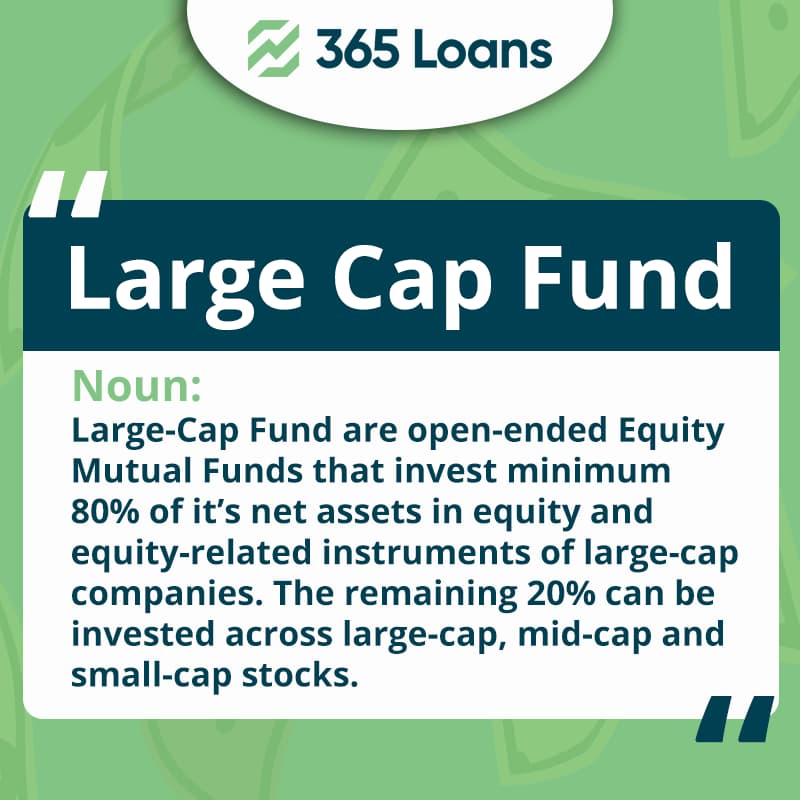

Mutual funds, notably as part of employer-sponsored 401(k) plans and self-directed IRAs, are one of the most popular ways to participate in the stock and bond markets. Mutual funds enable you to invest in a diverse portfolio of assets in a single fund at a cheap cost. As a result, you will be able to quickly, conveniently, and affordably build a diversified portfolio.

But, with thousands of funds to choose from, how can you pick the best ones for your portfolio?

Top-performing low-fee mutual funds to invest in

365loans cherry-picked top funds available for investing by average people (i.e., not ones that required a $5 million minimum investment, using Morningstar data and based on the following criteria:

- Five-star quality rate U.S. stock funds on Morningstar;

- Without sales load (i.e., commission);

- Better 5-year performance than the S&P 500, which has historically averaged a 10% annual return;

- An expense ratio of less than 0.5 percent;

- Funds with a manager who has been in charge for more than five years.

To meet the ranking requirements, the mutual funds listed below have shown satisfactory performance statistics as of July 30, 2022.

Best mutual funds to invest in for the short term

Vanguard Value Index Fund (VVIAX)

The CRSP U.S. Large-Cap Value Index, which comprises large companies that are cheap relative to the market, is tracked by this fund.

- 2022 YTD performance: -0.7 percent

- Historical performance (annual over 5 years): 11.6 percent

- Expense ratio: 0.05 percent

Fidelity 500 Index Fund (FXAIX)

This fund invests in major publicly traded corporations and may resemble an S&P 500 index fund in appearance.

- 2022 YTD performance: -12.2 percent

- Historical performance (annual over 5 years): 13.5 percent

- Expense ratio: 0.015 percent

Schwab Fundamental U.S. Large Company Index Fund (SFLNX)

This fund replicates the total performance of the Russell RAFI U.S. Large Company Index by investing in large publicly traded firms.

- 2022 YTD performance: -2.6 percent

- Historical performance (annual over 5 years): 13.5 percent

- Expense ratio: 0.25 percent

Vanguard Equity Income Fund (VEIPX)

This fund invests in inexpensive stocks of mid-size and large firms that pay above-average dividends.

- 2022 YTD performance: 1.8 percent

- Historical performance (annual over 5 years): 11.7 percent

- Expense ratio: 0.28 percent

Voya Russell Large Cap Index Portfolio (IIRLX)

The fund seeks returns equal to the Russell Top 200 Index’s total return.

- 2022 YTD performance: -13.7 percent

- Historical performance (annual over 5 years): 13.8 percent

- Expense ratio: 0.36 percent

Best mutual funds to invest in for the long term

To satisfy any long-term investing ambition, 365loans screened through funds with outstanding ten-year track records using the same criteria as the above.

Again, all statistics meet the requirements by showing satisfactory results as of July 30, 2022.

Fidelity 500 Index Fund (FXAIX)

This fund invests in large publicly traded companies and may look much like an S&P 500 index fund.

- 2022 YTD performance: -12.2 percent

- Historical performance (annual over 5 years): 13.5 percent

- Historical performance (annual over 10 years): 14.4 percent

- Expense ratio: 0.015 percent

Fidelity NASDAQ Composite Index (FNCMX)

This index fund tracks the performance of the entire Nasdaq stock exchange, which includes over 3,000 stocks.

- 2022 YTD performance: -22.2 percent

- Historical performance (annual over 5 years): 15.2 percent

- Historical performance (annual over 10 years): 16.7 percent

- Expense ratio: 0.29 percent

Voya Russell Large Cap Index Portfolio (IIRLX)

The fund targets returns that correspond to the total return of the Russell Top 200 Index.

- 2022 YTD performance: -13.7 percent

- Historical performance (annual over 5 years): 13.8 percent

- Historical performance (annual over 10 years): 14.4 percent

- Expense ratio: 0.36 percent

Voya Russell Large Cap Growth Index Fund (IRLNX)

This index fund tracks the performance of the Russell Top 200 Growth index, which includes large stocks.

- 2022 YTD performance: -21.0 percent

- Historical performance (annual over 5 years): 17.0 percent

- Historical performance (annual over 10 years): 16.5 percent

- Expense ratio: 0.43 percent

Shelton NASDAQ-100 Index Direct (NASDX)

This fund tries to replicate the performance of the Nasdaq-100 index.

- 2022 YTD performance: -22.2 percent

- Historical performance (annual over 5 years): 17.3 percent

- Historical performance (annual over 10 years): 18.2 percent

- Expense ratio: 0.50 percent

Picking the best mutual funds for you to invest

Choosing the ideal mutual fund for you is highly dependent on your requirements, especially your risk tolerance and time horizon. However, it also depends on what else you have in your portfolio. Therefore, understanding your portfolio and financial status is critical before deciding which mutual fund is suitable.

Even if you find a fund type you like, you will want to compare which funds are better in several aspects. There are various types of mutual funds for you to invest in, and it might be a good idea to get to know each out there a bit more while looking for the right one for you.