As we journey through life, it’s essential to anticipate the unexpected and plan for our future needs. One critical aspect of this planning is ensuring that our healthcare needs, particularly as we age, are adequately addressed. Long-term care insurance steps in as a valuable tool, offering financial protection and peace of mind for the later stages of life. In this article, we’ll delve into the realm of long-term care insurance, exploring what it entails and why it’s an essential part of your comprehensive financial strategy.

Understanding Long-Term Care: The Need for Coverage

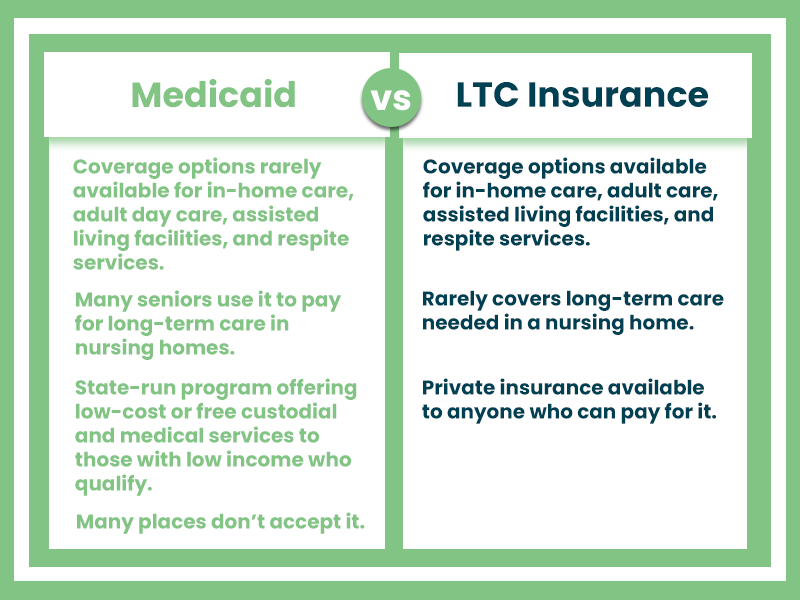

As life expectancy increases, the likelihood of needing long-term care rises. Long-term care encompasses a range of services, from assistance with daily activities like bathing and dressing to more intensive medical care in a nursing home. While some may assume that these services are covered by traditional health insurance or government programs, the reality is that they often aren’t, leaving individuals and families with substantial financial burdens.

Enter Long-Term Care Insurance

Long-term care insurance fills this gap by providing coverage for services and support when you’re unable to perform daily tasks independently. It offers a degree of financial security and preserves your hard-earned assets, enabling you to receive care without exhausting your savings or burdening your loved ones.

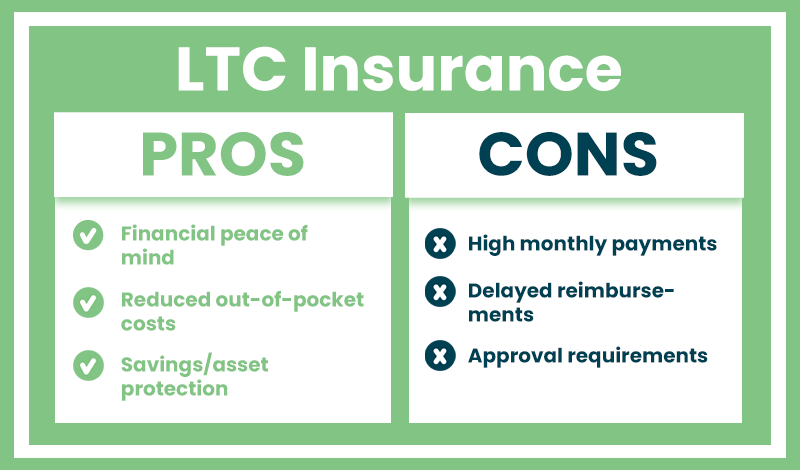

Key Benefits of Long-Term Care Insurance

- Asset Protection: Without insurance, the cost of long-term care can quickly deplete your savings and assets. Long-term care insurance helps preserve your financial legacy by covering expenses related to care services.

- Choice and Control: With this insurance, you have more control over the type of care you receive and where you receive it. Whether it’s in your own home, an assisted living facility, or a nursing home, you have the freedom to choose based on your preferences and needs.

- Less Strain on Family: Long-term care needs often fall on family members, creating emotional and financial strain. Insurance can alleviate some of this burden and ensure your loved ones have peace of mind knowing you’re receiving the care you need.

- Maintaining Quality of Life: Long-term care insurance helps you maintain your quality of life by ensuring you have access to necessary care and services without compromising your financial stability.

When to Consider Long-Term Care Insurance

It’s never too early to start considering long-term care insurance. Ideally, you should begin researching and planning in your 50s or early 60s, before health issues potentially arise. Premiums tend to be lower when you’re younger and in good health, making it a more financially feasible option.

Choosing the Right Coverage

Selecting the right long-term care insurance policy requires careful consideration. Factors to evaluate include the scope of coverage, benefit amounts, waiting periods, and any potential restrictions. Consulting with a financial advisor or insurance professional can help you tailor a policy to your needs.

In Conclusion

Long-term care insurance isn’t just about planning for potential health issues; it’s about safeguarding your financial well-being and ensuring you can maintain your quality of life even when faced with challenges. As you map out your future healthcare needs, consider integrating long-term care insurance into your overall financial plan. By doing so, you’re taking a proactive step towards securing your future and providing yourself with the care and dignity you deserve.