Inflation is known as “the silent murderer of money,” which is a good enough reason to try to stop it. And there’s a valid explanation.

If inflation is not controlled, you can lose your money’s value, increasing the cost of everything you buy. Typically, a healthy economy includes a small amount of inflation, or about 2% every year. This is because a slight price increase on products and services increases consumer spending, which boosts the economy. However, if inflation rises too quickly, money loses value, which drives up the cost of goods and services.

Inflation Rates Statistics for Q3 2022

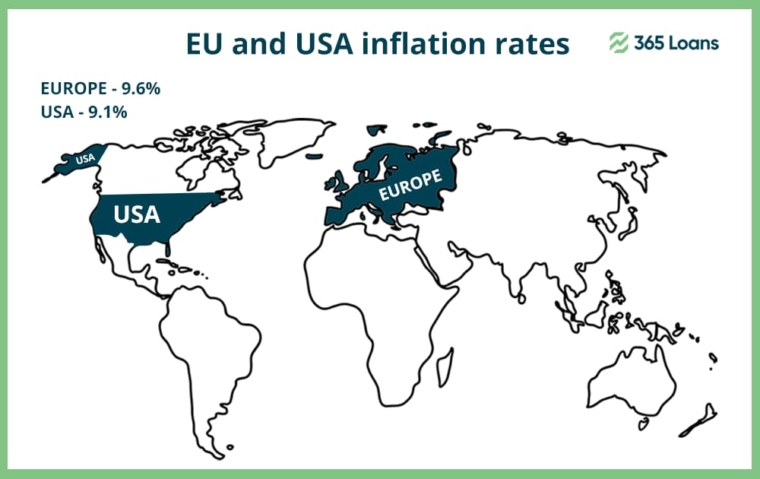

The Baltic states experienced the most increase in annual inflation in all of Europe in June 2022, with the EU’s annual inflation rate rising by 9.6%.

At the same time, overseas, after reaching a more than 40-year high of 9.1% in June, the US annual inflation rate fell more than anticipated to 8.5% in July 2022, which was lower than market expectations of 8.7%.

So, the last statement alone brings up one step closer to realizing what issue inflation is. But can you do anything to address that?

Let us discuss three methods you might employ to combat inflation and weather the financial storm.

1. Reduce your spending

Cutting costs and spending less is one of the quickest and most straightforward strategies to combat inflation. You might not be able to do anything about your mortgage or auto loan, but you undoubtedly have the money to cancel a few streaming or digital subscriptions. You can also cut back on social outings, so consider hosting a potluck party for your pals rather than going out for dinner and drinks.

When things are hard, we must practice extraordinary patience and creativity in our spending. We frequently pay more for branded goods or tiny conveniences. Take some time before making any purchases to ensure you’re receiving the most outstanding deal possible because inflation is currently at an all-time high. It could also mean buying items in bulk, waiting until they’re on sale, or using coupons. It could even mean choosing generic or off-brand goods over name-brand ones to save a few euros.

With just a few modest lifestyle changes, you can avoid inflation if it is 10% per year and cut your spending by 10%. That’s all there is to it.

2. Contribute your money to make more money

Growing your money through investments is a popular method for avoiding inflation. Gaining a passive income through investing can assist you in offsetting the value loss brought on by inflation.

There are plenty of investment possibilities available; the only question is which ones are best for you.

Here are some popular investment options for battling inflation.

- Invest in stocks

Different stock kinds may be impacted by inflation in different ways. For instance, as the cost of borrowing money rises during inflationary periods, growth stocks that depend on borrowing money to grow sometimes struggle during these times. Contrarily, businesses that deal in consumer goods and energy typically fare well when there is inflation.

For many people, buying stocks is one of the primary motivations for investing in the stock market. While stocks might be risky, they tend to gain in value over the long run, which helps people maintain their spending power. Conversely, money kept in the bank will lose weight over time.

- Invest in precious metals

One of the most well-known and often-used strategies for governments and individual investors to combat inflation is using precious metals. The fact that gold and other precious metals have a finite quantity and are valued by almost everyone makes them well-known as the go-to hedge against inflation.

- Invest in government bonds

Bonds are merely debt securities, so when the government (or a business) needs money, it will assure investors that it will repay the money with interest. As a result, many investors resort to government bonds when looking for investments with lower risk and predictable returns. Some bonds, including Treasury Inflation-Protected Securities (TIPS) and U.S. Series-I Savings Bonds (I-Bonds), are created explicitly to outperform inflation.

- Invest in real estate

Real estate often appreciates in value during periods of inflation. Real estate is no exception to the rule that asset values rise as a result of inflation. Therefore, you can charge tenants more if you own real estate that you rent out because average rentals are typically greater. The same idea holds true for home sales prices, which rise in tandem with inflation.

- Invest in P2P lending

Peer-to-peer lending is a novel strategy for portfolio diversification and a weapon against inflation. Interest rates rise along with inflation, so you can charge borrowers higher interest rates when you lend them money. However, even when inflation increases, P2P lending can take this into account and still give you better returns when inflation is high.

3. Get paid more

You have the right to request a wage increase in response to rising inflation rates, even though there are no guarantees that your employer will agree. Of course, you have to be strategic when asking your supervisor for a raise. Demanding more money is generally not going to get you what you want because everything is more expensive. Instead, carefully craft your argument and develop the evidence to support your request.

When you speak with your boss, strive to emphasize the value you bring to the organization by mentioning some of your most recent accomplishments and how they helped the business reach its aims. To support your proposal, you should also look at the typical salaries of workers in your position at competing firms. Finally, you can bring up the rising cost of living due to inflation, but remember that you’re asking for a raise primarily based on your merit and not merely because things are more expensive.

How to fight inflation?

A robust mechanism that can depreciate your money is inflation. But by employing these methods, you may stop the erosion and keep or even increase your money. To beat inflation, do your homework, make wiser financial decisions, and use your skills.