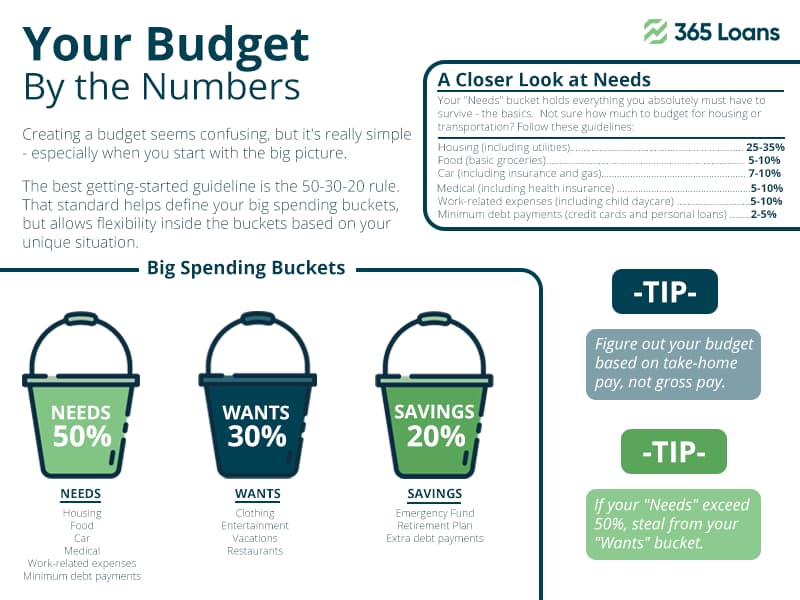

Budgeting is a fundamental aspect of financial well-being, and the 50/30/20 rule has emerged as a popular and effective framework for managing personal finances. This rule, championed by Senator Elizabeth Warren, suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. While this rule provides a solid foundation, the key to financial success lies in tailoring these percentages to fit your unique lifestyle and goals.

Understanding the 50/30/20 Rule: A Brief Overview

Before we delve into customization, let’s revisit the core principles of the 50/30/20 rule.

- 50% for Needs: This category includes essential expenses like housing, utilities, groceries, insurance, and transportation.

- 30% for Wants: Discretionary spending falls into this category, encompassing non-essential items such as dining out, entertainment, and luxury purchases.

- 20% for Savings and Debt Repayment: This portion is dedicated to building savings, emergency funds, retirement contributions, and paying off debts.

You Might Want to Check Out: Personal Budget Optimization: The 50/20/30 Rule

Tailoring the Rule to Your Lifestyle: Finding the Right Balance

1. Adjusting the 50% for Needs:

- Evaluate your individual circumstances. If your housing costs are higher due to location or family size, you may need to allocate more than 50% to cover essential expenses. Conversely, if you live in a more affordable area or have a minimalist lifestyle, you might allocate less.

2. Customizing the 30% for Wants:

- Recognize your spending priorities. If you’re a food enthusiast, allocate more to dining out. If travel is your passion, increase your budget for vacations. Tailor this category to align with your values and what brings you joy.

3. Optimizing the 20% for Savings and Debt Repayment:

- Prioritize your financial goals. If you have high-interest debt, allocate more to debt repayment until it’s under control. As your financial situation improves, consider redistributing to maximize contributions to retirement accounts or long-term savings.

Real-Life Examples: Making It Work for You

1. The Young Professional:

- For someone early in their career, focusing more on the 20% for Savings and Debt Repayment can fast-track building an emergency fund, contributing to retirement, and paying off student loans.

2. The Family with Children:

- Families with children may allocate more than 50% to Needs, especially if childcare and education expenses are significant. Flexibility in the Wants category allows for quality family experiences.

3. The Aspiring Entrepreneur:

- Individuals starting their own business might allocate a higher percentage to Wants initially to invest in their venture, with a plan to adjust as the business becomes more stable.

Tips for Successful Customization:

- Regularly Review and Adjust:

- Your financial situation will evolve, so make it a habit to reassess and adjust your budget accordingly. Life changes, and so should your financial plan.

- Emergency Fund as a Priority:

- Regardless of your lifestyle, prioritize building and maintaining an emergency fund within the 20% for Savings. This safety net is crucial for unexpected expenses.

- Aligning with Values:

- Tailor your budget to reflect your values and priorities. This ensures that your money is supporting what matters most to you.

In conclusion, while the 50/30/20 rule provides a solid framework for budgeting, its true power lies in its adaptability. Customize the percentages to suit your lifestyle, goals, and values, and remember that financial success is a journey, not a one-size-fits-all destination.