Paying off debt is a common financial goal for many individuals and households. It not only provides a sense of relief and peace of mind but also sets the stage for long-term financial stability. However, with various debts to tackle, it can be overwhelming to know where to start and how to develop an effective repayment plan. This is where debt repayment methods such as the debt snowball and debt avalanche come into play.

In this article, we will explore and compare the two popular methods — debt snowball and debt avalanche — and help you choose the right method for paying off your debts. By understanding the principles, benefits, and considerations associated with each method, you can make an informed decision that aligns with your financial situation and personal preferences.

The Debt Snowball Method

The debt snowball method is a debt repayment strategy that focuses on paying off debts in order from smallest to largest balance, regardless of interest rates. Instead of prioritizing debts based on interest rates, the method encourages individuals to start by tackling their smallest debts first while making minimum payments on the rest. As each smaller debt is paid off, the funds that were allocated to it are then directed toward the next debt on the list. This approach creates a sense of progress and accomplishment as debts are eliminated one by one, providing psychological motivation to stay on track.

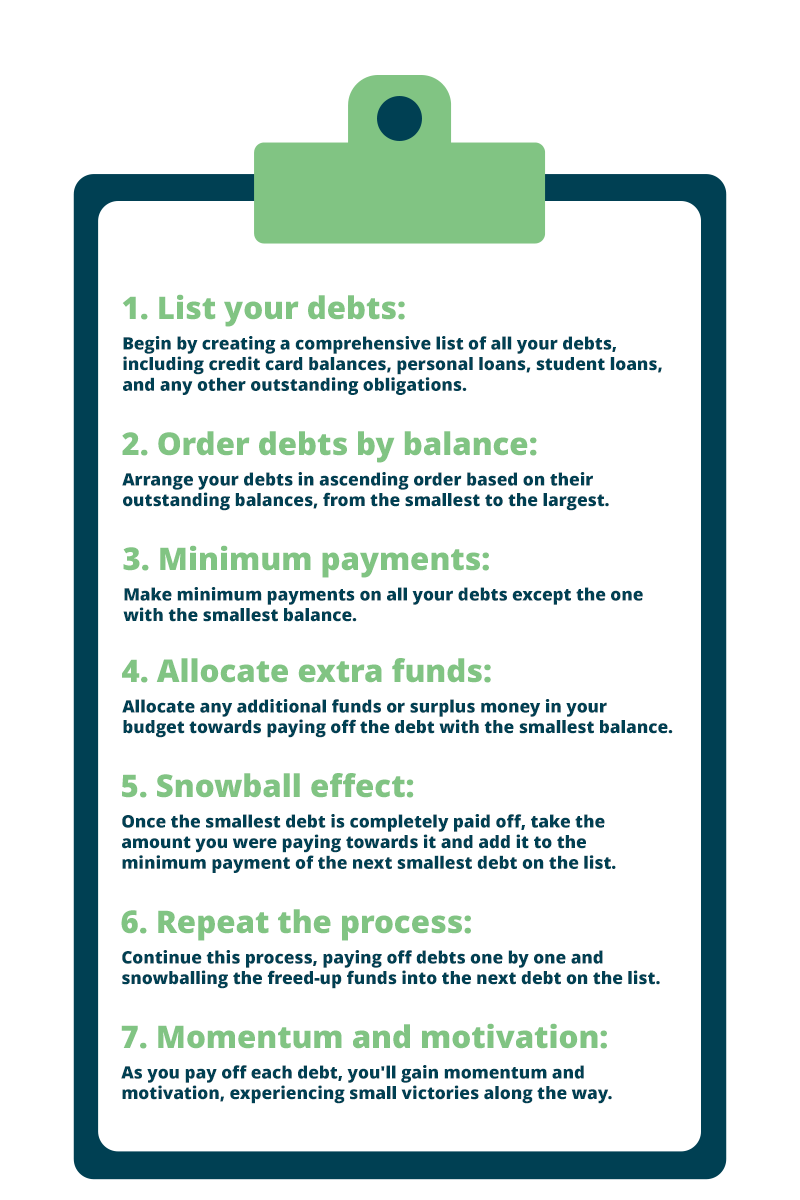

Steps to Implement the Debt Snowball Method

The debt snowball method involves the following steps:

