Investing is pledging your financial resources in funds for an anticipated return. Your financial resources may include cash and other assets such as gold or intellectual property. Note the word anticipated before return; it means the investment may or may not produce the yield you expect.

Before you begin planning your investing journey, there are a few key points that you should always keep in mind:

- Improve your financial literacy and investment understanding before you begin;

- Investments are always positively correlated when it comes to risk-reward relation, i.e., the higher the risk, the higher the return;

- Diversify your investments.

These rules would apply to any size of your investment and at all stages of your life. However, as a rookie in the investment field, it is even more important to make a careful and effective plan.

Although your investment plan may vary depending on your career stage, the volume of investment, and your expected returns, you can take a specific route to succeed.

Step 1: Plan before you act

It sounds simple, but many fail to recognize what makes a good investment plan. As a beginner, you need to set your long-term financial objectives first. Then, break down those objectives to current goals regarding specific spending and saving amounts.

Creating budgets is an effective way of achieving short-term financial control. It would be best if you familiarized yourself with standard investing methodologies and investment types. Make yourself comfortable with financial literacy. For example, stock and bond investments are both different types of investments.

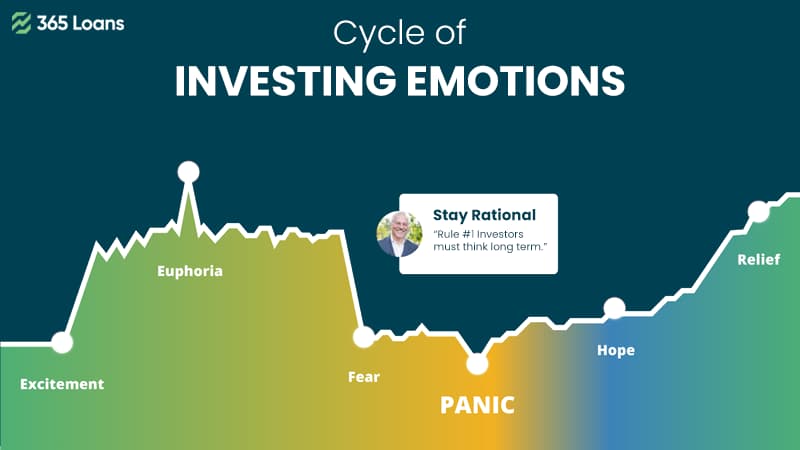

Step 2: Assess your risk appetite and risk tolerance

Do not scratch your head! Risk appetite is your willingness to absorb financial risk, and risk tolerance is the limit to which you can bear the economic impact.

Remember the risk-reward rule above? This is where it counts in practically.

Step 3: Create an initial investment budget

It is wise to start slow and experiment a little as a rookie. Once you accumulate investment basics, you can grow bigger.

Create your initial investment budget depending on your financial goals with investments and risk factors.

Step 4: Select your first investment option

You can do all your investment tasks by yourself, through an online platform, or a traditional brokerage house. Every investment method has its pros and cons. As a beginner, it can be a wise option to start with the help of a professional broker.

If you wish to start slow and do it by yourself, you should start by investing in banking instruments. Either way, this is the crux of your investing journey.

Here are a few investment options to choose from:

- Investment in Bank Accounts: These special investment accounts offer higher interest rates than a typical savings account. These special saving accounts and certificates of deposits (CDs) are low-return options but the safest investments.

- Investments in Stocks: Probably the most anticipated and desired way of investment. Stock investments require different strategies to harvest profits. You can earn a regular payment with dividend stocks, capital gains with growth and blue-chip stocks, and others. These are the riskiest investment options of all; hence offer the highest returns too.

- Investment in Index Funds: Just like your investments in stocks, these are the index funds comprising different stock options. The best thing with Index funds is that they come with a diversified and best-performing selection of stocks. These index fund investments usually come with high initial investment requirements.

- Investment in Forex: Currency pairs swing prices several times a day. Foreign exchange or Forex trading is all about capitalizing on these fluctuations favorably.

- Real Estate Investments: This option is for you if you wish to plan for long-term investments. Real-estate investments are the most widely used options and remain yet most productive. You can invest in a real-estate project or a real estate stock fund.

- Commodities and Digital Currencies: You may already know commodity investment ideas like Gold, Silver, and Oil. These investments also function similarly to stock and forex investments. Their prices also fluctuate with the demand and supply rule. One latest addition to investment lists are digital currency options like Bitcoin.

There is no one-fits-all formula for choosing which type of investment is better for you. However, you can decide your investment option by carefully evaluating your investment strategy.

Step 5: Analyze your initial results and refine your strategy

As you start your investing strategy, you may need to revise it often. Do not hesitate to experiment. Remember, only your due diligence can make your investments safer. If you invest through a broker agent, online financial advisory service, or real estate agent, you will come to know there are fees and commission structures.

Also, your returns would now be taxed differently as your income improves. That can change your investment requirement quickly. Fine-tune your investment strategy until you find the best match for your risk and reward strategy.

Carefully plan your investment goals; commit to achieving them with full zeal once you make a plan.