Whether you’re trying to consolidate debt, pay for unexpected expenses, or start a business, loans can be a lifesaver. But if you’re not careful, you could fall victim to a loan scam or fraud, losing your money and risking your financial security.

In this article, we’ll explore some common loan scams and frauds, teach you how to identify them and provide you with some tips on how to avoid them. Upon completing this article, you will have an enhanced understanding of safeguarding your finances and making prudent choices in relation to loans.

Types of Loan Scams and Frauds

There are various loan scams and frauds, and scammers are constantly developing new ways to trick unsuspecting victims. A few of the prevalent scams and fraudulent schemes comprise:

How to Identify Loan Scams and Frauds

Now that you know some of the most common loan scams and frauds, it’s important to know how to identify them. Here are some warning signs of being cautious of:

How to Avoid Loan Scams and Frauds

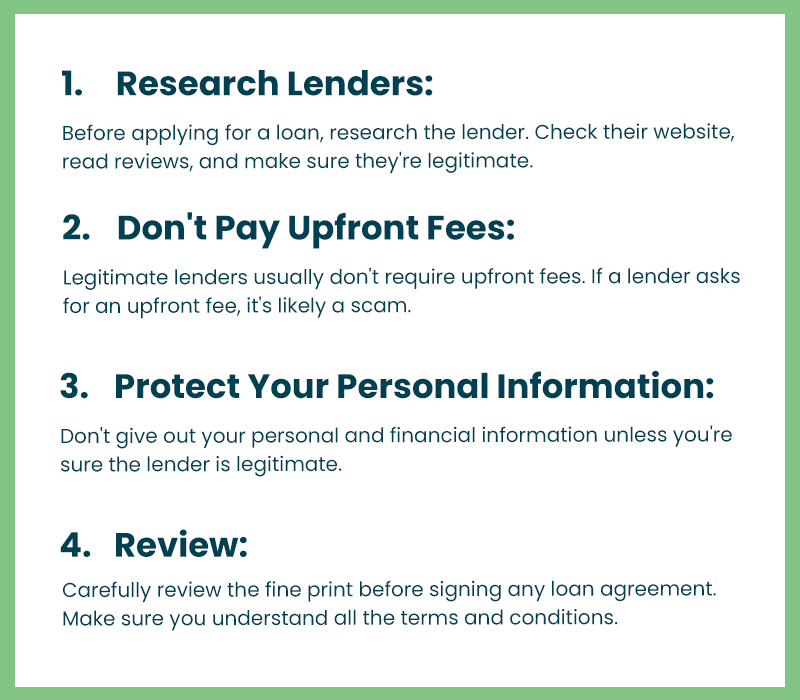

Now that you know how to identify loan scams and frauds, it’s important to know how to avoid them. Here are some suggestions to bear in mind:

Conclusion

Loan scams and frauds can happen to anyone. However, by being aware of the common types of scams and knowing how to identify and avoid them, you can protect your finances and avoid becoming a victim. Always research lenders, avoid upfront fees, protect your personal information, and read the fine print before signing any loan agreement.

At 365loans.org, we take loan scams and fraud seriously. Our dedication lies in offering our clients secure and safe loan choices.

Our team of experts thoroughly vets all of our lenders to ensure they are legitimate and trustworthy. We also provide our customers with all the information they need to make informed loan decisions.