A certificate of deposit (CD) is an interest-paying type of account on a deposit amount for a predetermined period of time that some banks and credit unions may provide. Usually, these accounts offer a guaranteed rate of return.

Although the difference between CDs and standard savings accounts is not as significant as it previously was, CDs typically offer higher rates of return.

How do CDs function?

You must choose a term before you may open a CD. The phrase refers to how long the money is kept in the account. You promise the bank that you will keep your money in the account for a year, for instance, if you open a CD with a one-year term. When the period of the CD expires, it matures, at which point you can either take the money out or continue the CD.

Banks reward you for sacrificing some financial flexibility when you open a CD by typically offering higher interest rates than savings accounts.

When saving money for a specific aim, especially when you know when you will need access to the funds, CDs are the best option because they provide less flexibility and access to your money. But, on the other hand, they are less helpful for the money you might need to access fast, like those stored in an emergency fund.

After a CD matures, the bank will give you some time to modify the account. For example, you may take your money out of the account or add more deposits during this time. The grace period typically lasts five to ten days.

What makes a CD worthwhile?

CDs offer a guaranteed rate of return while being a low-risk place to store money. As a result, they are wise investments for short- to medium-term objectives like saving for a down payment on a house or a new automobile.

A CD is a wonderful place to keep the money you want out of your hands for a set period because early withdrawals usually incur a fee. Additionally, you will probably make more money than you would in a typical savings account.

A CD is not always the most outstanding choice for everyone or in every situation. For example, CDs frequently have greater minimum deposits than savings account-linked CDs. Therefore, it might not be the ideal choice if you require money for an emergency. If so, you should keep the money in a more liquid account, such as a savings or money market account.

While CDs have higher interest rates than savings accounts, they are still low-risk investments and offer lower yields than stock market investments. Therefore, aim for a riskier investment if you want to achieve a higher rate of return.

Pros of investing in a Certificate of Deposit

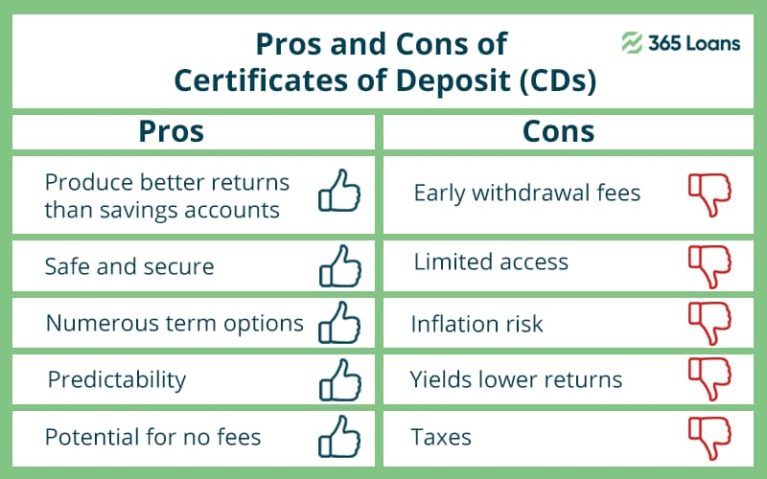

You might think about managing your savings objectives using a CD for many reasons. Here are a few of the primary advantages or benefits of using a certificate of deposit account for money savings.

- Better rates than other savings accounts

CDs may be able to provide better deposit interest rates than savings or money market accounts. That is because you consent to keep your funds in the CD for a predetermined amount of time. As a result, your annual percentage yield (APY) and interest rate depend on the bank, the length of the CD, and the overall interest rate environment.

You should compare the interest rates between high-yield savings accounts and CDs side by side. Additionally, if you are opening a CD at a time when rates are generally low, you might prefer a bump-up or step-up CD that enables you to profit when rates start to increase.

- Safety

One of the safest locations to keep your money is in a CD, along with savings and money market accounts. This is so that any funds held in a CD are protected.

You are protected in the event that an FDIC-insured bank closes its doors or ceases operations if you purchase your CD account from one. The current coverage cap is $250,000 per depositor per financial institution for each account ownership category. The NCUA similarly insures your funds at federal credit unions and the majority of state-chartered credit unions.

