Budgeting is not a complex financial tool to execute. It can yield much broader financial goals than just monthly expense controls.

As a rule of thumb, you should contribute more towards high-cost debts first. At the same time, you should set up a portion of your budget for an emergency fund. Without savings for emergencies, your debt cycle will never remain under control. The subsequent budget portions can follow the savings, investments, and retirement contributions.

Personal budgets play a vital role in achieving wealth management and financial objectives. However, budgetary planning for long-term financial goals is an often overlooked area. Many people think of budgeting as a control tool for the short-term such as every month. However, budget planning can help you achieve financial goals if planned and executed rightly.

Define your financial goals

Defining the financial goals for both the short-term and long-term is a difficult task. You cannot achieve the targets without defining your financial goals’ scope objectively.

One way of defining the financial goals is to apply the corporate financial identifier tool “SMART.” It says your financial goals should be:

- Specific;

- Measurable;

- Achievable;

- Realistic; and

- Timely.

Let us say you are in your 30s, starting married life with a stable job, and you plan to retire before your 60s. First, you can set a “SMART” financial retirement objective of $1.5 million. Then you will create a solid financial plan, including budgets to achieve that objective over the years.

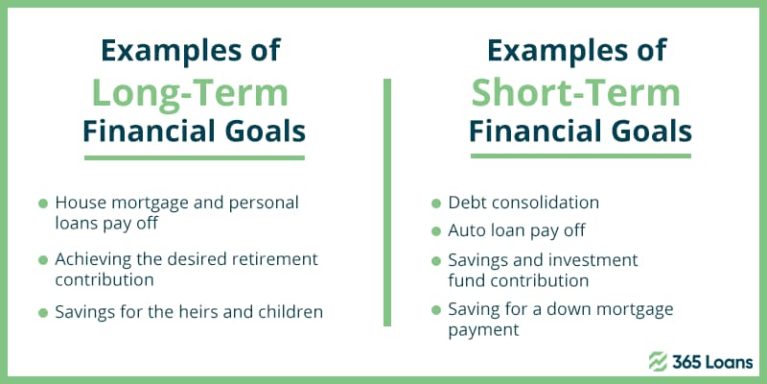

Categorize the financial goals

Once you have identified your financial budgets, it is time to categorize the financial goals into categories. One way of classifying financial goals is to state them on a short-term and long-term basis.

The way you categorize will directly affect your budgeting categories. For example, you will have to create a cushion for savings contribution with your budgets for the short-term and retirement contribution for the long-term.

Prioritize the financial goals

Prioritizing financial goals often leads many people to mutually exclusive choices. For example, many people cannot decide between paying off their debt or savings. Budgets can help you achieve financial goals by prioritizing tasks effectively.

Once you adopt personal budgeting habits, you will have a readily available plan for your prioritized financial goals. Say, if you have toxic debt with high-interest rates, you should consider priorities and set a higher portion in the budget to reduce that debt first.

Create the most suitable budget plan for you

There are several budgeting templates and methodologies that you can choose from. We would suggest creating a simple, short-term personal budget to begin with. Then, gradually monitor the performance and set higher financial objectives. If you place financial goals too high upfront, the failure will lead you to shun budgeting.

As you prioritize the financial goals, match your budgeting tool with these objectives. Create a compelling and achievable budget based on broader categories first.

For example:

- Set a portion of your budget for short-term needs, like monthly household expenses (NEEDS).

- Create a part of the budget for midterm expenses, such as the down payment of the mortgage (WANTS).

- Manage a portion of your budget for long-term financial objectives, such as savings and retirement contributions (SAVINGS).

Once you groom the spending habits systematically, you will find it much easier to follow the budgetary controls. Budgets do not deprive you of luxuries and other spending habits; they make you disciplined with your habits.

Monitor and Revise

It is acceptable to stumble with your budget plans and fall behind your financial goals. Unfortunately, most of us fail at first, but re-plan and re-do it all together.

Monitoring and control are among the most critical points that many forget about budgets. For example, corporate budgets always show variance with original plans. However, a practical budget plan will always offer flexibility to revise and adapt to the changes.

Match your financial goals with budgeting plans at each execution stage to get the best results.