Introduction

If you’re in your 20s, you might feel there needs to be more point in saving money. After all, you’re just starting and have student loans to pay back. And let’s face it: nobody likes thinking about retirement when they’re young! But the truth is that if you start putting away money for your future now, the rewards will last for decades — maybe even for generations. You can’t buy your way into financial security by using credit cards or other forms of debt, but by making smart choices now, you’ll create an environment where you can make long-term investments without taking on too much risk.

Invest in a 401(k) or IRA.

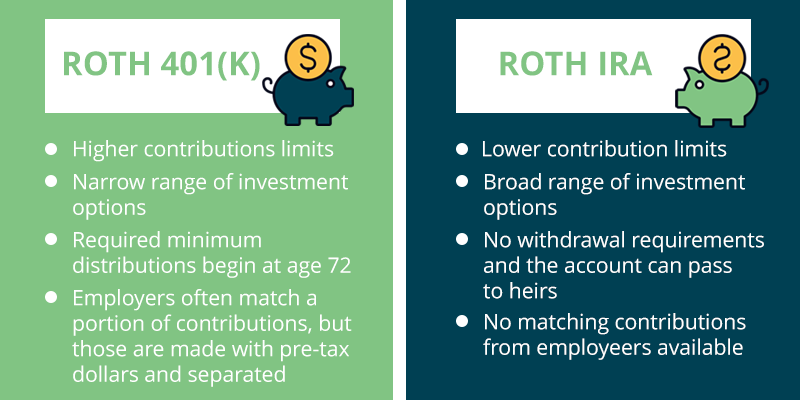

If you still need to contribute to a 401(k) or IRA, consider doing so in 2023. These tax-advantaged retirement savings plans are designed to help people save for their golden years.

A 401(k) is an employer-sponsored plan offered by your employer; it allows you to contribute pre-tax earnings into an account that grows on a tax-deferred basis until withdrawal. The money can then be withdrawn tax-free when you retire or leave the company–but only if certain requirements are met (for instance, if you’re younger than 59 and a half).

An IRA stands for individual retirement account; this type of investment vehicle allows investors to make contributions into one or more accounts that grow on a tax-deferred basis until withdrawal (like with a 401(k)). However, unlike employer-sponsored plans like 401(k), there are no restrictions on who can contribute: anyone with earned income over certain thresholds can open an IRA account at any time during their life cycle and invest as much as they wish until age 70 1/2 without penalty.[1]

Start saving for retirement now.

Be sure to start saving for retirement before you’re older. The earlier you begin, the more time your money has to grow and compound. The earlier you start saving, the less money it will take to reach your goal.

Start by setting up an automatic savings plan with your bank or credit union so that a certain portion of each paycheck is automatically deposited into a separate account dedicated to retirement savings. At least 10% of every paycheck should go toward this fund-but if possible, aim for 15% or more (if this seems too much at first glance). You’ll thank yourself later!

Make sure you’re not maxing out your credit cards.

The first thing you should do is make sure that you’re not maxing out your credit cards. Credit card debt is a huge problem and can lead to bankruptcy if you don’t manage it properly. Here are some tips on how to avoid maxing out your credit cards:

- Only spend what’s in your bank account anytime, even if there’s a big sale at the mall or online store.

- Never use all available lines (or “chips”) on a single card; only use one chip per transaction when possible. For example, if there are five lines available on one card but only three lines available on another card (and one line has already been used), only use three chips from this second card during each transaction until they’ve all been used up–then switch over completely! This way, no matter how much money goes missing due to fraud or theft (which happens surprisingly often), it won’t affect every single thing we want/need because some purchases were made before others were even completed.”

Pay down your debt.

Once you have a good financial situation, it’s time to take action.

- Start by paying down the highest-interest debt first. This will save you money in the long run and help build momentum for reaching other goals.

- After that, pay off any other debts until they’re all gone! Then start saving for retirement or building an emergency fund so that you can weather any unexpected expenses without having to use credit cards or borrow money from friends and family members again in case of emergencies – it’ll be great when those bad habits are gone!

Look into refinancing your mortgage.

Refinancing your mortgage may be too much of a hassle, but it’s worth considering. You can save thousands of dollars over the life of your loan and pay off debt faster if you refinance into one with a lower interest rate.

To refinance, first, ensure you meet all requirements for getting approved for a new loan (there are many). Then find out what kind of rates are available from lenders in your area by searching online or contacting local banks and credit unions directly–and consider any fees associated with refinancing into an unfamiliar lender before deciding where to apply!

Open a Roth Individual Retirement Account (IRA).

- Open a Roth Individual Retirement Account (IRA). In addition to your 401(k), consider opening an individual retirement account (IRA). IRAs are designed to help you save for retirement and can be opened by anyone regardless of age or income level.

- Contribute to it regularly. You can contribute up to $6,000 per year if you’re under 50 years old, which will grow tax-free as long as you don’t withdraw any money until after age 59 1/2–and even then, only if it has been in your account for at least five years.*

- Invest wisely with low-cost index funds or exchange-traded funds (ETFs). The key here is finding low-cost investments that track the overall stock market without charging high fees–which can eat away at returns over time.*

Get disability insurance if you aren’t already insured against disability.

If you’re not currently covered by disability insurance, consider purchasing it. This type of insurance protects you and your family from financial hardship if you cannot work due to illness or injury. It’s important to note that disability insurance is expensive, so even though it can be worth the cost, there may not be enough money in your budget right now (or ever). If this is the case for you and your family, don’t worry! You can still apply for Social Security disability benefits without an employer-sponsored policy.

You can set yourself up for financial success by investing now, paying down debt, and putting money aside for retirement.

- Investing in your future: You can set yourself up for financial success by investing now, paying down debt, and putting money aside for retirement.

- Paying down debt: If you have any credit card balances or other loans, it’s important to pay them off as soon as possible so that they don’t drag on your ability to save money later on.

- Saving for retirement: Even if you’re not yet ready to retire (or even if there isn’t a clear end date), making regular contributions into an employer-sponsored 401(k) or individual retirement account (IRA) is one of the best things anyone can do for their future financial well-being.

Conclusion

Good luck with your financial planning! Whether you’re just starting or have decades of experience, investing in yourself and your future is important. And that’s not just because it helps build wealth-it also gives us peace of mind knowing that we’re prepared for anything life throws at us.