- Assured returns

Since rates are generally fixed for the duration of the term, CD accounts offer predictability in that it is straightforward to estimate how much interest you will earn over time. Calculators for certificates of deposit let you enter your savings amount and APY to see how much your money will grow.

Consider the scenario where $5,000 is used to open a five-year CD that pays 1.00% APY. You would have $5,255 and change at the conclusion of your CD period. You can customize your choice of CD periods and interest rates to assist you in accomplishing your goal if you are saving for a long-term objective with a deadline.

- No maintenance fees

You might be required to pay a monthly maintenance fee to utilize a savings account or money market account, which can significantly reduce your interest returns. On the other hand, certificate of deposit accounts usually do not require a monthly maintenance cost.

This implies that you keep all interest income. As a result, CDs can be a fee-friendly way to grow investments, provided you do not need to take money out of one before it matures.

- CD laddering

With the help of CD laddering, you may keep your money accessible and liquid while considering interest rate changes. When you create a CD ladder, you open several CDs, each with a different interest rate and maturity date.

This method of using certificates of deposit for savings results in perpetually maturing CDs. After that, you can choose whether to withdraw your money or roll it into a new CD to benefit from greater rates.

Cons of holding a Certificate of Deposit

Although you can use CDs to save for various financial objectives, they are not always the best option. Here are some drawbacks to be cautious of before opening CDs to save money.

- Accessibility

You have a limited number of withdrawals and transfers to your linked checking account with a savings account or money market account.

On the other hand, you normally have to hold onto your money until the maturity date of a certificate of deposit. Therefore, a CD is probably not the greatest investment for your emergency fund.

You may also include debit or ATM cards with savings and money market accounts. You might also be able to draw checks against your balance in a money market account. Typically, certificates of deposit do not provide certain features.

- Inflation

The term “inflation” refers to the gradual adjustment in product and service pricing. In a situation with low-interest rates, increasing inflation could surpass the rate of return on your CDs.

This implies that even while your funds are increasing, they will not go as far when it comes time to use them. You should note that this risk exists even when holding funds in savings and money market accounts.

- Lower returns generally

In general, the rate of return is lower for investments or savings vehicles that are more secure. While CDs can provide steady earnings and stability, investing in stocks or mutual funds may allow you to see your money increase more quickly.

You might be able to beat inflation while earning larger returns if you invest your money in the market rather than in CDs. But be aware that there are other risks associated with that.

- Penalties for early withdrawals

You can store money you do not want to spend straight away on CDs. However, although you are not prohibited from doing so, there is frequently a cost associated with early withdrawals from certificates of deposit.

Withdrawing money out of a CD before it matures is frequently subject to an early withdrawal penalty from banks and credit unions. This fine may take the form of a fixed amount or a percentage of the interest accrued. In other situations, it might even be the entire interest amount, making your attempts to use a CD as a savings vehicle pointless.

- Subject to volatile interest rates

Knowing the state of interest rates is necessary while using CDs as a saving strategy. Your CDs will generally provide a better return when rates are high. Money held in CDs will not grow as much, though, when interest rates are low.

Interest rate risk is present with CDs because it is possible to lock in money at one rate just to watch rates rise. You would not be able to benefit from that higher rate without opening a new certificate of deposit unless you have a step-up or bump-up CD.

Why would someone invest in a CD?

CDs at banks and credit unions are usually considered secure investments with a guaranteed rate of return. In exchange for locking up your funds for a predetermined amount of time, you receive an interest rate, often higher than you would with a conventional savings or money market account.

If you choose to open a CD, begin by contrasting CD offerings from several banks. Even though opening a CD at your present bank would seem obvious, that does not necessarily guarantee it is the best choice. Online banks are typically the best option if you want to get a better interest rate and lower costs.

Keep in mind your financial objectives as well. Which CD term will work best depends on how quickly you want to accomplish your goals. Having a precise idea of when you anticipate using the funds will also assist you in avoiding paying early withdrawal fees.