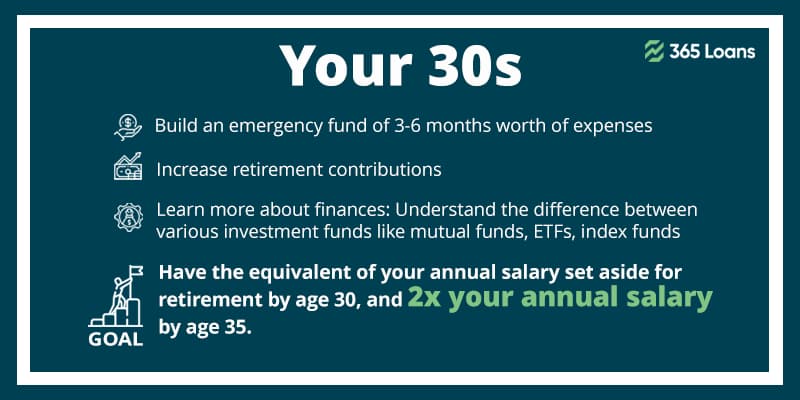

At this stage of your life, your early age, enthusiasm, and nerves start to settle down a little. You are young enough to stay energized for any challenge and mature enough to make wise decisions such as investments. On the other hand, you may likely have several debts on your credit report, your expenses tend to be higher than in your 20s, and mortgage payments entrapped you a bit.

By this stage, you already know basic financial literacy and investing options to consider, at the very least. So you are at the right time to start investing and planning your retirement at this age. Here are a few tips to help you manage investing in your 30s.

Start contributing toward your retirement fund

If you have not already, this should be the first task on your to-do list. Your 401(k) contribution might have started if you are doing a job by that time.

Calculate the taxation, net receipts after any mortgage payments, and allocation for the expenses in the future. If you are short of money in post-retirement age, it is time to invest in another fund, such as a Roth IRA.

Invest in Stocks, ETFs, and Index Funds

Stock market funds offer a higher return than average equity investments. Index funds are high-return investment options as they usually (read “always”) comprise high-performing stocks.

Consider investing in index funds such as NASDAQ 30 and S&P 500. Similarly, you can consider investing in exchange-traded funds (ETFs). You can achieve your high return and diversification goals with this option together. You can start stock investment through an online financial advisory program, a Robo-advisor, or a brokerage house.

Investing in both equity stocks and index funds requires a different strategy. Avoid investing with a stock IPO if you have never invested in stocks earlier. Consider high-growth stocks, often called blue-chip stocks, to begin with. ETFs and index funds, on the other hand, are relatively safer investing options. Perform a little market check for best-performing index funds and stocks, or seek advisory help.

Revisit your risk-reward strategy

There is nothing wrong with being passionate about your dreams and financial goals. Just avoid being over-confident. You can invest in risky investments at this stage of your life if you favor the well-known adagio:

No investment plan can guarantee returns and mitigate 100% risks. Instead, do your due diligence on high-performing, high-growth stocks to invest your money.

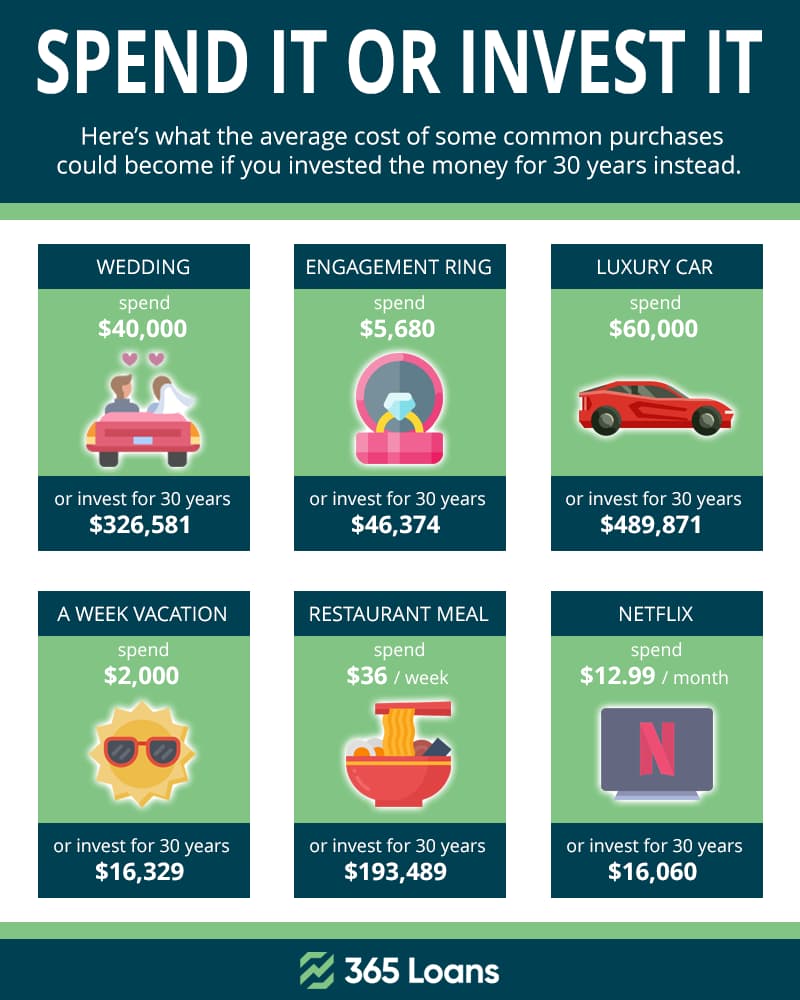

Keep an eye on your current expenses

Your long-term financial success with investments can reap the rewards if you can save well in the short term. You should not be cutting your necessary expenses. Instead, consider junk expenses like unnecessary online subscriptions, expensive or distant family vacations, and renting extra parking slots.

Small savings can accumulate in your investment accounts. But, even if you can save on interest, it will be a good enough saving.

Tax planning

As you increase your income options by working an extra job or passive income ideas and returns on investment start to flow, your taxes pile up too.

Your current income is taxed yearly, but long-term investments such as real estate, retirement funds, and stocks will be taxed at capital gains realization. Therefore, create a cushion for your taxes for those long-term investments.

Consolidate your debts

Debt consolidating may not sound like an investment option to you at this stage, but it may prove to be your best investment. Your savings will never get fat if a large chunk of your hard-earned money goes to interest payments and legal fees.

Some simple strategies can help you save big on the interest that ultimately can become your investment.

- Consider paying by cash instead of a credit card if possible;

- Repay your credit card bills in total if you have savings;

- Consider consolidating your debts with cheaper and flexible loans such as an RCF;

- Improve your credit score. Your interest cost is directly linked to your credit score;

- Consolidate your outstanding small loans such as credit cards, student loans, and auto loans.

Contingency planning

This advice holds for anyone at any stage of life, really. Contingencies are unplanned, unwanted events that are inevitable somehow. You can only plan to mitigate the effects like a financial risk, but you cannot entirely avoid them.

It may sound simple, but always create an emergency cash fund. It can save you financial trouble and expensive payday loans with high-interest rates.