There are several reasons why it appears to be more challenging to maintain your financial stability year after year. Some of it concerns how our attitudes around money have changed. Another fair share is related to the current state of the economy. But there is a third factor to why some people are left behind. Lack of the necessary adaptability, that is.

So, what should you do if you are living paycheck to paycheck and there appears to be no way to advance?

Getting your mindset in the correct place is the first step.

How to stop living paycheck to paycheck?

You must make the conscious decision that you are done scraping by and will transform your financial condition no matter what it takes.

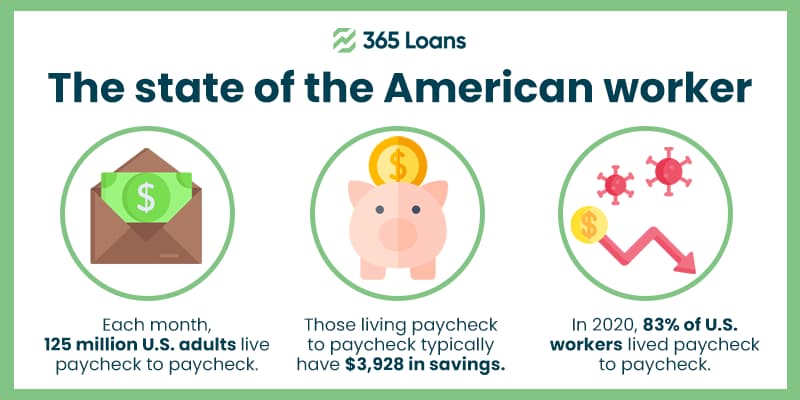

Of course, living paycheck to paycheck is entirely normal as long as you are content with your lifestyle; many people find it gratifying when they live within their means. But, on the flip side, it may sweat you a little, considering unforeseen events may happen at any time.

There is a method to escape the cycle of living paycheck to paycheck and permanently defeat the mindset that goes along with it. First, you need to determine the cause of your paycheck-to-paycheck living.

Reasons you are still living paycheck to paycheck

- Like most people, you are spending too much money: You might be lavishing more than you earn. It would help if you exercised more control over your spending habits. Because most people do not have a strategy, they spend more money than they earn.

- You are not making enough money: It could be because you are underemployed or just not putting in enough effort to go out and kill it at work. Anyhow, increasing your income could alleviate your financial condition.

- You are not differentiating between needs and luxuries: Many items once regarded as “extras,” like cable TV, paid subscriptions, and eating out frequently, are now regarded as necessities. But these are wishes rather than needs. If you allow them, these extras could leave you completely dry.

- You are accepting debt as part of your life: It is unnecessary to be that way. Contrary to what you may have heard in the media, debt is not necessary for survival in the contemporary world. Credit card debt and auto loans are not necessities.

- You do not have a financial plan: You do not monitor your finances and spend till there is nothing left, not knowing where any of the money goes. Then, once you receive your next paycheck, you repeat the process. Most people wind up living paycheck to paycheck in this way.

- Electronic money feels too easy to spend: Shopping with credit cards does not sting as much as using cash. You overspend before you realize it when you swipe and sign.

6 strategies for stopping the paycheck-to-paycheck life cycle

Once you have identified the issue’s root, you can start implementing practical solutions to deal with those issues and permanently eradicate them.

1. Do a monthly budget

Budgets are not only cost estimates; they bring control to our lives. If you continuously refuse to make and implement budgets, you will keep running out of options.

Budgets reform your spending habits. Create monthly, weekly, and even daily budgets before spending a penny. Allocate and prioritize your spending costs before you spend somewhere you did not suppose to be.

You will have to compare the actual spending against what you estimated. For example, create a shopping list, and your next grocery shopping could see a drastically lower counter bill.

2. Save first, then spend

One reason you cannot save money is leaving it till the end of each month. Saving before spending requires a shift in your habits. The best way to do it is to differentiate between your needs and wants. For example, aim to save 10% of your monthly income as soon as you get your paycheck.

If you do not have a cushion for emergencies, you will always rush to quick loans when contingencies happen. But unfortunately, debts incur heavy interest costs and never let you save money.

3. Get out of debt

Debt is a decision. Debt is not required to lead a comfortable and meaningful life, yet it is the route that most people have taken. Debt prevents you from improving your financial situation by stealing your hard-earned cash in the form of interest and fees.

Do you prefer to pay money to banks and other financial institutions or your bank account?

The greatest approach to start making money is to pay off your debt, period.

4. Create a passive income stream

Ideally, create multiple passive income sources if you can. For example, putting your money in Certificates of Deposit (CDs) and stock investments are different financial strategies that could help you do so.

Think of some trendy passive income streams like earning a few bucks with freelancing, blogging, and YouTube. These unorthodox income methods do not require heavy initial investments and are certainly not as risky as stock investments.

Passive income will reduce your monthly interest bills on the one hand and accumulate wealth on the other.

5. Refashion your lifestyle

Sifting through your spending habits is all you have to do to find the holes leaking money. No, it doesn’t require a dramatic shift in your living standards. But, essentially, you need to ask yourself why you could not save enough this month?

Just explore a few simple options before attending any financial advisory sessions.

- Are you an impulse buyer?

- Do you eat out more often than ordinary?

- Can you do it without a luxury wristwatch?

It does not mean shunning your necessities; it only means prioritizing your needs before your wants.

6. Remodel your financial plan

Without a strategy, you will be unable to change your financial situation. Being impulsive seldom works. Create a documented plan for your debt relief strategy, and then start moving forward with it. Do not hesitate to seek an expert’s advice if you need it.

Overcome paycheck-to-paycheck life

You likely have a fair notion of the factors that might be causing the issue by this point. So be frank and brutally honest with yourself right now.

You must examine your circumstance carefully and honestly to determine the issue’s root. Although facing those concerns could be difficult, lying to yourself will never help you succeed in life.