Experiencing financial struggles through life is more common than you might have thought, and it is a good foundation for growing as financially responsible adults. When times are tough, though, and we need financial help, it is easy to get desperate.

Life could be especially challenging for people who already suffer from bad credit history and cannot qualify for a bank loan. In addition, many people find it uncomfortable to ask for money from family or friends at times like this. So instead, payday loans seem to be their only solution.

What is a Payday Loan?

A payday loan is a short-term, high-interest loan that enables borrowers to get cash quickly. It functions differently from the consumer or other personal loans.

Typically, such loans range in size from $100 up to $2,000 in most cases and have a relatively short time for repayment. Usually, the borrower is expected to repay the loan in 16 to 30 days, but you could extend the agreed timeframe to one year.

Frequently, people refer to such loans using different names, including cash advance, payday advance loan, fast loan, bad credit loan, short-term loan, paycheck advance, and deferred deposit transaction. While they might sound different, they are the same financial instrument and bear the same risks.

Payday loans work as much online as offline in a lender’s physical office. Often, there is no particular set of requirements borrowers must meet, and the application process is relatively straightforward.

Once approved, the loan money is received within 48 hours or less via check, cash, or bank wire. Whenever the due date comes, the lender must pay back the total amount of the loan; otherwise, negative consequences start accumulating. Usually, that translates as high-interest rates, which may get you into an endless cycle of debt.

Pros of Payday Loans

Despite many opposing sides to payday loans, many people still turn to them when they need money. It is because these loans also have some advantages, and while seeing them, people frequently ignore the disadvantages.

- Easy access to money

The main advantage of payday loans is that it is easy to get. Borrowers can go through the application process online or in the lender’s office and receive the requested money in less than 24 hours. So it is very tempting, especially when people require extra funds urgently.

- No strict requirements

Compared to banks and other alternatives, payday loan lenders do not have strict requirements for borrowers. They do not check the credit background since these loans target people with bad credit. Many people who do not qualify for bank credits choose to go with it.

- No security needed

Payday loans are unsecured loans, which means that borrowers do not have to back them up with some collateral. In other words, they know that if they cannot repay the money on time, they will not lose their collateral. However, they will most definitely face increased charges.

Cons of Payday Loans

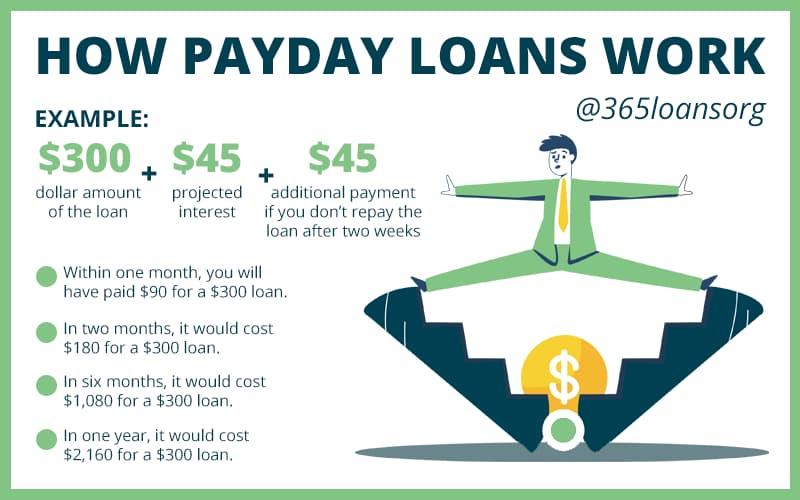

- They are expensive

Payday loans might not seem expensive, but they are. The annual percentage rate could be up to almost 400%. The difference is very high when you compare it to other personal loans. Usually, a personal loan’s annual percentage rate ranges from 4% to 36%. Even the APRs on credit cards range from about 12% to around 30%.

- You can get trapped in a debt cycle

Since payday loans are expensive, it is easy to get trapped in the debt cycle. As a result, many people cannot pay back the loan when it is due and often take new loans to pay back the other ones.

- Payday loans are predatory

Payday loans are considered predatory for several reasons:

- They have a high-interest rate, and the costs can quickly escalate.

- The lenders seldom check if the borrower can repay the money.

- They often give money to people with low financial literacy and capabilities who cannot repay the money on time.

Because of this, they are accumulating more fees and getting trapped in the debt cycle.

Is it a good option to go for a payday loan?

While payday loans might seem attractive because it is so easy to get, in the vast majority of cases, it is not the best solution. So while thinking about taking it, consider the high costs and possible future complications of it and make sure to learn about the alternatives first.

Knowing what a payday loan is, how it works, and its advantages and disadvantages will help you decide if taking it is a good option or not. But, even then, one should be very careful when taking such a loan.