Insurance can sometimes feel like a maze of policies, premiums, and jargon. One term you’ll encounter in almost every insurance policy is the “deductible.” But what exactly is a deductible, and how does it affect your insurance costs? Let’s break it down in simple terms with some real-life examples.

What Is a Deductible?

A deductible is your financial skin in the insurance game. It’s the amount you agree to pay out of your pocket before your insurance company steps in to help. Imagine it as the entrance fee to the insurance party.

Auto Insurance Example:

Let’s say you have auto insurance with a $500 deductible. You accidentally back into your neighbor’s mailbox, causing $1,000 in damage to your car. You’ll pay the first $500, and your insurance company will cover the remaining $500. So, your deductible is like a self-imposed cap on how much you’re willing to pay for repairs before your insurer takes over.

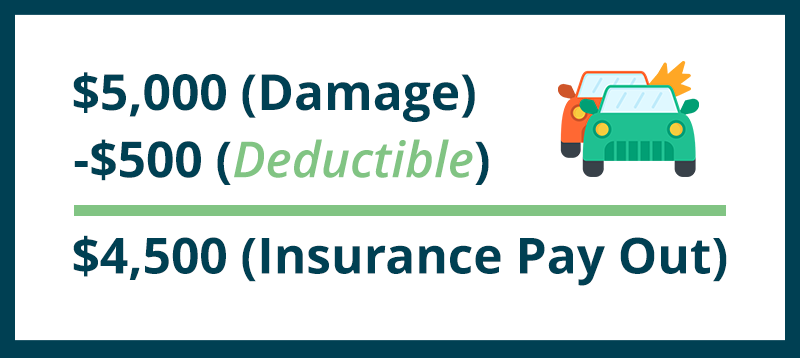

Home Insurance Example:

In this scenario, you have home insurance with a $1,000 deductible. A tree falls on your roof, resulting in $5,000 worth of damage. You’ll be responsible for the initial $1,000, and your insurance will handle the remaining $4,000.

Health Insurance Example:

With health insurance, let’s say you have a $2,000 deductible. You need surgery that costs $8,000. You’ll pay the first $2,000, and your health insurance will cover the remaining $6,000.

How Deductibles Affect Your Costs

Deductibles are like a lever that you can adjust to control your insurance costs. Here’s how they impact your expenses:

1. Premiums vs. Deductibles: The relationship between your deductible and your premiums is like a seesaw. If you choose a higher deductible, your insurance company will reward you with lower monthly or annual premiums. It’s a bit like saying, “I’ll handle more of the small stuff if you lower my monthly bill.”

Example: You could save about 25% on your car insurance premium by opting for a $1,000 deductible instead of a $250 deductible. So, if you’re a safe driver and don’t expect to file many claims, a higher deductible might be a wallet-friendly choice.

2. Risk Tolerance: Your deductible choice should match your comfort level with financial risk. Think about how much you can afford to pay out of pocket if something goes wrong. If scraping together $1,000 in a hurry would be tough, a lower deductible might be the way to go, even if it means slightly higher premiums.

Example: If you’re living paycheck to paycheck, a $500 deductible on your renters insurance can provide peace of mind. You might pay a bit more each month, but if your laptop gets stolen, you won’t struggle to come up with $1,000 for a deductible.

3. Claim Frequency: Deductibles are a nudge to discourage small claims. If you file claims frequently, you may see your premiums rise. So, sometimes it’s better to handle minor expenses on your own.

Example: Let’s say your phone screen cracks, and it’ll cost $300 to fix. If your homeowners or renters insurance has a $500 deductible, it’s probably best to skip the claim and cover the repair yourself. That way, you avoid a claim on your record that could lead to higher premiums.

Conclusion

Understanding deductibles is like having the key to unlock smart insurance choices. It’s all about balancing what you can afford today with what you might need tomorrow. So, when you’re shopping for insurance, remember to ask about deductibles and choose the one that best suits your budget and comfort zone. It’s your financial ticket to the insurance party, so make it work for you!