because of a high currency, American importers may purchase items from other countries for less money. For example, the majority of softwood lumber imported into the United States comes from Canada, and prices have returned to pre-pandemic levels.