Investing is a vital aspect of personal finance, and one common question that often arises is whether savings bonds are a good investment choice. Savings bonds, often seen as a conservative option, possess unique characteristics that make them an attractive choice for certain financial goals. In this article, we’ll dive into the world of savings bonds, explore their benefits, drawbacks, and provide real-world examples to help you decide if they align with your financial aspirations.

The Basics of Savings Bonds:

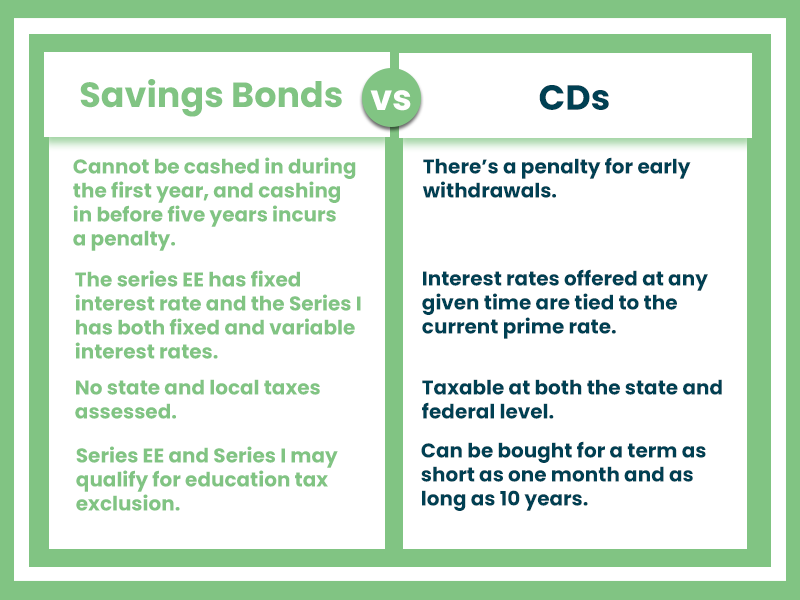

Savings bonds are government-backed debt securities designed to encourage savings and finance government projects. In the United States, two primary types of savings bonds are EE and I bonds.

I Bonds Vs. EE Bonds:

| I Bonds | EE Bonds | |

|---|---|---|

| Format | Paper and Electronic | Electronic only |

| Purchase Price | Face Value | Face Value |

| Interest | Composite Rate (Fixed + Variable) | Fixed for bonds after May 2005 |

| Maximum | $15,000 | $10,000 |

| Interest Compounded | Semi-Annually | Semi-Annually |

| Redemption | After 12 months | After 12 months |

| Penalties | Less 3 months if redeemed before 5 years | Less 3 months if redeemed before 5 years |

Benefits of Savings Bonds:

- Safety: Savings bonds are among the safest investments available. They are backed by the full faith and credit of the government, making default nearly impossible. This safety net ensures your initial investment is secure.

- Steady Returns: While not known for high yields, savings bonds offer a predictable and reliable source of income. EE bonds, for example, earn a fixed interest rate, while I bonds combine a fixed rate with inflation protection.

- Tax Advantages: Interest earned on savings bonds is exempt from state and local taxes. Moreover, if the bonds are used for qualified education expenses, the interest may be entirely tax-free at the federal level.

Drawbacks of Savings Bonds:

- Low Yields: Savings bonds tend to offer lower returns compared to other investments, such as stocks or corporate bonds. This means that over the long term, your money may not grow as much as it would in higher-risk, higher-reward investments.

- Lack of Liquidity: Most savings bonds have a minimum holding period of one year and a penalty for early redemption if cashed within five years. This lack of liquidity can be a drawback if you need immediate access to your funds.

- Inflation Risk: EE bonds, in particular, may not keep pace with inflation, potentially eroding the purchasing power of your investment over time.

You Might Want to Read Next: Should you break a CD early for a better rate?

When Are Savings Bonds a Good Investment?

Savings bonds can be an excellent choice for specific financial goals and situations. For instance:

- Emergency Fund: They can serve as a safe, accessible component of an emergency fund, ensuring your money is readily available when needed.

- Education Savings: Savings bonds can be a tax-efficient way to save for educational expenses, especially when used for higher education costs, where the interest may become tax-free.

- Conservative Portfolios: Investors seeking a low-risk, conservative addition to their investment portfolio may allocate a portion to savings bonds to reduce overall portfolio risk.

Real-World Example:

Suppose you’re a parent planning to save for your child’s college education. You decide to purchase I bonds, which offer both a fixed and inflation-adjusted interest rate. Over the years, the I bonds protect your investment from inflation while providing a consistent return.

When it’s time for your child to attend college, you can redeem the bonds without worrying about paying federal taxes on the accrued interest, ultimately helping you cover tuition costs.

Conclusion

Savings bonds can be a good investment choice for specific financial goals and individuals seeking safety and stability in their portfolios. However, their lower yields and limited liquidity make them less suitable for long-term wealth accumulation or aggressive investment strategies. As with any investment decision, it’s essential to align your choice with your financial objectives, risk tolerance, and time horizon to determine if savings bonds are a suitable addition to your financial plan.