Personal loans and corporate debt financing are inevitable parts of our lives. In some situations, availing of the loans becomes a more viable option than any other source of financing. It is especially so when savings and deposit certificates do not offer contingency or are non-existent in the first place. Loans, however, come with specific pros and cons.

Economic recessions and joblessness, such as the ongoing ones caused due to the recent coronavirus pandemic, might compel you to apply for loans.

If you have planned to apply for personal loans, consider these top 5 things before making the final decision.

1. Will you be able to repay?

That is a no-brainer to ask whether you have the loan repayment ability or not. However, your lenders or creditors will ask the same question at first, too. The question gets trickier if you already have loans such as high-interest credit cards, home equity or mortgage, student loan, or others.

Inability to repay on time for monthly installments or default may result in dire consequences. Therefore, the first thing to consider before applying for any personal loan should be to evaluate your income streams.

2. What will be the cost of the loan?

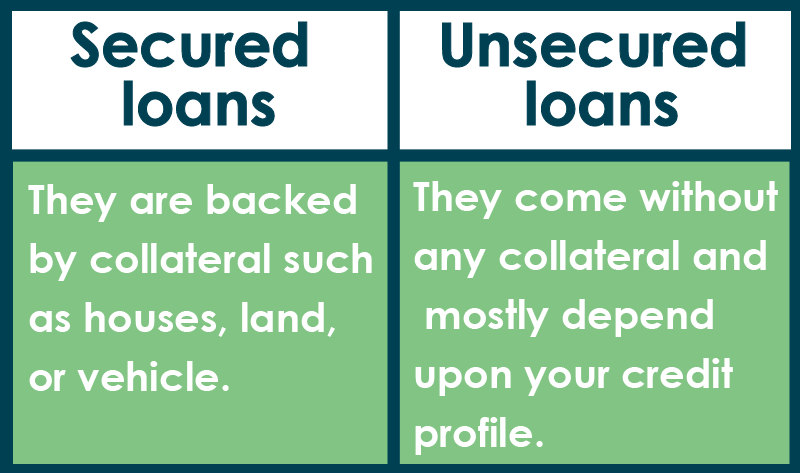

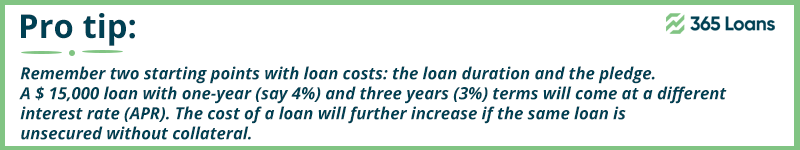

Your loan cost will heavily depend on your type of loan – secured or unsecured – and your credit score.

Usually, the higher your credit score, the lower your loan costs. However, unsecured loans come with high-interest rates and often include originating fees.

Some other factors like your credit history, loan duration term, debt to income ratio, and any default history also play an essential role in deciding your loan costs. Lenders would summarize your credit profile considering all of these points. The better you score, the lower the cost of your loan.

3. How will you use the loan amount?

Many people consider applying for loans just because they can afford them. However, deciding on the purpose of personal loans is critical.

Debt consolidation with high-interest-rate credit card payments, student loans, and other personal loans is one popular option for many. Others apply for a personal loan for home improvements, maintenance, medical bills, and existing debt pay-off. While all of such options offer a reasonable justification, remember the repercussion on loans too.

You might want to check out: Does it hurt your credit score if you consolidate debt?

If you can build substantial savings or have money invested, you can easily cover some of these regular one-time expenses, such as home refurnishing.

4. What if you default on the loan?

Loan default for both secured and unsecured loans will have severely damaging implications for you.

In the case of a secured loan, the bank will seize your collateral, whether it is your house, property, or vehicle. Unsecured loans also pose the same level of default risks. The lenders have the powers to force a lien against you to recover their loan amounts. In addition, for any future debt financing, your credit score, debt-to-income, and leverage ratios will be scrutinized by the creditors.

5. Will you be able to avoid the debt cycle?

Despite coming last, this is perhaps the most crucial point to consider for you with practical implications.

When discussing the loan cost, we did not mention the opportunity cost with loans. Your monthly payments with loans can go towards your IRA or bank savings.

Many people apply for a personal loan for avoidable reasons and fall into a debt cycle. That cycles start right from your first student loan or accumulated credit card loan, then moves on with an auto loan, first mortgage, home equity loan, and a personal loan. To avoid falling into a cycle, always consider why you are applying for a specific loan in the first place – is it a necessity or a desire that you can go without.

Always evaluate the consequences that come with personal loans. You should not limit the evaluation to only the interest rate and monthly installment calculators, but also think about how it is going to affect your everyday life and decisions.