Real Estate Investment Trusts, or REITs, are a popular and accessible way to invest in real estate without actually owning property. By buying shares in a REIT, investors can earn income from rent and property appreciation, while enjoying diversification benefits and professional management. However, like any investment, REITs come with risks and considerations that investors should be aware of. In this article, we’ll provide a comprehensive overview of REITs, including their history, types, advantages, and risks. We’ll also discuss how to invest in REITs, from choosing a brokerage account to monitoring your portfolio. Whether you’re a seasoned investor or just starting out, this guide will help you understand REITs and how they can fit into your investment strategy.

What are REITs?

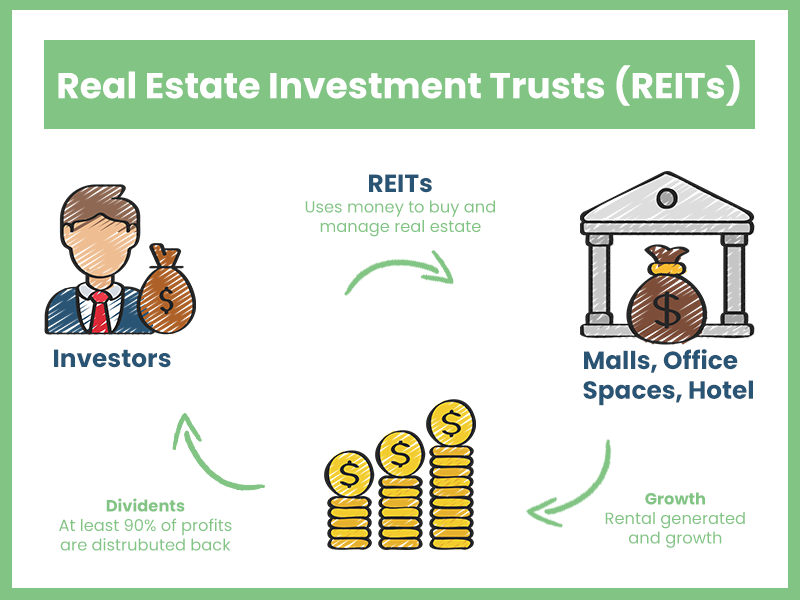

Real Estate Investment Trusts, or REITs, are companies that own or finance income-producing real estate properties. When you invest in a REIT, you are essentially buying shares in a portfolio of properties, similar to how you might buy shares in a mutual fund or exchange-traded fund (ETF).

The concept of REITs dates back to the 1960s, when the US government created a new tax designation that allowed real estate companies to operate like mutual funds, receiving special tax treatment in exchange for paying out the majority of their income to shareholders as dividends. This tax status has helped make REITs a popular and accessible way for investors to participate in the real estate market.

REITs make money through rental income from properties as well as capital appreciation from buying and selling properties. They may also earn income from fees charged for property management, leasing, and other services. REITs are required to pay out at least 90% of their taxable income to shareholders in the form of dividends, which can make them an attractive source of passive income for investors.

Risks of investing in REITs

Investing in REITs comes with several risks that investors should be aware of. One of the most significant risks is interest rate risk. As interest rates rise, the cost of borrowing for REITs increases, which can reduce their profitability and make them less attractive to investors. Market risk is another factor to consider, as REITs can be sensitive to broader market fluctuations and economic conditions. Sector-specific risks are also important, as different types of REITs may be impacted by factors such as shifts in consumer behavior, changes in technology, or supply and demand imbalances. Regulatory risks should also be considered, as changes in tax laws or other regulations can impact the profitability and operations of REITs.

How to invest in REITs

Here are some steps to help you get started on investing in REITs.

- Choose a reputable brokerage account: To invest in REITs, you’ll need to open a brokerage account that offers access to them. Choose a brokerage firm that has a good reputation, low fees, and user-friendly tools. Research the different brokerage accounts available to find one that fits your needs and budget.

- Select individual REITs or REIT ETFs: You can invest in REITs by purchasing individual stocks or through an ETF that holds a diversified portfolio of REITs. Individual REITs may offer more potential for growth and higher dividend yields, but they come with more risk. REIT ETFs, on the other hand, provide more diversification and lower risk, but may have lower returns.

- Understand financial metrics: Before investing in REITs, it’s essential to understand the financial metrics used to evaluate them. Some of the most important metrics include funds from operations (FFO), the price-to-earnings ratio (P/E), and dividend yield. These metrics can help you assess a REIT’s financial health and potential for growth.

- Consider the type and location of the REIT: There are many different types of REITs, including residential, commercial, industrial, and healthcare. Each type has its own risks and rewards, so it’s important to research and consider which type of REIT fits your investment goals and risk tolerance. Additionally, consider the geographic location of the properties owned by the REIT, as factors such as local real estate trends and economic conditions can impact the performance of the REIT.

- Monitor your investments: After you’ve invested in REITs, it’s important to monitor them regularly to ensure they align with your investment goals and risk tolerance. Keep an eye on key financial metrics, news related to your investments, and overall market conditions to make informed decisions about buying, selling, or holding your REIT investments.

Conclusion

In summary, REITs provide an opportunity to invest in real estate without the need for significant capital or direct property ownership. By investing in REITs, you can potentially generate income through dividend yields and diversify your investment portfolio. However, it’s important to understand the risks involved, such as interest rate risks, market risks, sector-specific risks, and regulatory risks.

REITs can be a valuable addition to your investment portfolio, providing potential for long-term growth and income. However, it’s essential to do your research, understand the risks involved, and make informed investment decisions.