Life is a rollercoaster, filled with twists, turns, and unexpected surprises. While we can’t control every twist, we can take measures to protect ourselves financially. Enter the world of risk management and insurance, two powerful tools that can help secure your financial future. In this article, we’ll explore the fundamentals of risk management and insurance in plain language, offering practical insights along the way.

Risk Management: The First Line of Defense

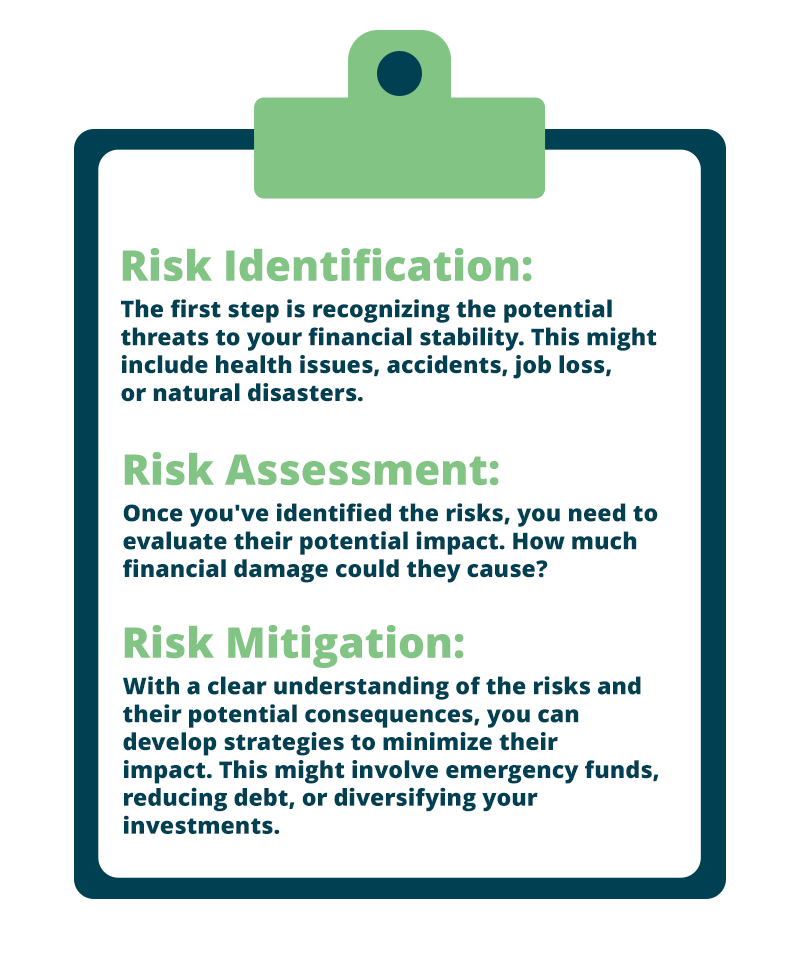

Risk management is your financial shield against unexpected events. It’s a proactive approach to identifying and mitigating potential risks. By recognizing these risks, you can take steps to minimize their impact on your financial well-being.

Risk management involves:

The Role of Insurance: Your Financial Lifesaver

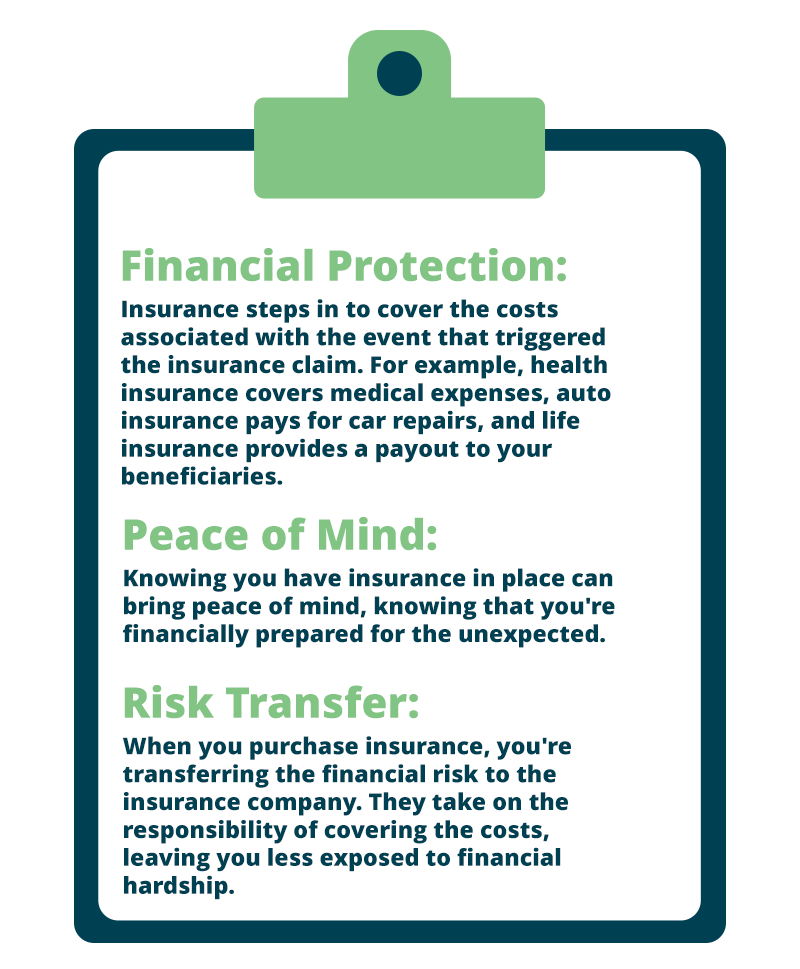

Insurance is a financial safety net. It’s a contract between you and an insurance company, where you pay regular premiums in exchange for coverage in case certain predefined events occur. Insurance is essential because it helps protect your financial stability when life takes an unexpected turn.

Insurance provides:

Types of Insurance: Tailoring Protection to Your Needs

Insurance isn’t a one-size-fits-all solution. There are various types of insurance designed to address specific risks. Here are some common types:

- Health Insurance: This covers medical expenses, ensuring you receive necessary medical care without the burden of high costs.

- Auto Insurance: It protects you against financial losses resulting from accidents, theft, or liability claims while driving.

- Life Insurance: This provides financial support to your loved ones in case of your passing, helping them cover expenses like mortgages, debts, and living costs.

- Homeowners Insurance: It safeguards your home and personal belongings from damage or theft, offering peace of mind for homeowners.

You Might Also Want to Read: Insurance Claims 101

Assessing Your Insurance Needs: Don’t Overpay or Underprotect

Before purchasing insurance, take the time to assess your unique risks and financial situation. This step ensures that you choose the right coverage without overpaying or leaving gaps in your protection.

Consider factors such as:

- Your health and medical needs.

- Your vehicle and driving habits.

- Your family’s financial needs in the event of your absence.

- The value of your home and personal belongings.

By evaluating your risks and financial circumstances, you can make informed decisions about the types and amounts of insurance coverage that best suit your needs.

Conclusion:

Risk management and insurance are invaluable tools for securing your financial future. By understanding the principles of risk management, evaluating your risks, and choosing appropriate insurance coverage, you can shield your finances from life’s unexpected surprises. Remember, the key is to tailor your protection to your specific needs and circumstances, ensuring that you’re well-prepared for whatever life throws your way. With the right risk management strategies and insurance coverage in place, you can navigate life’s uncertainties with confidence.