One of the most crucial abilities you’ll ever need is knowing how to secure your financial well-being. Given recent global and market events, you may be wondering whether you should make changes to your investment portfolio. Mutual funds have emerged as the perfect go-to avenue for low-risk investors to build a backup retirement plan rather than a fortune.

The objective behind mutual funds is to scale back investment risk. Therefore, mutual funds investment will typically be less risky than other investment products, thanks to their diversification. Yet, all investments are subject to losses, disregarding the particular product of choice.

Information is an investor’s best tool.

It is recommended to get familiar with what to expect from the product to ensure you have a good experience with what you buy before investing in Mutual Funds.

1. Determine your investment objectives

The first step toward successful investing is determining your investment objectives. Either with the assistance of a financial advisor or on your own. You should know your investment risk tolerance, whether you seek steady growth or quick value advancement.

Sit down and examine your overall financial condition before making any investment decisions. Then, get familiar with what you can afford to lose.

There is no guarantee that your investments will be profitable. But if you develop and implement an educated plan about savings and investing, you should be able to acquire financial security and enjoy the rewards of money management over time.

2. Explore different Mutual Funds investment categories

Many investors mistakenly believe that mutual funds are a risk-free way to build money in the future. Indeed, the widely spoken claim is that if you want strong returns, you should invest in equity funds or aggressive hybrid funds. Or that if you’re going to store your money somewhere that is not easily influenced by market volatility, you should consider bond funds. However, one cannot profess that a specific mutual fund category is high or low risk based on a standard scale or characteristic.

The first and foremost aspect to remember is that the risk of each mutual fund category varies. Therefore, it is a rule of thumb to always check the risk-o-meter of any Mutual Fund scheme before investing money in it.

3. Consider an appropriate asset allocation

As an investor, you can protect your investment portfolio against severe losses by integrating different asset categories that will fluctuate based on distinct market conditions. Asset allocation will allow you to lower the chance of losing money and smooth out your overall investment results. In addition, historical trends prove that market factors that cause one asset category to perform well frequently cause another to perform poorly. Therefore, by investing in multiple asset classes, you will be able to offset your losses in that asset category with higher investment returns.

Furthermore, asset allocation is paramount since it could significantly impact whether you will reach your financial goals. Your investments may not fulfill your objectives if you do not include enough risk in your portfolio.

4. Create an investment discipline through a Systematic Investment Plan (SIP)

Investing in Mutual Funds via automated solutions is a critical financial choice. SIPs work by following the Rupee Cost Averaging approach, through which a set sum is withdrawn from your account at regular intervals and invested in a fund of your choice. This approach focuses on developing investing discipline and allows you to profit from market volatility. Automated investing works best when the market falls because you get more items for the same price. However, when the markets are expensive, you still spend the same money but buy less. Eventually, this helps you reduce your overall investment costs and earn long-term solid returns.

5. Create and maintain an emergency fund

Regardless of the amount of money you decide to invest in mutual funds, it is vital to always take care of yourself first to take advantage of the available opportunities. Most wise investors save enough money in a savings product to handle an emergency, such as unexpected unemployment. A widely known personal finance tip is to save up to six months of your income, so you know that money will always be there when you need it.

5. Keys to financial success

Knowing how to save or invest is an ability nobody is born with. Every successful investment endeavor begins with the fundamentals. People from all walks of life prove that anybody who embarks on the road to achieving financial security is opted in for financial success, as long as he is determined.

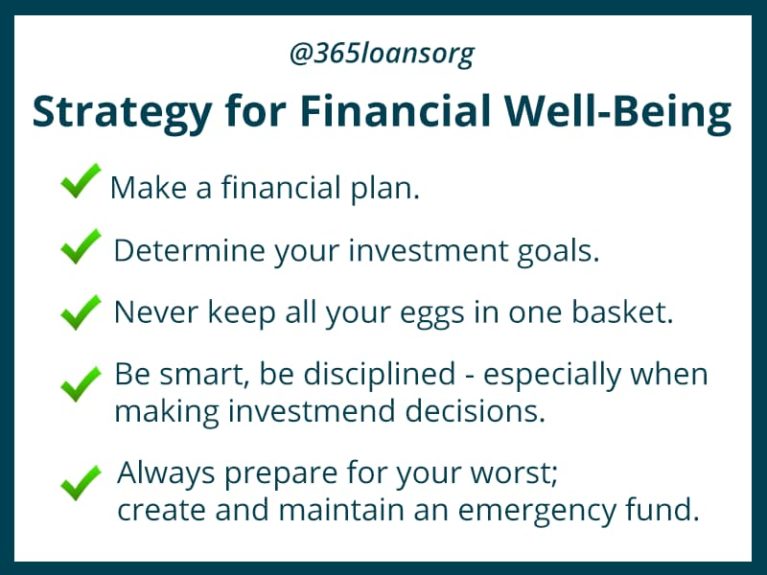

If you want to be the next one to achieve your financial success, make sure that you take away those keys to financial success with you:

