Pursuing higher education is a valuable investment in one’s future, but the rising costs of college can often pose a significant financial burden. To bridge this gap, many students turn to student loans as a means of financing their education. While student loans can provide essential funding, it is crucial to manage them wisely to avoid long-term financial stress. In this article, we will delve into the ins and outs of student loans and explore smart strategies for managing educational finances effectively.

Understanding Student Loans

Student loans are specialized loans designed to help students cover the cost of tuition fees, textbooks, living expenses, and other educational necessities. These loans typically come with lower interest rates and flexible repayment terms, making them an attractive option for aspiring students.

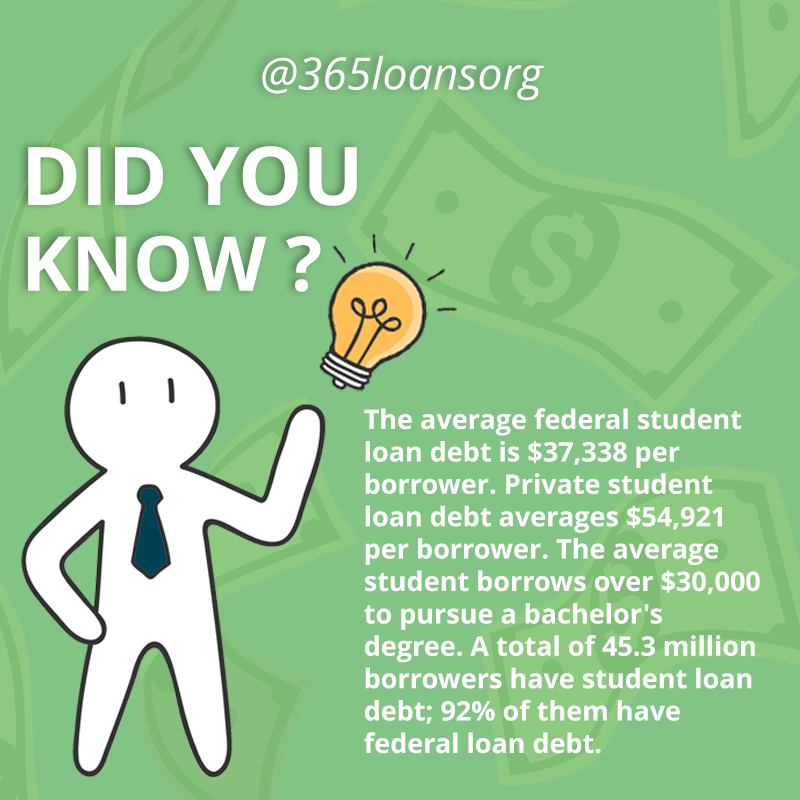

There are two main types of student loans: federal and private. Federal loans are funded by the government and often offer more favorable terms, such as fixed interest rates, income-driven repayment plans, and various forgiveness programs. Private loans, on the other hand, are provided by banks, credit unions, and other financial institutions. They usually have higher interest rates and fewer repayment options but can be a viable option for students who have exhausted their federal loan options.

Creating a Budget and Planning Ahead

Before taking out a student loan, it is crucial to create a comprehensive budget to estimate your total expenses and determine how much you need to borrow. Consider tuition fees, accommodation costs, books, transportation, and living expenses.

Maximizing Scholarships, Grants, and Work-Study Programs

To minimize the need for student loans, explore all available avenues for scholarships, grants, and work-study programs. Scholarships and grants are essentially free money that does not require repayment, and they can significantly reduce your financial burden. Additionally, participating in work-study programs can provide income while gaining valuable work experience.

Borrowing Responsibly

When taking out student loans, it is essential to borrow responsibly and only what is necessary. Remember that you will have to repay these loans with interest in the future. Aim to borrow the minimum amount required to cover your educational expenses and avoid the temptation of taking on additional loans for non-essential items.

Understanding Loan Terms and Interest Rates

Before signing any loan agreement, carefully review and understand the terms and conditions, including interest rates, repayment plans, and any associated fees. Federal loans typically have fixed interest rates, meaning they remain the same throughout the repayment period. Private loans, however, may come with variable interest rates that can fluctuate over time. Knowing the specifics of your loans will help you plan your finances accordingly.

Managing Repayment

Repayment of student loans typically begins after you graduate or leave school. It is crucial to understand your repayment options and choose the one that aligns with your financial situation. Federal loans offer various repayment plans, including income-driven repayment options that base your monthly payments on your income and family size. Private loans may have fewer repayment options, but some lenders offer flexibility, such as deferment or forbearance, in case of financial hardship.

Developing a Repayment Strategy

To manage student loan repayment effectively, develop a repayment strategy that fits your financial goals. Consider making extra payments whenever possible to reduce the overall interest paid over the loan’s lifespan. Create a budget that prioritizes loan repayment while balancing other financial obligations.

Seeking Professional Guidance

Navigating the world of student loans can be complex, so seeking professional guidance can be beneficial. Reach out to your school’s financial aid office or consider consulting with a financial advisor who specializes in student loan management. They can provide personalized advice, help you understand your options, and assist in making informed decisions about your educational finances.

Conclusion

Student loans are a valuable tool for financing education, but managing them wisely is essential for a secure financial future. Remember, a well-planned approach to student loans can alleviate the stress of debt and pave the way for a bright academic journey and future career success.