The dream of homeownership often begins with the daunting task of saving for a down payment. While it may seem like an uphill battle, there are strategic steps you can take to fast-track your journey to owning a home. In this article, we will guide you through six unique and effective steps to help you save for a down payment on a house with efficiency and purpose.

Step 1: Establish a Clear Savings Goal

Before embarking on your savings journey, set a specific target for your down payment. For instance, if you’re eyeing a $250,000 home and aiming for a 20% down payment, your goal would be $50,000.

Step 2: Craft a Detailed Budget

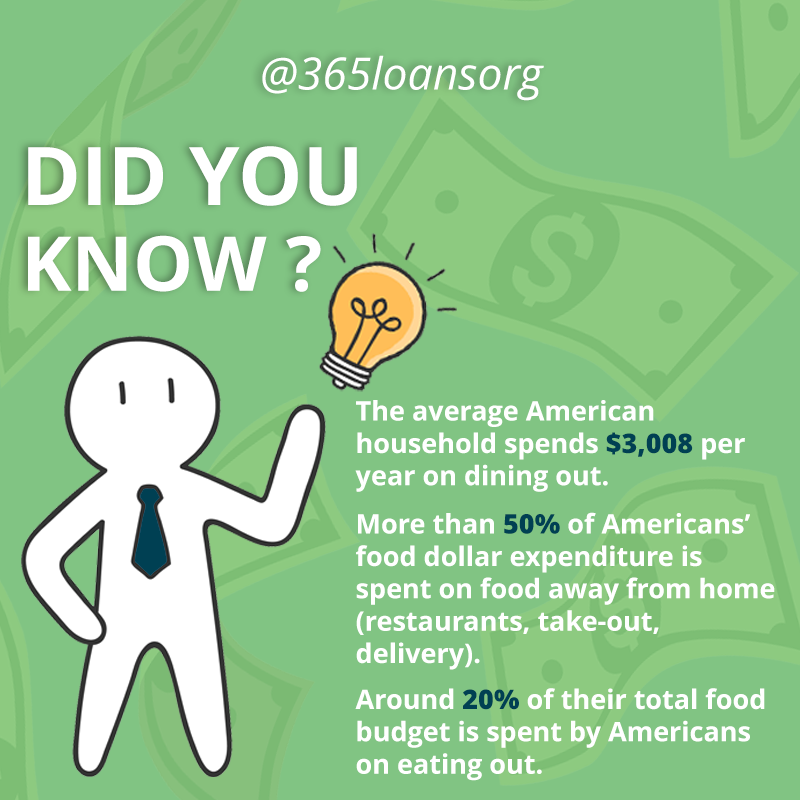

The foundation of effective saving is a well-structured budget. Begin by meticulously tracking your income and expenses. Identify areas where you can cut back without sacrificing your quality of life. For instance, reducing your dining out expenses or reevaluating your subscription services can free up extra funds for your down payment.

Step 3: Automate Your Savings

Make saving effortless by automating your savings contributions. Set up an automatic transfer from your checking account to a designated savings account on your payday. This ensures a consistent and disciplined approach to saving, without the risk of spending your earmarked funds.

Step 4: Explore High-Yield Savings Accounts

Traditional savings accounts offer minimal interest, but high-yield savings accounts offer higher rates, helping your money grow more swiftly. Research reputable financial institutions offering competitive rates and move your down payment fund there.

Step 5: Supplement Your Income

Consider taking on a part-time job, freelancing, or initiating a side hustle to augment your income. The additional earnings can significantly boost your savings rate. Online platforms like Upwork, Fiverr, or TaskRabbit offer opportunities to monetize your skills.

Step 6: Windfalls and Tax Refunds

Windfalls, such as bonuses or unexpected gifts, present ideal opportunities to bolster your down payment fund. Rather than indulging in impulse spending, allocate these unexpected funds to your savings. Similarly, when you receive a tax refund, consider directing it entirely or partially toward your down payment goal.

In conclusion, the path to homeownership may seem daunting, but with a strategic approach, you can expedite your journey to owning a home. By defining clear goals, developing a budget, automating your savings, exploring higher-yield accounts, increasing your income, and capitalizing on financial windfalls, you can save for a down payment more rapidly than you thought possible. Remember, each financial choice you make brings you closer to the keys to your new home. Happy saving!