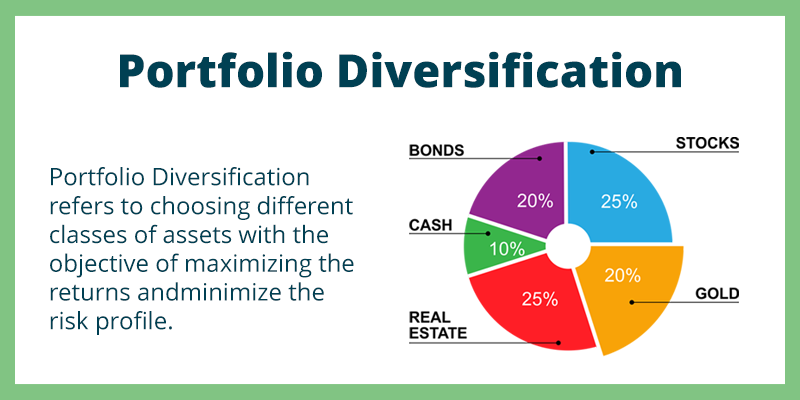

As you step into the world of finance, you come across the term “portfolio diversification” quite often. But do you know what it means and why it is important? Diversifying your financial portfolio can help reduce the risk of financial losses while increasing the chances of earning better returns.

In this blog post, we’ll explore the concept of portfolio diversification and guide you through creating a well-diversified portfolio to help secure your financial future.

What is portfolio diversification?

To put it simply, portfolio diversification is investing in various assets to spread your investments and minimize the risk of losing money. A well-diversified portfolio usually includes investments in different asset classes, such as stocks, bonds, real estate, and commodities. Each asset class behaves differently in response to market fluctuations, and having a diverse portfolio can help protect you from any sudden changes in the market.

The benefits of portfolio diversification

Diversifying your financial portfolio can offer several benefits. Firstly, it can reduce the risk of losing money. By spreading your investments across various asset classes, you minimize the impact of any downturn in a particular market. Secondly, it can increase your chances of earning better returns. While one asset class may be underperforming, another might perform well, increasing your portfolio’s value overall. Finally, diversification can help you achieve your financial goals more confidently as it offers a more stable and predictable investment strategy.

How to diversify your financial portfolio

Now that you know the importance of portfolio diversification, let’s explore how to diversify your portfolio effectively. Here are some steps you can follow:

Identify your financial goals and risk tolerance

Your financial goals and risk tolerance will determine how you diversify your portfolio. If you have a high tolerance for risk, you might want to consider investing in higher-risk assets like stocks. On the other hand, if you have a low tolerance for risk, you may want to invest more in bonds or real estate.

Determine your asset allocation.

Asset allocation is the process of dividing your investments among various asset classes. Your asset allocation should be based on your financial goals, risk tolerance, and investment horizon. For example, if you’re investing long-term, you may want to allocate a larger portion of your portfolio to stocks.

Choose your investments

Once you have determined your asset allocation, you can select individual investments. It’s essential to diversify your investments within each asset class. For example, if you’re investing in stocks, you should invest in various companies across different industries.

Monitor and rebalance your portfolio.

Your portfolio must be monitored and rebalanced periodically to ensure it stays aligned with your financial goals and asset allocation. Over time, some investments may perform better than others, causing your asset allocation to become imbalanced. Rebalancing involves selling investments that have become overweight and buying investments that have become underweight.

Common mistakes to avoid

While diversifying your financial portfolio can be beneficial, avoiding some common mistakes is essential. These mistakes include:

- Over-diversifying: Over-diversification can dilute your returns, making it difficult to achieve your financial goals. It’s essential to strike a balance between diversification and concentration.

- Failing to rebalance your portfolio: Neglecting to rebalance your portfolio can result in an asset allocation that no longer aligns with your financial goals and risk tolerance.

- Not considering taxes: Taxes can significantly impact your portfolio’s returns. It’s important to consider the tax implications of your investments when diversifying your portfolio.

Conclusion

In conclusion, portfolio diversification is essential to building a secure and profitable finance portfolio. It can help reduce the risk of financial losses and increase the chances of earning better returns. By following the steps mentioned in this article and avoiding common mistakes, you can create a well-diversified portfolio that aligns with your financial goals and risk tolerance. Remember to periodically monitor and rebalance your portfolio to ensure it meets your objectives.

Don’t let market fluctuations put your financial future at risk. Take control of your finances today by diversifying your portfolio. At 365loans.org, we understand the importance of portfolio diversification in securing your financial future.