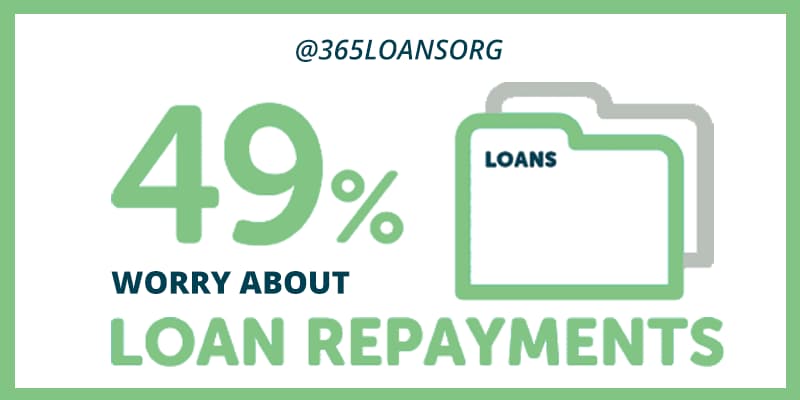

No one wants to keep dragging student loans through life, but paying off student loans fast is not as easy as it seems. The perks of continuing with student loans may include keeping the Federal Loan protection or forgiveness and grace periods. But at the same time, student loans come with high-interest rates than most long-term loans explaining why you would want that as part of your history.

Before you decide on settling the student loan, though, evaluate your financial position. You may be unable to contribute more to the student loan payoff strategy.

Here are a few steps to help you repay your student loans faster.

Analyze your Student Loans first

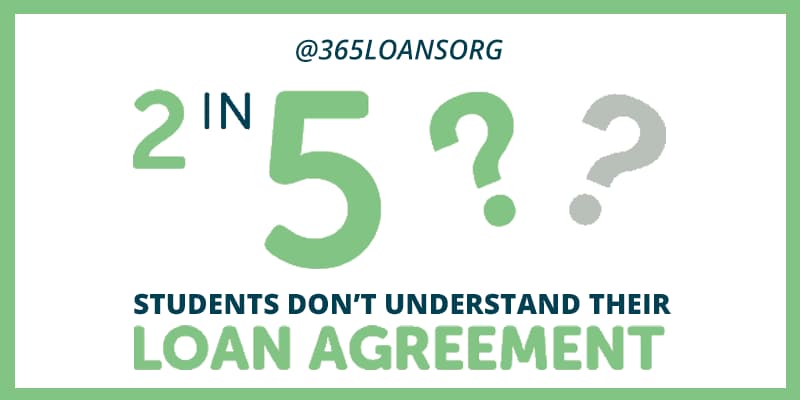

You do not need to make spreadsheets to analyze college loans. All you have to do is to find out the interest rate and the type of loan for each facility separately.

For example, ask yourself the following questions:

- Which are the loans with the highest interest rates?

- Which one is with an adjustable rate?

- Which one comes with a fixed interest rate?

Monitoring and prioritizing your loans will help reduce your monthly costs and organize the repayment plan. Start contributing to the highest interest rate loan first. The more you pay towards the high-interest rate loans, the lower your monthly interest bill.

Decide on an extra contribution with a specific loan

Let us take this honestly; you would not be able to make extra payments to each student loan. This is where prioritizing student loans will come in handy again.

If you can make a $50 additional payment monthly on a $15,000, 9% APR loan that we mentioned above, you will save $1,900 on interest. In addition, you will be able to pay off the loan in 4 years instead of 5. Then again, if you can double that monthly extra, you can save even further.

How to fund the extra payment?

“Make extra payments to settle the loans faster” is a bit of standard advice you will start hearing during your college days. But, of course, creating extra cash to repay any loan would need an additional source of income at the very least.

As a modern-day graduate, you must harness the power of tech-based passive income ideas. You might be young enough not to have money to invest in stocks. Instead, create your passive income through unorthodox means like Freelancing or Uber drives.

Think of unconventional ways of making extra income. Say, renting out extra bed space in your house. Only this time, the sharing will bring you dual benefits of additional income and reduced interest bills.

Automate your savings and extra contributions

You would not be able to save if you left it to casual habits. So instead, automate a portion of your income to the savings account with no debit card in your hand. Then, use that saving account balance to make extra payments on your student loans. Make it a seamless process, just like your auto-renewal subscriptions.

It may seem like a tiny step, but it will change your spending pattern. It is easy to slip on savings if you can see surplus cash. Even if you only occasionally make extra payments towards loan accounts, it will have far better effects than not contributing.

Avoid Refinancing

Student loans usually come with a ten-year term. At some point, if you have reached a financial tangle, refinancing may seem an obvious debt consolidation strategy for many. However, it may not be good if you have made more than half of your student loan repayments.

Otherwise, you will replace the student loans with a low-interest rate personal or equity loan. Unfortunately, these loans stretch the repayment terms to a more extended period; and that is the jumble.

Stick to the minimum as a last resort

It does not sound nice, but you better stick with the original repayment plan of your student loans. Of course, everyone wants to settle student loans as fast as possible, but it is not feasible for everyone.

Ensure you do not fall behind the minimum monthly payments to avoid repercussions. You would not want to lose your credit score and make a red mark on your credit history this soon.

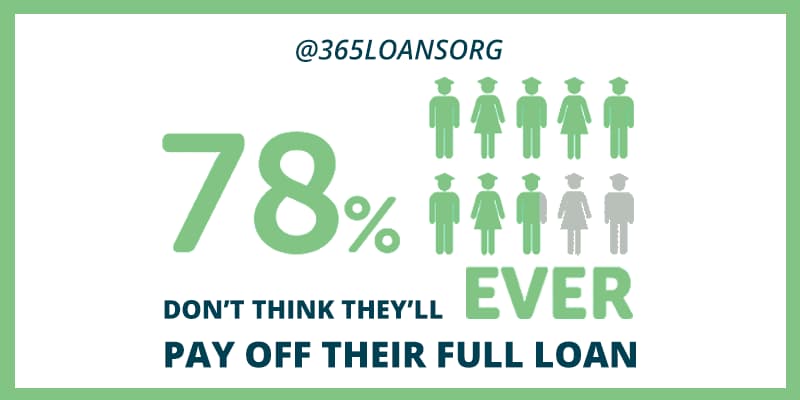

Do not set your hopes too high on Student Loan Forgiveness

Most likely, you were assured that getting student debts was not a massive concern because you could quickly get them forgiven later. However, the forgiveness of student loans is not the reality that it seems to be. You must fulfill many prerequisites to qualify. And even then, pardoning someone is not a given.

It would be ideal for you to have a well-paying career that you enjoy so that you can proceed with paying off your debt as quickly as possible. Doing this will prevent you from wasting years of your life waiting for your debts to be forgiven.

The Key

Theoretically, the more you contribute, the faster you get out of the tangling student loans. On the other hand, refinancing may sort things out for some, while an extra side hustle may favor others. Whatever the approach, evaluate your financial profile and work out the best plan accordingly.