You may believe that your credit score is adequate if you are authorized for a loan. Indeed, you should be proud of yourself for being a responsible adult with a good grade. But do not be lulled into a false sense of security. Even minor increases in your credit score can help you receive better rates, reduced insurance premiums, and a better job.

With so much on the line, let’s delve deeper into how your credit score affects your life and what you can do about it.

What does your credit score indicate?

Large financial companies collect much information about you, aggregate it, and try to predict your ability to repay the loan. Three prominent national institutions gather this information – Equifax, TransUnion, and Experian. Credit bureaus are what they’re called.

Each organization reviews your file and assigns a credit score to you and everyone you know based on their algorithm. The result is a three-digit number that tells the entire world how you compare to everyone else. The higher the number, the more confident these companies are in your dependability. The three organizations use slightly different methodologies, but the outcomes are comparable.

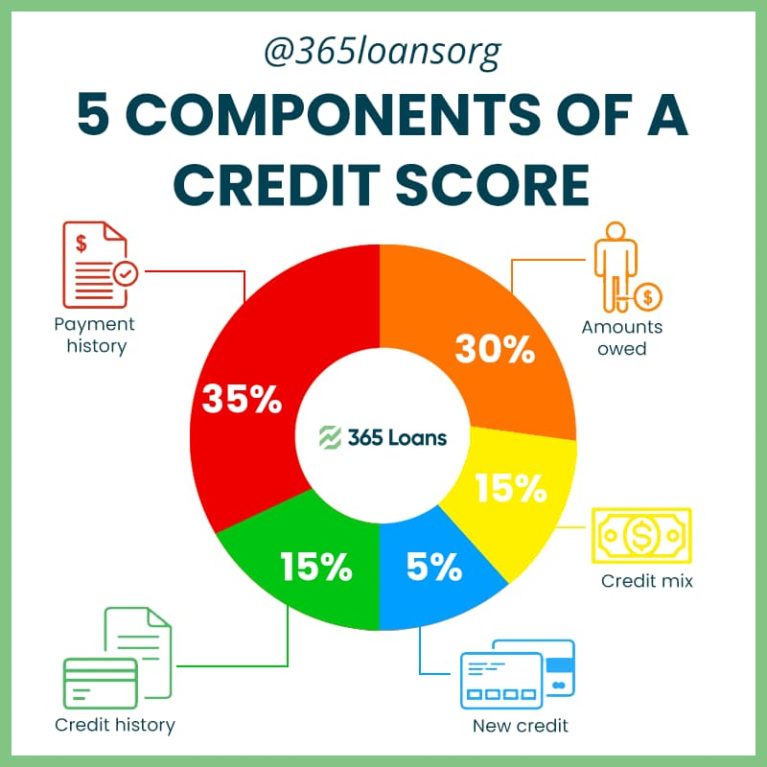

Again, the formula varies for each bureau; however, they all consider your payment history, current debt, length of credit history, type of credit, credit relationships, credit history, debt to available credit ratio, and debt to income ratio. They also consider your credit payment history and current debt.

Equifax, TransUnion, and Experian all examine the same data, but each weighs the inputs differently. Your score is rarely the same across all three bureaus for this reason. Therefore, more often than not, the Fair Isaacs-developed FICO score is the benchmark for credit scoring.

- The lowest possible FICO score is 350, while the highest score is 850.

- In reality, having 800 or more places you at the top of the population and makes you a favorable risk.

- You are in excellent company if your score falls between 750 and 700; a considerable portion of Americans fall within this range, which is thought to be a good score.

- The range of 700 to 749 is seen as acceptable.

- If your score is between 650 and 699, it’s considered fair.

- Anything under 650 will be regarded as below average.

Creditors, suppliers, insurance providers, and potential employers will consider you a fair or foul credit risk if your FICO score is less than 670. They thus make doing business with them more challenging and expensive for people with high-risk profiles. That makes achieving the best score you can get crucial for you.

Why having a good credit score isn’t enough?

The people you wish to do business with undoubtedly examine your credit score whenever you make financial decisions. Therefore, improving your score before you submit a mortgage application is very crucial for you. But it goes far beyond that.

When you wish to get phone service, open bank accounts, and arrange for the utilities to be connected at your new house, your credit is examined. You might also be startled to find that insurance companies check your credit score when you apply for life insurance. Unfortunately, potential employers might do the same when applying for a job. It could limit your options if either party believes that your financial situation is less than ideal. Your life insurance premiums may increase as a result, or even potential employers may choose to push your resume to the bottom of the pile.

How to improve your credit score, no matter how high it is?

Your initial course of action should be to be informed and proactive to get and retain the greatest score attainable. You could need to make a significant financial adjustment at some point, and you’ll want to have the strongest credit file you can have at that point.

Next, you should order a copy of your credit report. Free of charge. The big credit bureaus are required by law to offer you a free credit report once a year. Put a reminder in your calendar to contact those bureaus each year, so they can receive a copy of your report. Examine the report thoroughly once you’ve received it. Verify for any false negatives or negative information that shouldn’t be there. You can challenge the charge and get it dropped, even if it’s factual but unfair.

Once your credit report has been cleared up, make every effort to keep it at the best possible level. To do that, follow these steps:

- Pay off as much debt as feasible.

- Pay all bill charges on time. Call the company to discuss the details and your options if you have a problem with a bill.

- Don’t frequently apply for new credit cards.

- Maintain a credit usage rate of no more than 30%.

- Even if you do not utilize old credit lines, keep them unless they violate the above rule.

In the world of finance, your credit score is fundamental. But, even if you believe your score to be adequate, strive for the highest score attainable. You will probably be able to benefit from lower credit expenses and have greater financial chances in the future with a little bit of effort.