Personal budgets are integral to your finance management, investment, and saving. Creating a reasonable personal budget and optimizing it for the best results can save you much more money than your guesswork. For non-finance persons, it can be an overwhelming task, but the 50/20/30 rule is a low-effort solution worth trying.

The short-term gains with monthly and yearly budgets can form the basis of your long-term wealth management plan. Remembers, saving, investment, and budgeting are more of a habit than mere assignments.

The 50/20/30 Budget Rule

The so-called “50/20/30 budget guideline” (also known as “50-30-20”) was made famous by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan.

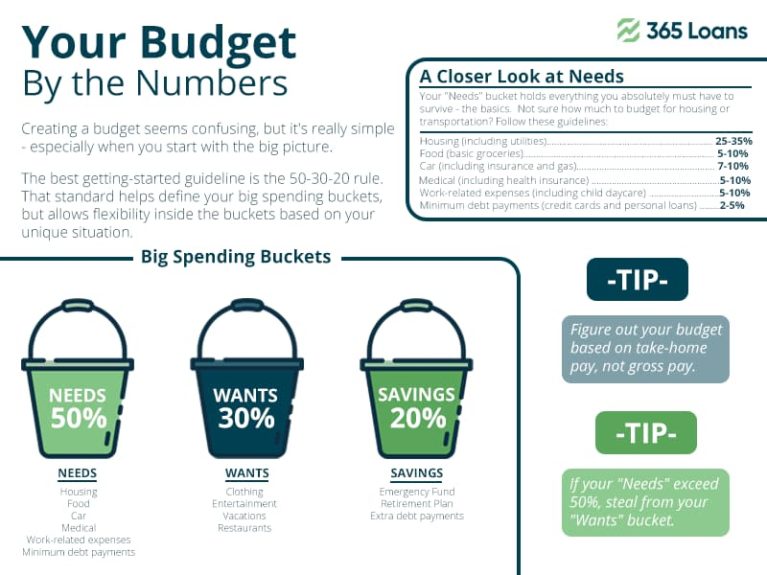

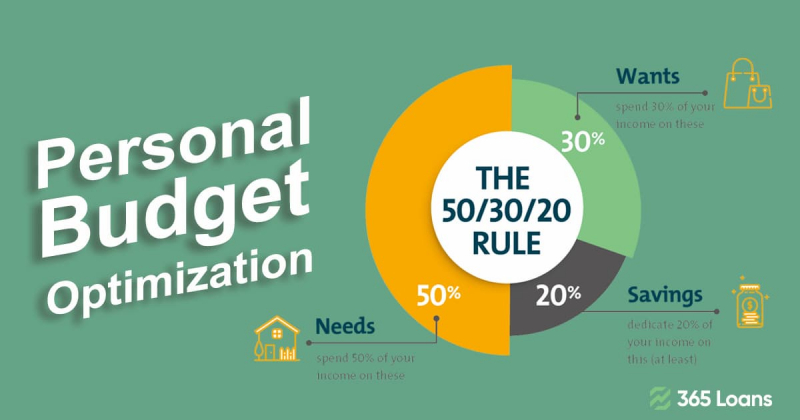

The general norm is to allocate your after-tax income in the following proportions: 50% for needs, 30% for wants, and 20% for savings. Here, you can find a brief of this simple budgeting strategy.

The 50%: Your Needs

The expenses you must pay, and the goods you need to survive are considered needs. These include mortgage or rent payments, auto loans, food expenses, insurance, medical expenses, minimum debt, and utility bills. You absolutely ought to have these.

Items considered extras, such as HBO, Netflix, Starbucks, and eating out, do not fall in the “needs” category.

You should only require half of your after-tax income to meet your requirements and commitments. You will need to either reduce your necessities or try to downsize your lifestyle, possibly to a smaller home or more modest vehicle, if you are spending more than that on your requirements.

The 20%: Your Savings

Second, make an effort to set aside 20% of your net income for savings and to invest. This includes making IRA contributions to a mutual fund account, investing in the stock market, and creating an emergency fund in a bank savings account.

If you lose your job or experience an unexpected incident, you should have at least three months’ worth of emergency savings. After building that, concentrate on retiring and achieving future financial objectives.

Repaying debt is another use for savings. While the minimum payments fall under the “needs” category, any extra payments save money because they lower the principle and accrued interest.

The 30%: Your Wants

Lastly, all the items you purchase that are not absolutely necessary are considered wants. This definition includes going out to eat and see a movie, that new handbag, athletic event tickets, trips, the newest electronic device, and ultra-high-speed Internet.

If you boil it down, everything in the “wants” category is optional. For example, instead of visiting a gym, you can work out and prepare meals at home or watch sports on television rather than purchasing tickets to an event.

This category also includes the decisions you make when upgrading, such as choosing a more expensive steak over a cheaper hamburger, purchasing a Mercedes over a Honda, or deciding between viewing TV for free with an antenna or paying for cable. In essence, wants are all the small extras you purchase to enhance your quality of life.

Importance of The 50/20/30 Formula

The 50-20-30 rule assists people in managing their after-tax income, primarily to have money set aside for emergencies and retirement savings.

Establishing an emergency fund should be every household’s top priority in case of job losses, unanticipated medical costs, or any other unforeseen financial costs. If a family uses its emergency money, it should concentrate on replacing it.

As people live longer, saving for retirement is also a crucial step. The secret to a comfortable retirement is to estimate how much money you will need in retirement and start saving early.

Takeaway

Ultimately, it would be best if you enjoyed life. Although it is not advised to live like a Spartan, following a plan will enable you to pay for your expenditures, save for retirement, and engage in more activities that bring you joy.