When it comes to assessing your financial health, one crucial metric to consider is your net worth. Net worth provides a snapshot of your overall financial standing by calculating the difference between your assets and liabilities. It not only gives you an understanding of your current financial position but also serves as a benchmark for tracking your progress over time. In this article, we will delve into the concept of net worth, explore its significance, and discuss how you can determine and improve it.

Understanding Net Worth

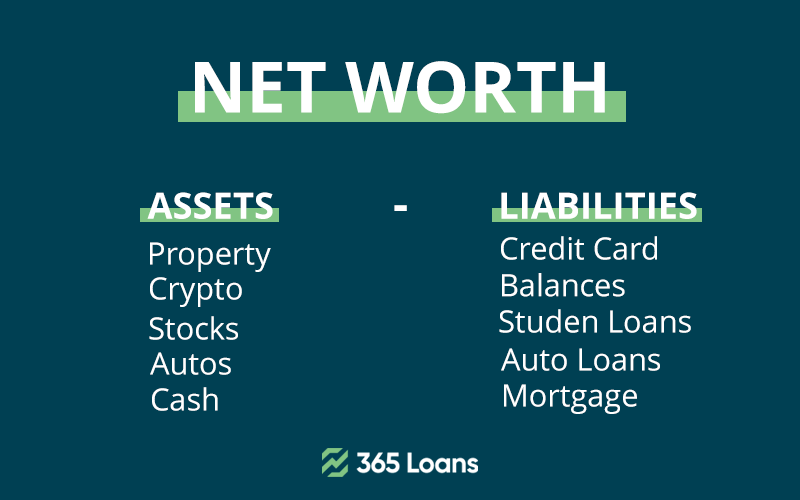

Net worth represents the value of everything you own (assets) minus the amount you owe (liabilities). Assets encompass a wide range of financial resources, including cash, investments, real estate, vehicles, and valuable possessions such as jewelry or artwork. Liabilities, on the other hand, encompass debts, loans, mortgages, and any other financial obligations you owe.

Calculating Your Net Worth

Determining your net worth involves a straightforward calculation: subtracting your liabilities from your assets. Here’s a step-by-step guide on how to calculate your net worth:

- List Your Assets: Begin by compiling a comprehensive list of all your assets. Include your savings accounts, checking accounts, investments (stocks, bonds, mutual funds, etc.), retirement accounts (401(k), IRA), real estate properties, vehicles, valuable possessions, and any other significant assets you own. Assign a realistic market value to each asset.

- Assess Your Liabilities: Next, make a list of all your liabilities. This may include mortgage loans, student loans, credit card debt, personal loans, auto loans, and any other outstanding debts you have. Note down the current balances or amounts owed for each liability.

- Calculate the Difference: Subtract the total value of your liabilities from the total value of your assets. The resulting amount is your net worth.

Net Worth Example

Assets:

Liabilities:

- Property: $400,000

- Cash in the bank: $10,000

- Car: $30,000

- Share portfolio: $20,000

- Crypto: $10,000

- Roth IRA: $50,000

- Mortgage: $300,000

- Auto loan: $20,000

- Credit card balances: $15,000

- Student loans: $25,000

Total Assets: $520,000

Total Liabilities: $360,000

Net Worth = (assets – liabilities)

($520,000 – 360,000) = $160,000

Interpreting Your Net Worth

Once you have determined your net worth, it’s essential to understand its implications:

- Positive Net Worth: A positive net worth signifies that your assets outweigh your liabilities, indicating a healthy financial position. It implies that you have accumulated wealth and are in a better position to meet your financial goals.

- Negative Net Worth: A negative net worth implies that your liabilities exceed your assets. This suggests that you have more debt than assets, which can indicate financial challenges and the need for debt reduction strategies.

Improving Your Net Worth

Boosting your net worth involves two primary approaches: increasing your assets and reducing your liabilities. Here are a few strategies to consider:

- Increase Income and Savings: Look for opportunities to increase your income through career advancement, side hustles, or additional sources of revenue. Simultaneously, focus on saving and investing a portion of your income to grow your assets over time.

- Manage Debt Effectively: Prioritize debt repayment by creating a budget, reducing unnecessary expenses, and allocating extra funds towards paying off debts. Consider consolidating high-interest debts or negotiating with creditors to alleviate the burden.

- Invest Wisely: Explore investment options that align with your risk tolerance and financial goals. Diversify your portfolio to mitigate risks and aim for long-term growth.

- Continuously Track and Update: Regularly review and update your net worth statement to monitor your progress. Set financial goals and track your net worth over time to evaluate your financial decisions and adjust strategies if necessary.

Conclusion

Net worth serves as a valuable financial metric, providing insights into your overall financial standing. By understanding and calculating your net worth, you gain a clearer picture of your financial health and can make informed decisions to improve it. Remember, building net worth is a gradual process that requires discipline, wise financial choices, and a long-term perspective. With diligence and the right strategies, you can work towards increasing your net worth and achieving your financial goals.