The term “recession” is often used in jest, rarely with any understanding of what it means or why it is so important. We will take this chance to define what a recession is, examine some significant recession features, and consider a scenario in which we might experience a recession soon.

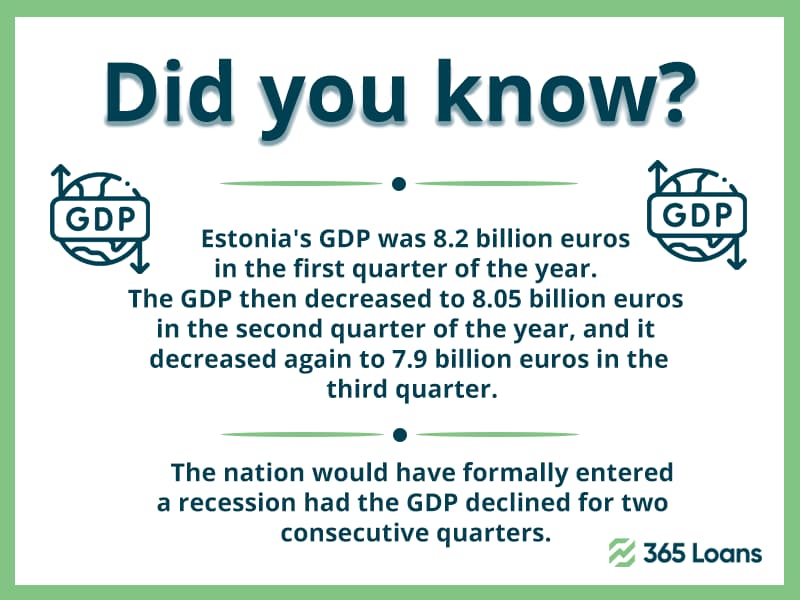

Generally, a recession is characterized as a severe and protracted period of diminishing economic activity. Though there is considerable debate about the precise definition of a recession, most people agree that it is recognized by two consecutive quarters of harmful gross domestic product (GDP) growth or lower GDP than the previous quarter. Recall that a country’s GDP represents the entire worth of its commodities and services.

Why do recessions occur?

Any economy can experience recessions, which typically last a few years. A recession may occasionally occur a year or two after the preceding recession, with little to no warning. Other times, an economy may experience ten or more years of expansion without a recession. Recessions typically occur roughly every three to five years.

Recessions do not have a single root cause. Instead, major economic problems bring recessions, including unemployment, deflation, and inflation. An economy cannot expand if people are not spending money, which causes a recession. People will quit spending if prices increase too quickly, which will cause a recession. People who are unemployed and have high unemployment rates will not be able to spend money since they will not be able to make any. Less spending and slower (or unfavorable) economic growth, such as a recession, result from these factors.

Is a recession coming in 2022?

Fears of a recession dominated news worldwide in the first half of 2022. Of course, nobody can foretell the future, yet many economists have predicted a coming recession in Europe and the US if it has not already started.

At this moment, it is common to encounter multiple mixed opinions on that subject. For example, in a National Association of Business Economics survey, 72% of economists predicted that the next US recession would start by the middle of next year if it has not already.

What would a 2022 recession look like?

Some economic downturns, like the Great Depression, have a significant and long-lasting impact. Other recessions, however, might only last a few months or be minor (like the recession that followed the collapse of the dot com boom in 2000–2001). A recession that might affect Europe, the US, and other nations worldwide is already being highlighted by economists and banks, including the Bank of England, Bank of America, and J.P. Morgan.

Nobody can predict the future because of the stock market’s volatility and inflation that is still circling close to all-time highs. To combat rising inflation, which is intended to limit economic growth, the European Central Bank (ECB), the US Federal Reserve, and other central banks are aggressively hiking interest rates. A coming recession would not surprise anyone, given how swiftly interest rates are rising and how uncertain the stock market’s future is.

But how would today’s recession appear?

This recession may not be as bad as others the globe has seen for various reasons. The property market is hot, possibly inflated, but overall appears to be stable. In addition, the EU and US labor markets are tight, with low unemployment rates. To top it all off, during the COVID-19 lockdowns, Europeans took advantage of the chance to save some money, resulting in a significant safety net for the European economy.

Inflation appears to be the primary source of concern for the US, most other major countries, and Europe. Although central banks are devoted to preventing hyperinflation, doing so might result in a slowdown in the economy and a possible recession. If that occurs, it can take some time before economies start to recover. But there is not much evidence to suggest that this recession would be as severe as those in 2020 and 2008 if we contrast it with those that preceded some of history’s worst ones.