Are student loans keeping you up at night? You’re not alone. According to the Federal Reserve, the average American graduates with over $30,000 in student loan debt. It’s a heavy burden, but there’s hope on the horizon: student loan forgiveness programs. In this article, we’ll cut through the jargon and reveal the facts about these programs, so you can finally breathe a sigh of relief.

Public Service Loan Forgiveness (PSLF):

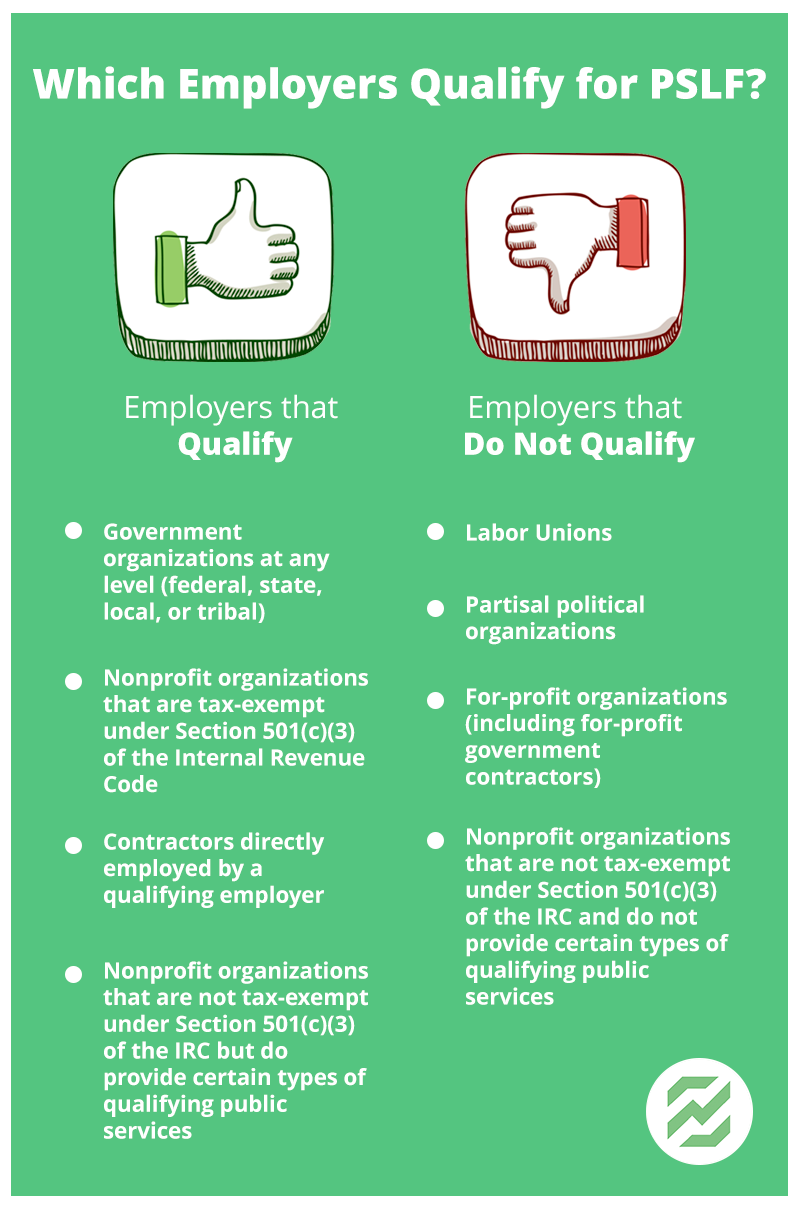

Ever dream of working for a non-profit, government agency, or as a teacher? You’re in luck! Under the PSLF program, if you make 120 qualifying payments while working for a qualified employer, the remaining balance of your federal student loans can be forgiven. Imagine a clean slate after a decade of hard work.

Income-Driven Repayment (IDR) Plans:

Do you have a lower income compared to your loan debt? With IDR plans, your monthly payments are calculated based on your income and family size. After 20-25 years of consistent payments, any remaining balance can be forgiven. It’s like paying what you can afford!

Teacher Loan Forgiveness:

Calling all educators! If you teach in a low-income school for five consecutive years, you could be eligible for up to $17,500 in loan forgiveness. That’s one way to give back and lighten your financial load.

State-Specific Programs:

Many states offer their own loan forgiveness programs for in-demand professions like nursing, social work, or law enforcement. For example, California’s Assumption Program of Loans for Education (APLE) helps teachers repay their loans, while the Texas Student Loan Repayment Assistance Program supports healthcare professionals. It’s like a local, tailored solution to your debt.

Borrower Defense to Repayment:

Did your school engage in fraudulent activities? You might qualify for Borrower Defense to Repayment, which wipes out your federal student loan debt if you can prove your school misled you. It’s justice served with a side of debt relief.

Temporary Tax-Free Forgiveness:

Thanks to the CARES Act, the American Rescue Plan, and other COVID-19 relief measures, all federal student loan payments were temporarily paused, and interest rates dropped to 0%. That’s not forgiveness, but it’s like a financial breather you didn’t see coming.

Waiting Periods and Tax Considerations:

While loan forgiveness programs can be a beacon of hope, it’s important to know that they often come with waiting periods, and some forgiven balances might be considered taxable income. Be prepared and plan ahead to avoid financial surprises.

In conclusion, student loan forgiveness programs are real, but they come with their own set of rules. Whether you’re a public servant, educator, or pursuing a specific profession, there might be a program tailored just for you. However, always stay informed, consult a financial advisor, and read the fine print.

Student loans don’t have to be a lifelong burden. With the right knowledge and a little patience, you can chart a course towards financial freedom. Don’t let your dreams be held back by debt; explore the possibilities of student loan forgiveness programs and take your first step toward a brighter, debt-free future.

Muchas gracias. ?Como puedo iniciar sesion?

Thank you for your comment. We don’t have such a feature at present. Let us know if you have any other questions 🙂