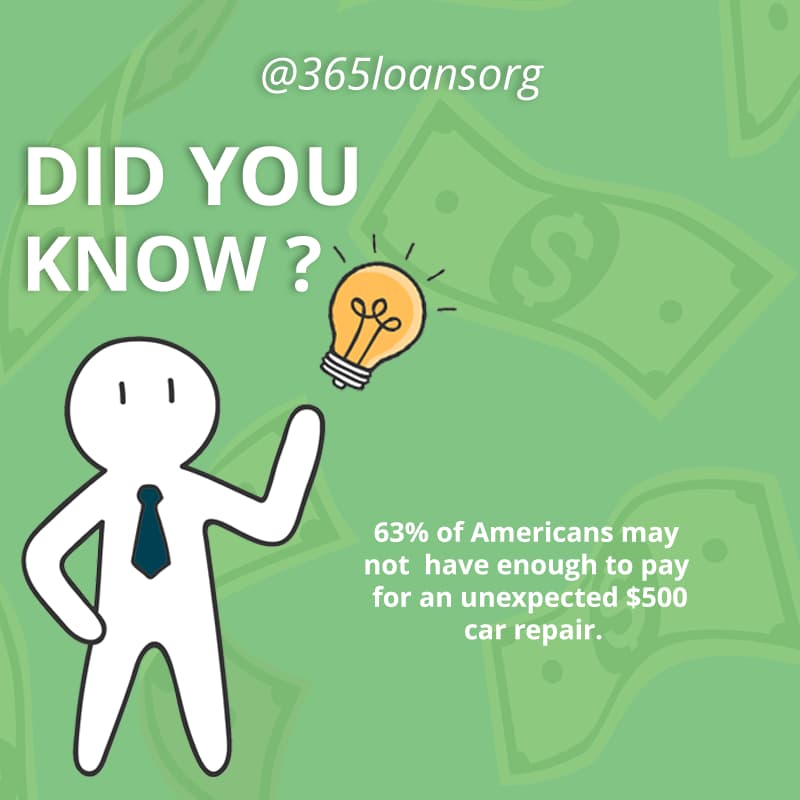

You have probably encountered events or obstacles in your life that could be classified as an emergency. These are unexpected events that usually have financial consequences. An emergency can be as simple as a furnace breaking down or as severe as a health problem that turns your world upside down.

While we cannot predict the next disaster, we can plan for it. Saving money for an emergency fund is the best way to deal with the financial consequences of an emergency. But where should you keep your emergency fund? While it is possible to open a new account at your local or online bank, there are other options to consider.

This article will look at five of the best places to keep your emergency fund.

Where Are the Best Places to Keep Your Emergency Fund Savings?

When the time comes to start saving for an emergency, where should you put it? Your emergency fund should be kept separate from your other bank accounts. You want your emergency fund to be easily accessible in case you need it right away. But you also do not want it to be too easy to get to, so you are not tempted to dip into these funds when it is not necessary.

Here are some of the best places to stash your emergency fund.

- High-Yield Savings Account (Top Choice)

A high-yield savings account to stash your emergency fund makes much sense. Almost all high-yield accounts are available through online banks. You cannot, however, withdraw funds from a physical bank location. Instead, you will need to use another bank account to transfer funds into and out of your high-yield savings account. This could result in a delay in receiving funds in the event of an emergency.

A high-yield savings account is still relatively accessible and offers a higher interest rate than a traditional savings account. The annual percentage yield (APY) on leading high-yield accounts ranges from 0.50% to 0.81%, depending on your account size.

Several online banks provide high-yield savings accounts. When opening an online savings account, it is critical to consider the rates and any fees, other perks offered, and withdrawal rules.

- Money Market Account (Second Best)

Money market accounts work in the same way as high-yield savings accounts. However, while both offer a higher APY than traditional bank accounts, they significantly differ. For example, money market accounts may include a debit card and check-writing capabilities, making them more convenient, particularly in a pinch.

