Have you ever wondered, “What is insurance?” or “Why insurance is important?” while reading over your insurance coverage or shopping for insurance?

You are not by yourself.

Insurance can be a perplexing subject. What is the process of insurance? What are the advantages of insurance? And how do you go about finding the most significant insurance for you? These are common queries, and thankfully, there are some simple answers to them.

To assist, here are a few essential insurance explanations:

What exactly is insurance?

Insurance is a financial safety net that assists you and your loved ones in recovering from a natural disaster or accident. When you get insurance, you will get an insurance policy, which is a legal contract between you and your insurance company. And, if you incur a loss covered by your policy and file a claim, insurance will pay you or a chosen recipient, known as a beneficiary, according to the terms of your policy.

The most controversial aspect of insurance policies is the fact that, in most cases, you pay for something you hope you never need. Of course, nobody wishes for anything awful to happen to them. But suffering a loss without insurance can put you in a difficult financial situation.

What are the advantages of insurance?

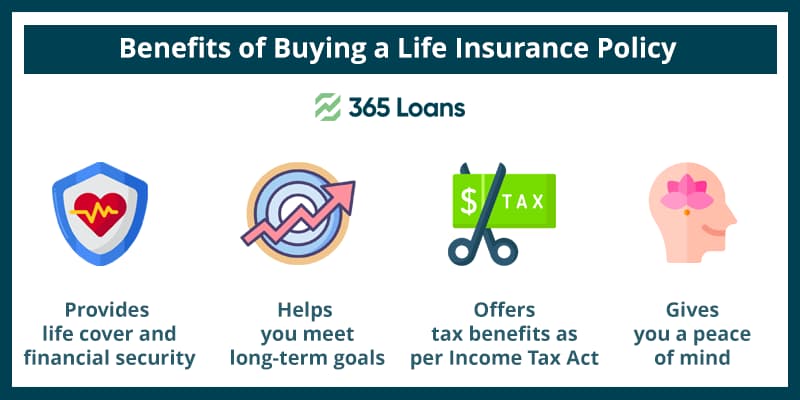

Insurance is a valuable financial instrument. It can help you live your life with fewer anxieties, knowing that if a calamity or accident occurs, you will receive financial aid, allowing you to recover faster.

When it comes to life insurance, this could mean that your family does not have to relocate or that your children can afford to attend college. In the case of auto insurance, it could mean having additional cash on hand to assist pay for repairs or a replacement vehicle following an accident.

After something horrible happens, insurance can help you get back on track as much as possible. Moreover, you may access benefits such as free roadside assistance, risk management counseling for businesses, or cash value in addition to a life insurance policy.

How do insurance policies function?

Insurance is essentially a massive rainy day fund administered by an insurance firm and shared by multiple policyholders. To remain financially strong enough to deal with anything that comes its policyholders’ way, an insurance company collects money from the policyholders and other investments to pay for its operations and any filed claims.

How do I pick an insurance company?

Here are a few things to think about while selecting an insurance company:

- Insurance protection: What kinds of insurance does the company provide? Can you get a discount if you buy all of your insurance policies through the company?

- Financial resilience: Is the corporation having the financial ability to pay your claim? AM Best, a US credit rating service, may help you determine the company’s financial strength.

- Agency structure: Would you rather work with a local insurance agent? Or would you instead manage your own insurance?

- Customer care: Do others recommend this company? What are online consumer reviews saying about it?

4 reasons why insurance is necessary for everyday life

- It helps you stay prepared and protected in advance.

Life is unpredictable and has a habit of surprising you when you least expect it. Insurance is critical for being fully prepared to deal with life’s contingencies. For example, life insurance plans protect your family and their financial necessities in the event of your untimely death. Your family should not be left to fend for themselves after your absence, and life insurance policies will come to their aid. They provide maturity benefits in addition to life protection, resulting in a substantial savings corpus for the future.

A valued item, such as your car or motorcycle, requires security in the form of vehicle insurance to shield you against out-of-pocket payments for repairs or untimely loss.

- It ensures you will meet your objectives.

Your current situation may be stable, with a continuous flow of income sufficient to fulfill your family’s lifestyle needs. However, suppose that an unexpected event leaves your family without your support, forcing them to meet their everyday needs with less financial power.

This is where a term insurance policy proves helpful. Secure your family’s future by purchasing a term insurance policy that will provide your nominee or dependent with a lump sum or monthly payout to help them meet their financial obligations. Term insurance is a type of life insurance that provides coverage for a certain period at a low premium cost.

- It keeps your mind relaxed.

Live a tranquil existence and control the hazards that you may encounter in your daily life. Protect your life with insurance and live a stress-free existence. With escalating medical expenditures, having health insurance is a must. Protect yourself and your family with health insurance coverage that will pay your medical expenses.

We put in much effort for our family. However, life insurance and term insurance policies are critical for securing your family’s future in your absence, and when the former is achieved, you can have complete peace of mind.

- It serves as an adequate investment tool.

Insurance is also an excellent investment vehicle. Life insurance programs make systematic savings possible by transferring funds through yearly premiums. In addition, you can reap the benefits of a lump sum distribution at the end of the policy term, resulting in a sizeable financial corpus.

Insurance increases savings by lowering your long-term expenses. You can avoid paying out of pocket for terrible situations such as medical bills, bike theft, accidents, and more. It is also an exceptional tax-saving strategy that can help you decrease your tax liability.

Why insurance is important, in a nutshell

Insurance allows for effective risk management in everyday life. The primary enemy of life is uncertainty, which may be avoided by purchasing insurance. Adequate insurance coverage can address the risks of becoming ill, losing your car, being involved in an accident while riding your bike, dying, and other issues.

In the case of term insurance plans, your family will not face financial hardship in the event of your premature death, and you can obtain coverage for the specified duration at a low cost. Therefore, utilize such insurance products to reduce the danger factor in your life.

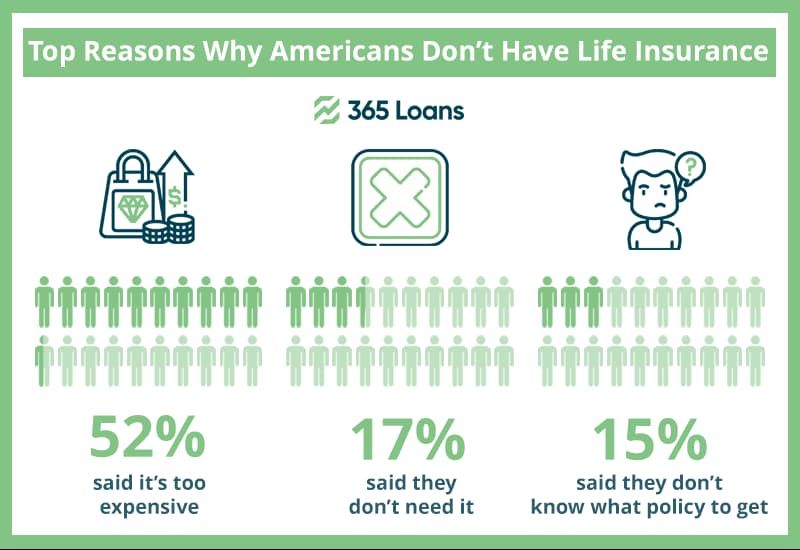

Everyone should understand the value of insurance, whether it be life insurance, term insurance, health insurance, or auto insurance. Instead of looking at the big picture, people are always concerned with how much money they must pay upfront for the insurance policy. Protect your life with insurance and reap the benefits.