You have misplaced your wallet and feel concerned. However, the money in your wallet is probably the least of your worries. Your driver’s license, debit and credit cards, health insurance cards, and possibly gift or loyalty cards are all stored in one wallet.

Although you have every reason to be troubled and dissatisfied, try to take reasonable action that will only increase the chance of finding the belonging or at least minimize the loss.

7 steps to follow in case you misplace your wallet

To recover a misplaced wallet, you must act quickly and begin making phone calls.

In case you have lost your wallet, go for the following procedure:

1. Attempt to locate the wallet

Allow yourself plenty of time to seek your wallet. Of course, this is assuming your wallet was lost rather than stolen.

Ask yourself, “Where did I last see my wallet?”

If you don’t recall, retrace your steps back to the last time you saw it. If you locate it, you will save yourself a lot of time and trouble. Of course, the logical first reaction is to put a halt to any prospect of money being released from your accounts as quickly as feasible. People who begin here are not necessarily incorrect; however, there are cases of people canceling every card in their wallet only to find it in the pocket of their other pants the next day.

Although time is of the essence, taking a few minutes to ponder and seek could save you much grief. Yet, don’t take too much before you accept the loss. The longer you wait to report missing or stolen cards, the more you may be held accountable for if your cards are used illegally.

2. Contact your debit and credit card companies

You are confident your wallet is gone at this point. It is time to cancel your credit and debit cards and apply for new ones.

Rather than simply telling your bank’s or credit card company’s customer care agent that you lost your wallet or that it was stolen, explain how you misplaced it or how it was stolen. Hopefully, this will alert your bank or credit card company in case a thief later attempts to withdraw money from your account using any of your identification.

3. Reach out to the police

If your wallet has been stolen, you must inform the police immediately. And you may rest assured that you are not the first person to have their wallet or purse taken. Even if the wallet has been lost, you should still contact the police.

Another reason to call the cops is that a criminal may have found your wallet. For example, suppose an identity thief successfully obtains a loan in your name and a lender, for whatever reason, does not believe that you were a victim of identity theft. In that case, that police record will be helpful evidence that you are telling the truth – and that you are not the one who took out the loan.

4. Put a freeze on your credit

Lenders cannot view your credit history or get your credit report while your credit is frozen. If lenders cannot review your credit, con artists cannot take a loan in your name. Therefore, this is a remedy you will want to keep in place for a while, if not eternally, to prevent an identity thief from purchasing a new automobile or opening credit cards in your name.

5. Contact your healthcare provider

You will need to replace your medical insurance card, and you should explain what happened to the customer support person. In addition, you want it documented that your medical card was lost or stolen in case someone attempts to impersonate you at a doctor’s or dentist’s office. It may seem improbable that a burglar would go to the dentist and then try to get your insurer to pay for the appointment, but such instances can occur.

6. Consider purchasing a credit monitoring service

If you want that extra piece of mind, you might subscribe to a service that would alert you to any instances of identity theft. Credit monitoring plans typically range between $15 and $35 per month. However, if you cannot buy a credit monitoring service, credit cards and banks are often great at alerting consumers to suspect behavior, even without asking them.

Furthermore, you can successfully monitor your credit on your own for free. You can request a free credit report at AnnualCreditReport.com, a service run by the three major credit bureaus. You can receive one free credit report from each bureau once a year. Many experts recommend obtaining a new credit report from a bureau every four months, so you are always in the habit of occasionally reviewing your credit reports – and getting them for free.

7. Ultimately, do not lose your nerve

You have probably done everything you can if you followed everything of the above by now. Even more, if your credit cards or bank account have been used, you won’t be out much, if anything.

Some major credit card companies provide zero liability. However, most banks and debit cards will often restrict your losses for unauthorized payments – and if you alert your bank before any charges occur, you will not be held liable if the thief is still able to make charges.

Meanwhile, if you have misplaced your wallet with valuable contents inside, keep in mind that it can still come up.

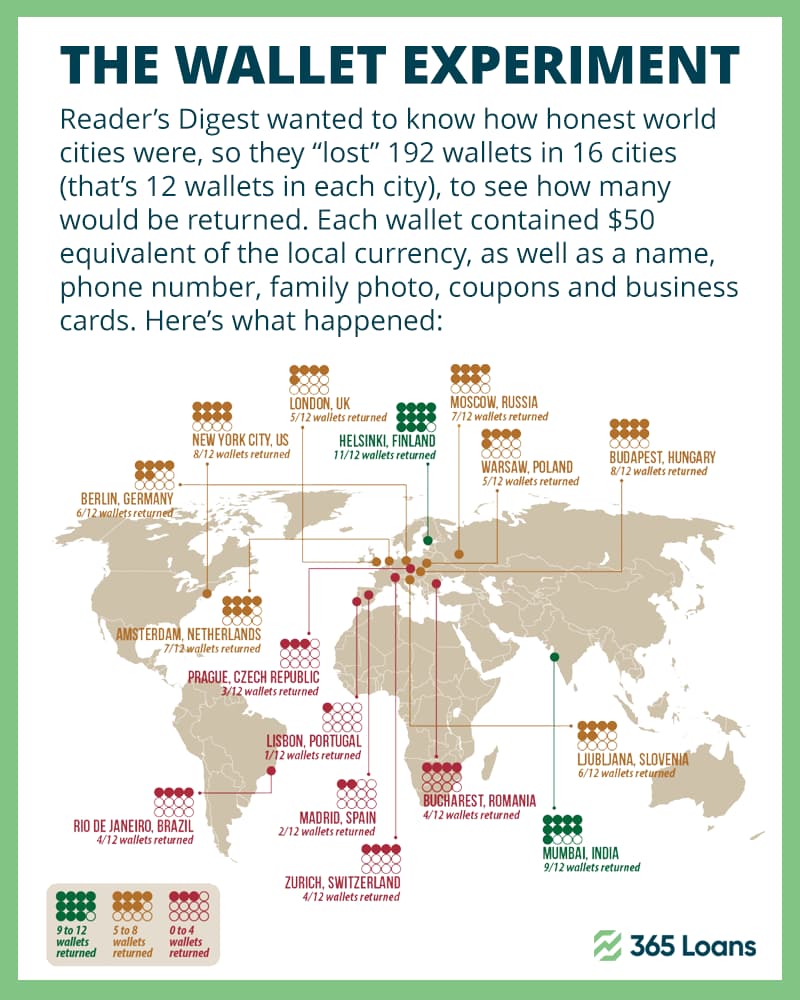

In virtually all countries, citizens were more likely to return wallets that contained more money. Neither nonexperts, nor professional economists were able to predict this result.

David Tannenbaum, in research on “Civic honesty around the globe“