Another distinction that may influence your decision about where to keep your money is the minimum deposit required to open an account, which with money market accounts is typically higher. In addition, some banks offer tiers of interest based on account balances.

To open a money market account, you can choose almost any local and online bank. Typically, you will find higher rates online. In addition, because they do not have all of the overhead costs that traditional banks do, online banks can offer better rates. Whichever option you select, make sure you understand how to access your funds quickly if necessary.

Federal law, like that of savings accounts, limits the number of transactions you can make from a money market account – six per month. Even though the government changed this Regulation D requirement in 2020, you will most likely be charged a fee by your bank or credit union if you exceed this limit. However, if your money market account is only used in an emergency, this should not be a problem.

- Certificate of Deposit (Third Best)

Certificates of Deposit (CDs) are an additional option for your emergency fund. They differ from the other options on this list in that you must keep your money in the account for a set period in exchange for a guaranteed rate of return. This could be as little as a month or as much as five years or more. When the term expires, you will be able to access your initial funds as well as any interest earned. A typical feature of all CDs is that they tend to pay higher interest rates than other bank accounts.

Earning a higher APY is excellent, but having your emergency fund in a CD carries some risk. What if an emergency arises before your CD has fully matured? In most cases, if you decide still to withdraw money from a CD during this period, you will have to pay a withdrawal penalty. In addition, some banks charge a flat fee, while others may charge a percentage of your CD’s interest.

Paying a fee can defeat the purpose of selecting a higher-interest account. It is almost like gambling on whether or not you will have an emergency during that time. There are a few no-penalty CDs available, but you should read the fine print to ensure that the feature is not tied to a specific circumstance, such as losing your job.

One solution is to build what is known as a CD ladder. This entails rolling over a number of CDs with varying term lengths, allowing you to earn more while still having access to some of your emergency funds. For instance, you could have one CD with a 3-month term, one with 12 months, and one with an 18-month term.

You can open a CD account at almost any bank. There are also online banks that offer CDs with better rates or longer terms. Some CDs require a minimum deposit, while others do not.

- Traditional Bank Account (Fourth Best)

If keeping your money in an online account or tied up for an extended period does not appeal to you, you can always keep your emergency fund in a traditional checking or savings account with a local bank. Of course, you will not earn as much interest, but you will have the peace of mind knowing you can access your funds immediately and at any time.

One disadvantage of this strategy is that keeping your emergency fund in a traditional bank account may result in you withdrawing money when it is not truly an emergency. To combat this, you could open a separate bank account from your other checking and savings accounts. However, this can at least add a level of difficulty that may keep you from withdrawing funds when there is not an actual emergency.

- Roth IRA (Fifth Best)

