Introduction

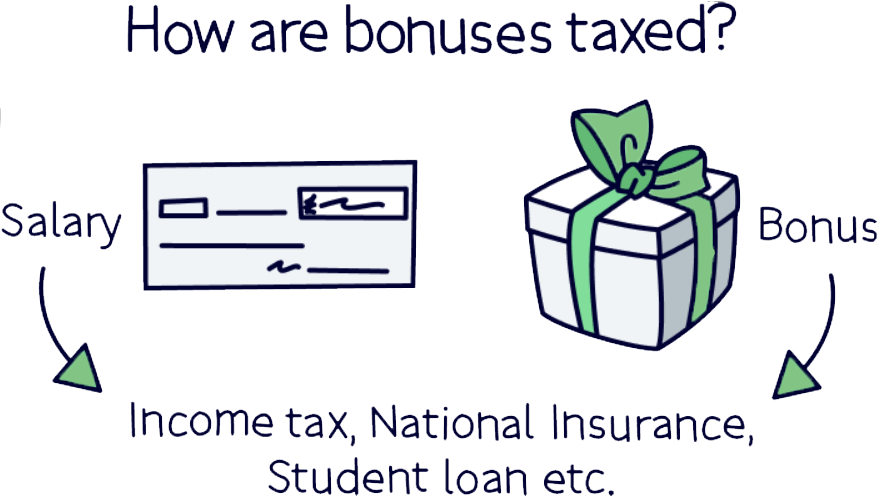

If you’ve ever received a bonus at work, you know it can be an exciting and welcome addition to your paycheck. However, if you’re not aware of how the income from your bonus is taxed, it could cost you more than just money—it could cost you time spent on tax returns.

This article will cover the different types of bonuses that may appear in your paychecks and how they’re taxed. We’ll also discuss why some bonuses are taxable while others aren’t. By the end of this article, you’ll have all the information you need to make smart decisions about your paychecks.

Bonuses are a form of compensation.

They can be paid in addition to your regular salary or replace a portion. Bonuses are only sometimes taxed the same way, however. Some types of bonuses may be added to your Form W-2 and taxed at ordinary income rates, while others may not be included on this form because they’re considered non-taxable compensation (NTC).

Bonuses received after retirement may also be NTCs if they’re available to all retirees regardless of how long they’ve worked for the company or whether their employment ended before or after retirement age.

Taxable bonuses can be added to your Form W-2

Bonuses are taxed as ordinary income and included in your W-2. Bonuses are taxable in the year they’re received, which means that if you received a bonus in January 2019, it would be included on your W-2 for 2018. If you work for more than one employer during the year and each pays a different bonus, your total may exceed $1 million; however, only 100% of that amount is subject to tax withholding (the rest goes toward Social Security benefits).

If your bonus is paid in lump sum, you’ll owe taxes on the entire amount. But if it’s paid over time, you can wait to pay tax on the amount until it’s received.

Some bonuses are not taxable.

For example:

- Expense allowances and reimbursements. These amounts are not considered income, so they’re not taxed. Suppose you receive an expense allowance or reimbursement for travel expenses. In that case, you must report it as income on your return if its value exceeds the amount deductible for regular business travel expenses under ITA s 37(1)(b) (e.g., mileage). You could deduct part or all of these expenses from your employment income at line 229 if they were incurred while away from home to earn employment income as an employee (e.g., meals and lodging).

- Commissions and other incentive payments paid by an employer as part of its sales force incentive program will generally be fully taxable when received by employees who work at arm’s length with their employers; however, commissions from independent contractors aren’t considered “bonuses” for purposes of this provision so these types won’t be subject to tax withholding unless specifically designated otherwise by CRA.

Non-taxable bonuses include expense allowances, reimbursements, commissions, and other incentive payments.

- Expense allowances are paid to an employee to cover certain business expenses. For example, a monthly expense allowance for gas or travel costs associated with your job is considered non-taxable income. It’s also non-taxable if your employer pays for meals while traveling on business or reimburses you for meals while traveling away from home overnight (you do have to keep track of these expenses).

- Commissions are payments based on sales volume or the number of sales; they’re often calculated as a percentage of gross profits or net profits after returns and allowances have been deducted from gross revenues. Commissions aren’t subject to federal income tax withholding but may be subject to state taxes depending on where you live and any applicable FICA taxes, which vary state by state.

Bonuses received after you retire may be non-taxable if they’re available to all retirees.

Bonuses, including incentive payments and commissions paid in connection with the performance of services or the sale of property, are subject to income tax withholding and employment taxes. Bonuses are also subject to FICA (Social Security) and Medicare taxes if paid as part of your regular compensation or salary. However, there is an exception for certain types of bonuses:

- Bonuses paid under a plan that doesn’t discriminate in favor of C corporation shareholders;

- Qualified profit-sharing plans;

- Certain stock rights issued by S corporations where there’s no discrimination between C corporation shareholders and other class members;

Bonuses received on retirement or termination are taxed as ordinary income.

The bonus is not subject to social security taxes but to Medicare taxes if the employee has worked more than 2 quarters in the year before their termination date.

Bonuses are sometimes taxed differently.

They can be taxed in different ways depending on the bonus type, and how you receive it, so you should check with your employer to find out how it will be taxed.

For example:

- If you receive a bonus considered supplemental wages, it is subject to withholding as regular income tax. This means that if you didn’t make enough money during the year or don’t have any other income sources besides your job (such as investments), then there would be no reduction from taxes withheld from this extra paycheck. Your employer may also withhold additional federal and state taxes based on their calculations about how much more money should go toward paying those taxes versus getting paid out in cash.”

Conclusion

Ultimately, it’s important to remember that not all bonuses are taxed similarly. If you need clarification on whether or not your bonus is taxable, ask your HR department or tax professional for help. They can tell you if any special circumstances might affect its treatment on your Form W-2 and 1099-MISC forms.