Benefits Of The Debt Snowball Method

The debt snowball method offers several benefits that can help individuals effectively manage and pay off their debts. Here are some key advantages of using the debt snowball method:

- Psychological impact: The debt snowball method provides a psychological boost by offering quick wins. Paying off smaller debts first creates a sense of accomplishment and motivation to continue the debt repayment journey.

- Momentum: As debts are paid off one by one, the snowball effect generates increasing momentum, driving you closer to becoming debt-free.

- Simplified approach: By focusing on the smallest debts, the debt snowball method simplifies the process and eliminates the need for complex calculations or considerations of interest rates.

The Debt Avalanche Method

The debt avalanche method is a debt repayment strategy that focuses on minimizing the overall interest paid and accelerating the debt payoff process. With the debt avalanche method, you prioritize paying off debts based on their interest rates, starting with the highest interest rate first. Instead of considering the size of the debt, you tackle the debt with the highest interest rate while making minimum payments on the rest.

Once the highest-interest debt is paid off, you move on to the next highest-interest-rate debt and continue the process. By targeting high-interest debts first, the debt avalanche method aims to save you money in interest payments over the long term and help you become debt-free faster. While it may not provide the immediate psychological motivation of the debt snowball method, the debt avalanche method is a strategic approach for individuals who prioritize minimizing interest costs and want to pay off their debts efficiently.

Steps to Implement the Debt Avalanche Method

The Debt Avalanche Method involves the following steps:

Benefits of the debt avalanche method

The debt avalanche method offers several benefits that can help individuals effectively manage and pay off their debts. Here are some key advantages of using the debt avalanche method:

- Interest savings: By targeting high-interest debts first, the debt avalanche method minimizes the total interest paid over time.

- Long-term financial gain: While it may take longer to experience the psychological wins, this method can lead to more significant financial savings.

- Cost-Effective Strategy: By strategically focusing on high-interest debts, you can save money that would otherwise be spent on interest payments. This allows you to allocate more of your financial resources towards achieving other goals or building savings.

Determining the Right Method for You

When deciding which debt repayment method is best for you, it’s important to consider the pros and cons of both the Debt Snowball and Debt Avalanche methods.

The Debt Snowball method entails paying off smaller debt balances first, regardless of interest rate. This can be an effective way to motivate you, as you can take pride in seeing the number of debt balances decrease quickly. The downside to this approach is that you may end up paying more in interest, since higher-interest debts are not being paid off first.

The Debt Avalanche method requires you to pay off the debts with the highest interest rates first, regardless of the balance. This is generally seen as the most cost-effective option, as it will save you the most money in interest over time. The downside is that it can take longer to make a dent in your total debt balance or the number of debt accounts due to the higher interest rates.

Which method is best for you ultimately depends on your goals and financial situation as well as the way your mind operates. If you need a sense of accomplishment from seeing progress quickly, the Debt Snowball might be the better choice. However, if your main priority is saving money, the Debt Avalanche might be more appealing. In any case, the important thing is to create a plan and stick to it.

Conclusion

In conclusion, the best debt repayment strategy for you will ultimately depend on the strategy you think you can stick to and the one that works best for your loan type, interest rates, cash flow situation, and long-term goals. If you have debt that has a wide spread in interest rates, the avalanche method will be even more powerful. If, on the other hand, you have numerous smaller debts at similar interest rates, the snowball method may help you manage the repayment process with more discipline.

No matter which debt payoff strategy you choose, paying off debt is good for your mental and financial health. Your dedication will give you peace of mind and open up new financial possibilities and a more rewarding future.