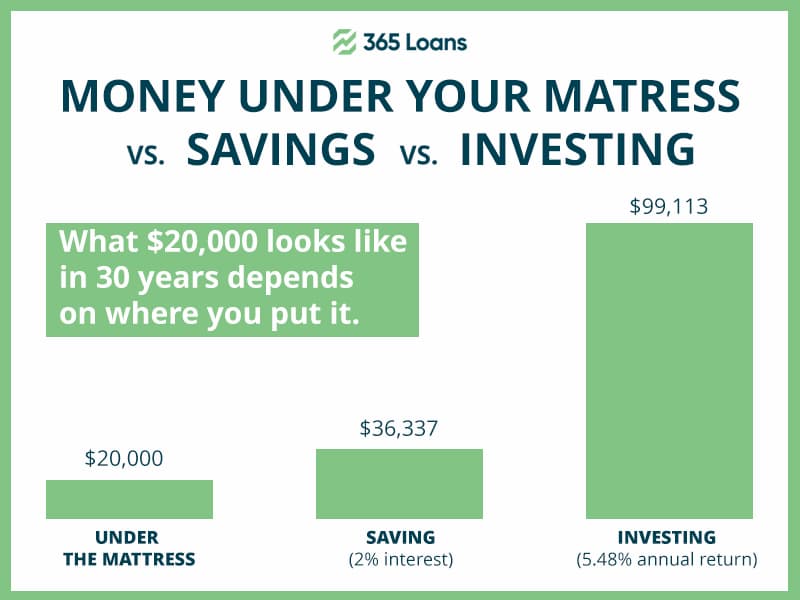

There is an argument for putting money into an investment account rather than keeping a traditional emergency fund. Even high-yielding bank accounts cannot keep up with rising inflation. Investing in a Roth IRA will almost certainly earn you more money in the long run.

Your emergency fund may lose value if you keep it in a Roth IRA. Choosing less risky investment options can help reduce the risk of loss. You can withdraw your Roth IRA contributions at any time without penalty. However, withdrawing earnings may result in tax consequences and early withdrawal penalties.

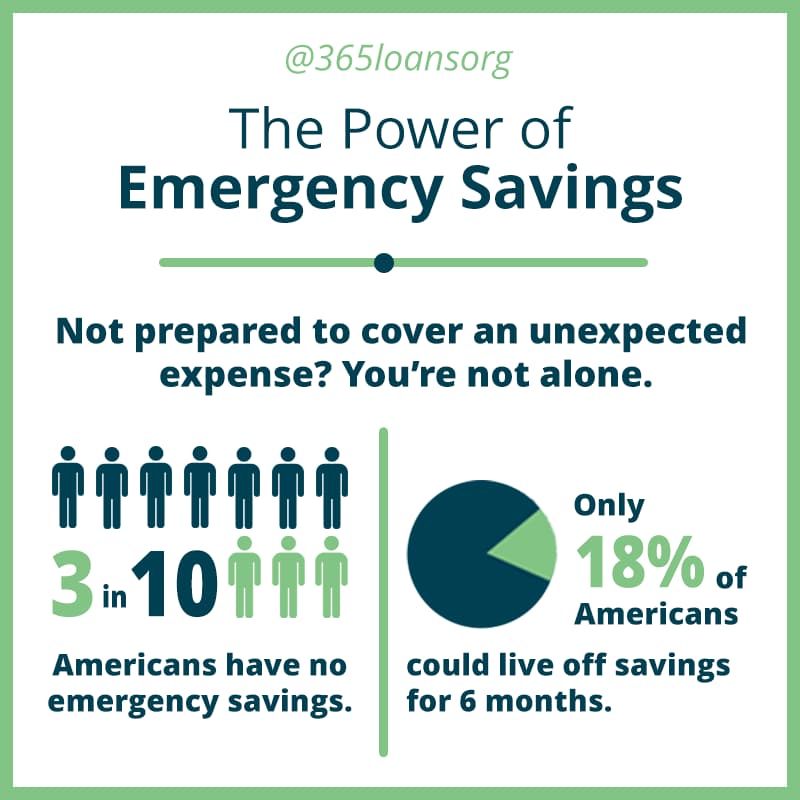

Why Should You Consider Having an Emergency Fund?

Emergencies occur. It is an unavoidable truth of life. You do not start an emergency fund just in case something goes wrong. Instead, you do so as a preparation in case something unexpected happens.

Having an emergency fund offers various advantages, two of which are critical:

- It gives financial assistance when something breaks, whether an accident or health concern, a loss of income, or another emergency occurs.

- It gives you a sense of security.

In a crisis, you may concentrate on the subject at hand without worrying about money. Without an emergency fund, you are left figuring out how to pay for something you did not save for, which can lead to poor financial decisions, such as incurring debt to spend money you do not have.

The ideal emergency fund provides peace of mind, knowing that you are prepared for most of life’s storms. This might be one month’s salary or six to eight months’ worth of living expenses. It all comes down to what makes you feel the most at ease.