Planning a car purchase ahead of time will allow you to look for a car loan with optimal terms, which will save you money, time, and stress. Making decisions early allows you to consider your options and helps you make the best judgments.

It’s crucial to take specific steps, including comparing lenders and setting budget limits, before visiting the dealership in order to obtain an auto loan with the greatest interest rate. Here are five recommended actions to consider:

1. Set your budget wisely

You have a higher chance of obtaining a loan that you can pay back on time and within your means if you have a budget. You can consider recurring expenses like insurance and vehicle maintenance with the use of a budget. You should make sure that your budget allows for both the loan and other ownership expenses, such as:

- Extra costs incurred at the time of purchase (taxes, title fees, and dealer fees); and

- Ongoing expenses as long as you own the vehicle (insurance, gas, annual registration fees, maintenance, and repairs).

Consider measures to lower the cost of your auto loan if you are having difficulties creating a budget that works for you, such as:

- Putting more money aside for a down payment;

- Acquiring a more affordable automobile;

- Getting fewer extras, options, or features;

- Utilize our recommendations to check and raise your credit score.

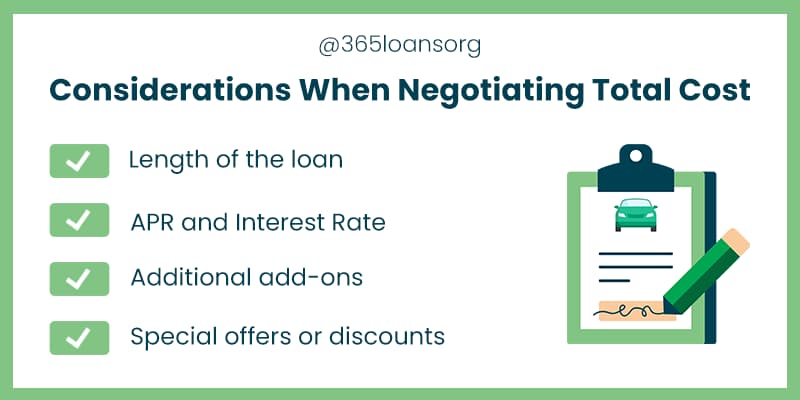

2. Consider optional extras in advance

It’s a good idea to consider add-ons in advance so that you are ready and aware of your preferences when you finance your car. These goods and services are negotiable and optional. However, the overall cost of your loan may rise if you decide to purchase them. You can save money by shopping around for any add-ons you decide you want.

Typical add-ons include:

- Physical car options include tire and wheel guards, glass tinting, alarm systems, and other things.

- Guaranteed Auto Protection (GAP) insurance: If your car is stolen or totaled, this extra insurance will cover the difference between the car’s value and the loan balance.

- These optional agreements, often known as service contracts or extended warranties, cover the cost of repairs for a few mechanical and electrical parts of the car.

- Credit insurance: This extra insurance covers your vehicle loan payments in the event of specific occurrences, including demise, injury, loss of employment, or loss of property.

You might also want to check out: 7 ways to save money on your car insurance

Your motor insurance provider might provide GAP insurance, credit insurance, and other comparable services. Check to see if you can find these items for less if you desire one or more of them.

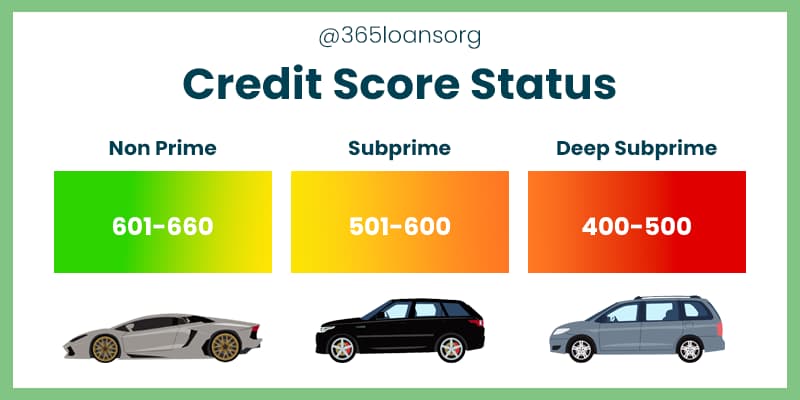

3. Find out your credit score

Your credit ratings are based on the data in your credit report. Therefore, your credit score heavily influences the kind of auto loan you can acquire and how much interest you will pay.

A credit score or scores are established for the lender when you apply for a loan, verifying your credit. Verify the accuracy of your credit report and challenge any inaccuracies you may uncover. According to the credit scoring methodology in use, typically, just one inquiry will be recorded for any requests made within a short period, typically between 14 and 45 days. So to minimize any damage to your credit score, it’s a good idea to compare loans inside that limited time frame.

4. Appraise having a co-signer

A co-signer is a person who, like you, is legally responsible for repaying the loan. Examples of co-signers include parents, family members, and friends.

A co-signer with a strong or excellent credit score could drastically cut your interest rate if you have a short credit history or credit that requires improvement and a low credit score. The lender will base its decision to approve the loan on the co-credit signer’s history and score. Therefore, you and the possible co-signer should carefully explore your options if you are thinking about getting a co-signer.

Both you and your co-signer will be liable for the loan’s repayment if you default on it. Even though the co-signer has no ownership rights to the vehicle, they are still responsible for the loan.

5. Know your trade-in worth

You can use online commercial sites like Consumer Reports, Edmunds, Kelley Blue Book, and NADA Guides to research the value of your car. In addition, you can determine a fair price by looking at examples of similar automobiles that have previously sold in your area. Only then can you make an informed decision about whether to sell it yourself or trade it in once you know how much your current vehicle is worth.

In one way, you and the dealer will agree on the value that will be applied to the cost of your next vehicle when you trade it in at a dealership. But, on the other hand, if you pursue a self-sale, you can utilize the proceeds from that as a down payment.

You have negative equity if you owe more on your current car than it is worth, also known as having “upside down.” Rolling the remaining amount from your old auto loan into your new one could significantly increase the cost of the new loan. Because you will be taking out a loan for more than just the cost of your new car, your overall loan cost could be significantly greater. If you subsequently decide that you want to refinance your auto loan, being upside down may limit your possibilities.

During any talks, you examine whether you are obtaining fair value for your trade-in and whether you can fully repay the old auto loan. After doing your research, you can safely move on to the next stage: shop around for an auto loan and compare your options to find the best offer.

Key questions to ask yourself at this stage:

- What can I afford to spend?

- How much can I put down as a deposit?

- Do I require or want a co-signer?

- What is the value of my trade-in?