With the advancements in technology and the growing trend of automation, individuals now have the power to simplify their savings process while simultaneously maximizing their financial resilience. In this article, we’ll delve into the concept of automating your savings and explore how it can help you achieve a more secure and prosperous future.

The Power of Automation

Automation has transformed various aspects of our lives, from the way we communicate to how we work. Similarly, when applied to personal finance, automation offers a host of benefits that can significantly impact your financial well-being. At its core, automating your savings involves setting up processes that allow a portion of your income to be automatically transferred to your savings or investment accounts. This “set it and forget it” approach eliminates the need for manual intervention and ensures consistent progress toward your financial goals.

Simplification Leads to Consistency

One of the primary challenges individuals face when it comes to saving money is maintaining consistency. Life’s busy schedule, unexpected expenses, and tempting discretionary purchases can often derail even the most well-intentioned savings plans. Automation addresses this issue by creating a seamless and regular savings routine. Once you’ve established automated transfers, your savings become a non-negotiable part of your financial landscape. This simplification reduces decision fatigue and removes the mental burden of manually moving money around.

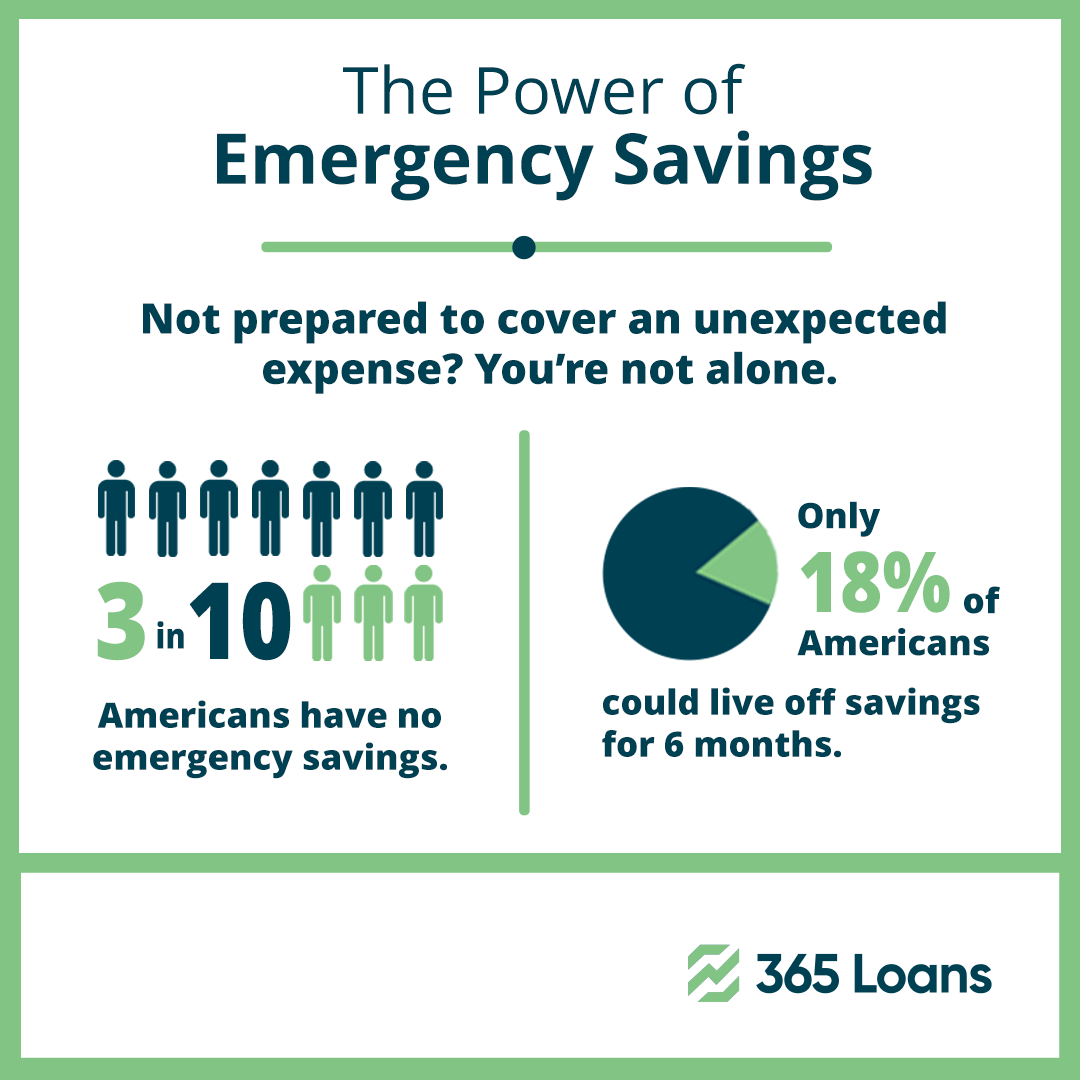

Building Emergency Funds with Ease

Emergency funds are a critical component of financial resilience. They provide a safety net during unexpected life events, such as medical emergencies or sudden job loss. Automating your emergency fund contributions ensures that you’re consistently building this crucial buffer. Set up a separate savings account specifically for emergencies and establish automated transfers that align with your budget. Over time, this approach can lead to a robust emergency fund that offers peace of mind in times of uncertainty.

You Might Want to Check Out Next: Emergency Fund: How Much Money is Enough?

Harnessing the Power of Compound Interest

Automated savings also work wonders when it comes to harnessing the power of compound interest. By consistently contributing to your savings or investment accounts, you allow your money to grow over time. Compound interest is the interest earned on both the initial amount of money and the accumulated interest from previous periods. The longer your money compounds, the more substantial the growth becomes. Automating contributions to investment accounts takes advantage of this compounding effect, potentially leading to significant wealth accumulation over the years.

Tailoring Automation to Your Goals

The beauty of automating your savings lies in its flexibility. You can tailor automation to suit your unique financial goals. Whether you’re saving for a down payment on a house, a dream vacation, retirement, or all of the above, automation can be customized to align with your aspirations.

Monitoring and Flexibility

While automation provides a structured approach to saving, it’s important to remember that your financial situation and goals may evolve over time. Regularly monitor your automated contributions and make adjustments as needed. If you receive a salary increase, consider increasing your automated savings to capitalize on the extra income. On the other hand, if you face unexpected financial challenges, you can temporarily adjust your automated transfers without abandoning your savings strategy entirely.

The Road to Financial Peace of Mind

In a world filled with financial uncertainties, automating your savings offers a roadmap to financial peace of mind. By simplifying the savings process and leveraging the benefits of automation, you can ensure that your financial goals are consistently pursued and achieved. From building emergency funds to capitalizing on compound interest, the advantages of automation extend beyond convenience. They empower you to take control of your financial future and cultivate a resilient foundation that can withstand the unpredictable nature of life.

With the technological tools at your disposal, you have the means to establish a consistent and effective savings routine. By embracing automation, you’re not only embracing convenience but also taking a significant step toward achieving your financial aspirations and securing a brighter future.