Mutual funds are one of the most popular investment options available to rookie, intermediate, and advanced investors. All that is required is a basic understanding of the essentials and a desire to expand one’s knowledge to make sensible, educated decisions. Yet, Mutual Funds investments are subject to market risks.

In the preceding part, we have covered a mix of 5 qualitative and quantitative selection processes that, if followed methodically, can get you to the final pick for your portfolio. Those fall within the scope of proactive measures you can take when determining the fund category to invest in. Identification of the financial goals, the time horizon, and risk tolerance with appropriate countermeasures; that is, in a nutshell.

In this sequential, we will continue with the minimum steps to assume while selecting a Mutual Fund scheme to best fit your demands.

6. Carry out a performance audit of the Mutual Fund

A solid mutual fund can continuously deliver stable returns for its investors over time, rather than merely hasty returns. The fund should be able to generate consistent returns throughout both bullish and bearish stock market situations.

When looking to evaluate the consistency of the performance factor, you should look for an analysis of:

- Performance against benchmark: TA mutual fund scheme’s performance and stock allocation are measured against a benchmark index. The investment philosophy of the program is guided by the benchmark index. As a result, a benchmark index’s asset allocation should correspond to the scheme’s investment goal. A large-cap mutual fund’s benchmark index, for example, should be a large-cap index, whereas a banking mutual fund’s benchmark index should be a banking index.

- Performance against category: Another aspect similarly vital to evaluate when deciding on a mutual fund scheme is its overall performance in evaluating its functional peer group. This approach facilitates getting holistic know-how of the fund’s overall performance. This evaluation needs to compare mutual fund schemes in one category. For instance, you should compare a small-cap mutual fund with another small-cap mutual fund, not mid-cap or large-cap funds.

7. Examine fees and tax implications

You would want to know your net returns on all investments made. You need to subtract all fees and expenses related to your investment portfolio.

Expense Ratio

The commission charged for proper investment management is known as the expense ratio. Because the expense ratio is measured over the investor’s whole portfolio and has a significant influence, it’s critical to look for a mutual fund with a lower expense ratio as an investor. In addition, empirical data shows that the smaller the expense ratio, the larger the Assets Under Management (AUM).

Exit Load

Like the expense ratio, some funds charge an exit load if you leave the fund early. As a result, you must determine whether the schemes have an exit burden or are free of it.

Taxation

Taxation is an essential consideration for investors, particularly newcomers. Equity mutual fund returns are taxed based on the holding period and the applicable tax rate. The rule is that long-term capital gains have lower taxes compared to short-term capital gains. Therefore, those who want to pay as little tax as possible should invest in funds that generate long-term capital gains (i.e., stocks held for more than one year).

8. Stay informed on economic changes

The performance of a specific sector or industry in which the fund is invested is one of the most critical factors influencing mutual fund investments.

The healthcare industry, for example, performed better than other sectors during the COVID-19 pandemic. As a result, stock prices in this industry have remained relatively stable and have outperformed others. Similarly, one sector may perform well for some time and then experience some stiffness.

It is judicious to keep an eye on the sectors in which a mutual fund invests and stay ahead of a potential negative ripple effect on the fund scheme caused by political or economic implications.

9. Inspect the scheme’s Assets Under Management (AUM)

The size of the mutual fund influences how well it performs. The total assets managed by a mutual fund scheme indicate the size of the collection of funds from investors and the approximate number of investors involved. Too many or too few funds can impact the fund’s performance.

To elaborate, if the fund grows too large, it becomes difficult for the fund manager to keep it running. Therefore, it is critical to consider the securities in a more extensive mutual fund portfolio. On the other hand, it is advantageous in the case of liquid funds or additional short-term debt funds.

How to choose a suitable Mutual Fund?

There are several parameters to consider when selecting the right mutual fund – return expectation, risk tolerance, investment horizon, and investment knowledge. In addition, you can judge the investment based on past performance, expense ratio, assets under management (AUM), your fund manager’s experience, and more. However, it is critical to conduct research before embarking on your investment journey. This will help you make a more informed decision and clearly understand the “what is what” in the mutual fund space.