A prenuptial agreement, commonly referred to as a prenup, is a legal contract between two people entering into marriage. This agreement outlines the financial responsibilities and expectations of each spouse in the event of a separation or divorce.

Prenups can address a wide range of issues, including property division, spousal support, and the treatment of assets acquired during the marriage. They can also outline the terms of inheritance and the distribution of assets upon death.

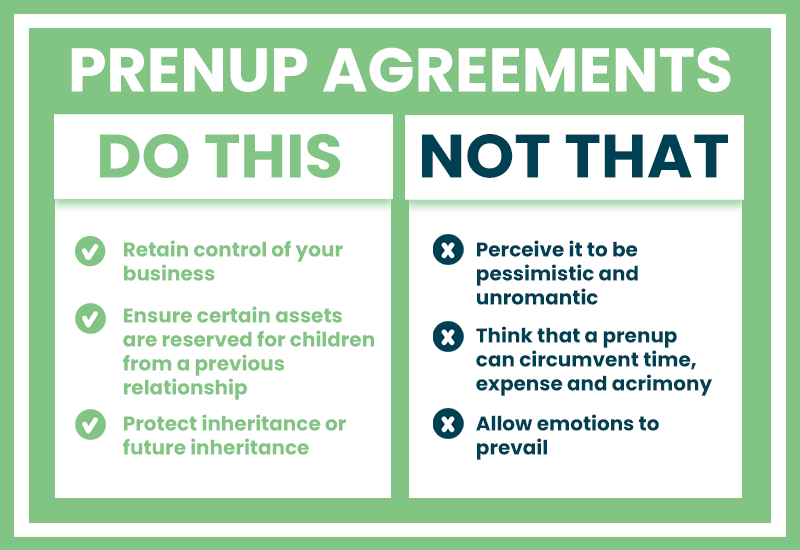

One of the main reasons people choose to enter into a prenup is to protect their individual assets and financial interests. For example, someone who owns a business or has substantial savings may want to ensure that these assets are not divided in the event of a divorce. Additionally, prenups can help to minimize the emotional and financial stress of a divorce by establishing clear expectations and agreements in advance.

Why You Should Consider Getting a Prenup

It is important to note that prenups are not just for the wealthy. Any couple, regardless of their financial status, can benefit from a prenup if they have concerns about their financial future.

When entering into a prenup, it is important to be transparent and honest about your financial situation and expectations. This includes providing full disclosure of all assets and debts. A prenup is only as effective as the information it is based on, so it is important to be upfront and honest from the start.

Additionally, prenups should be fair and equitable. This means that each spouse should be protected and their rights and interests should be respected. If a prenup is deemed to be unjust or unfair, it may not be enforced in court.

It is also important to have a qualified attorney review and draft the prenup. An attorney can ensure that the prenup is legally binding and that all the necessary provisions are included.

5 Reasons to Get a Prenup

While prenups may not be necessary for everyone, they can provide peace of mind and protect individuals’ financial futures. It is important to have an open and honest discussion with a partner and seek professional advice before deciding whether to get a prenup.

Here are five reasons why getting a prenup may be a smart decision:

- Protection of assets: A prenup can protect each spouse’s assets acquired before marriage, as well as assets accumulated during the marriage. This is especially important for individuals with significant assets, such as business owners or those with family wealth.

- Clear division of property in case of divorce: A prenup can establish how property and assets will be divided in case of divorce. This can reduce conflict and make the divorce process smoother and less costly.

- Reduction of legal fees in case of divorce: In case of divorce, a prenup can help reduce legal fees by establishing the terms of the divorce beforehand. This can reduce the amount of time and money spent on legal battles.

- Protection from debt: A prenup can protect each spouse from the other’s debt acquired before or during the marriage. This can prevent one spouse from being held responsible for the other’s financial mistakes.

- Second marriages or blended families: Individuals who have children from a previous relationship may want to protect their assets for their children’s inheritance. A prenup can help ensure that each spouse’s assets are distributed according to their wishes in case of divorce or death.

Conclusion

In conclusion, a prenuptial agreement is a legal contract between two people entering into a marriage that outlines their financial responsibilities and expectations in the event of a separation or divorce. A prenup can help to protect individual assets and financial interests and minimize the stress of a divorce by establishing clear expectations and agreements in advance. If you are considering a prenup, it is important to be transparent and honest about your financial situation, ensure that the prenup is fair and equitable, and have a qualified attorney review and draft the agreement.