Not having enough and having too much money can equally lead to problems. Budgeting can be tricky, and financial crises might arise. Financial problems can occur suddenly. If you know what reasons could cause your economic issues, though, you can avoid them.

It is essential to talk about money as it impacts more than just your wallet, such as your relationships and stress levels.

What exactly are financial issues?

Financial issues are any issues that need to be resolved or overcome and are mainly related to money. Ideally, you should settle any issues you are now facing because they are detrimental to your life and will only worsen.

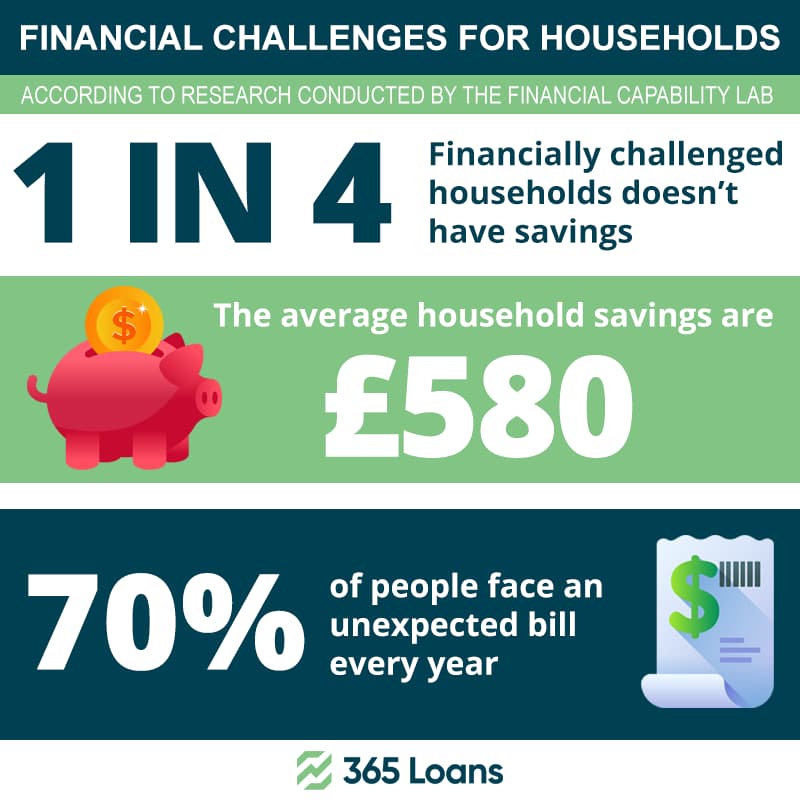

There are also financial annoyances, like unexpected expenses, for example. A financial disturbance could be your significant other spending $10 more than planned on an unneeded item. But things occasionally happen, and unless a financial annoyance becomes part of something greater, it is wiser to ignore it and relax.

Typical reasons causing financial issues

What deserves your attention are persisting problems and their causes. Most financial concerns can be divided into a few groups. The main categories of economic issues include the following:

Lack of financial planning

You will probably run into issues if you feel disorganized about your finances and do not make plans. For example, if you do not have a plan for the money you earn, you could not have enough to cover your payments, and you might be caught off guard if a significant expense arises out of the blue.

Doing no planning or keeping your finances disorganized exposes you to issues.

Furthermore, financial planning helps with self-control. You can earn all the money in the world, then spend it all, only to find yourself back where you started. Economic issues with self-control include not having the self-control to stick to a budget or spending money when you know you should not. If you find it difficult to say no to yourself, it will be challenging to realize your dreams.

To manage your finances successfully, practice making decisions in advance about how you will spend and save your money.

Lack of financial culture

Without financial education, one main reason for financial troubles can be a lost opportunity, a loss of money, or a bad investment.

Not knowing enough about money and how it works constitutes a lack of financial education. Poor monetary judgments are superficial to make if you lack sufficient financial knowledge. Moreover, a lack of financial expertise makes it simple to invest in the wrong things or fall for get-rich-quick schemes, which can ruin your budget.

Simple financial education and careful investigation before placing money into investment or savings accounts can quickly rectify this.

Lack of common objectives within the family

Family dynamics can impact finances, which is a severe issue. For example, reaching your financial objectives may be hindered if you and your spouse have different views on money management or if a family member continually requests money without contributing to the family goals.

Due to divergent viewpoints, family conflicts can prevent you from creating a budget or conserving money. They can also be stressful. Relationship problems might arise from disagreements or financial stress.

For instance, if a family member constantly pressures you to back their brand-new business venture, or perhaps you wish to pay for your children’s college but cannot.

When there are conflicts, both relationships and money can rapidly become complicated. Because of this, it is crucial to discuss your financial objectives and establish a strategy that all family members can follow.

Lack of sufficient money flow

One of the kinds of financial issues that won’t simply go away is not making enough money at your job. Additionally, a lack of funds can undoubtedly derail your financial objectives.

Although it is not difficult to identify income-based money problems, solving them might be complex. Whatever the cause, a lack of funds will unquestionably cause issues for your budget. New employment, a side business, or better money management might be necessary.

How to deal with your financial issues?

There is a considerable correlation between good mental health and financial security.

Additionally, your relationships may improve, you may enjoy a better retirement, and so forth. So here are some ideas for dealing with money issues.

- Identify the issue: Determine the reality of the situation first. Remember that the symptom is not the same as the actual problem. For example, overspending may be a symptom, but a lack of financial restraint is the real issue. Work through the sources of your economic issues by first identifying them. You can accomplish this in various ways, depending on the problem, such as by keeping a journal, discussing things with friends or your spouse, or making financial objectives.

- Educate yourself financially: More financial literacy is always a good thing. Take some of our free financial courses as an investment in yourself. Additionally, talk to people you know who are good with money and read books and podcasts. You will feel more at ease managing your money after you fully comprehend financial jargon and have knowledge of investing, retirement planning, and saving.

- Discuss financial limits with family: Though unpleasant, this is occasionally unavoidable. If family members are contributing to the financial issue, having some difficult conversations with them could be substantial. Typically, this would be your spouse, a member of your family, or a friend. Even though it can be difficult, expressing your feelings and creating boundaries are crucial. Otherwise, you can run out of money or might not be able to pursue your financial goals.

- Reduce self-treats and increase self-discipline: Is this a difficult task? Yes. Does it merit it? Absolutely. Being self-disciplined and putting off satisfaction takes real skill and is crucial for your financial development. Depending on what you value and find most challenging about money, decide on rules for your spending and saving. You will quickly learn that postponing gratification pays off long-term if you treat yourself frequently and stick to your goals.

- Increase your net profits: Earning more is another strategy to address financial issues. More money will help you if your problem is that you can’t pay your bills, or you want to save for an important goal. Looking for ways to raise your income can entail asking for a raise in pay, leaving your current position, or looking for a new one. While it may initially seem like a busy schedule, it will eventually bring you where you want to go.

- Track your progress: You cannot deal with money once and then put it out of your mind. Having a sound system to track your development will be helpful because it frequently arises in your life. Budgeting, keeping track of your savings targets, and reviewing your finances annually to determine whether you are accumulating wealth are all ways to achieve this.

Common financial issues might overwhelm you if they go unaddressed. But you can go over all that with sufficient preparation, knowledge, and discipline.

To see actual results and permanently resolve financial issues, never forget to pinpoint the real problem and track your progress. Next, you divide the good financial habits from the bad ones and focus on repeating the former.