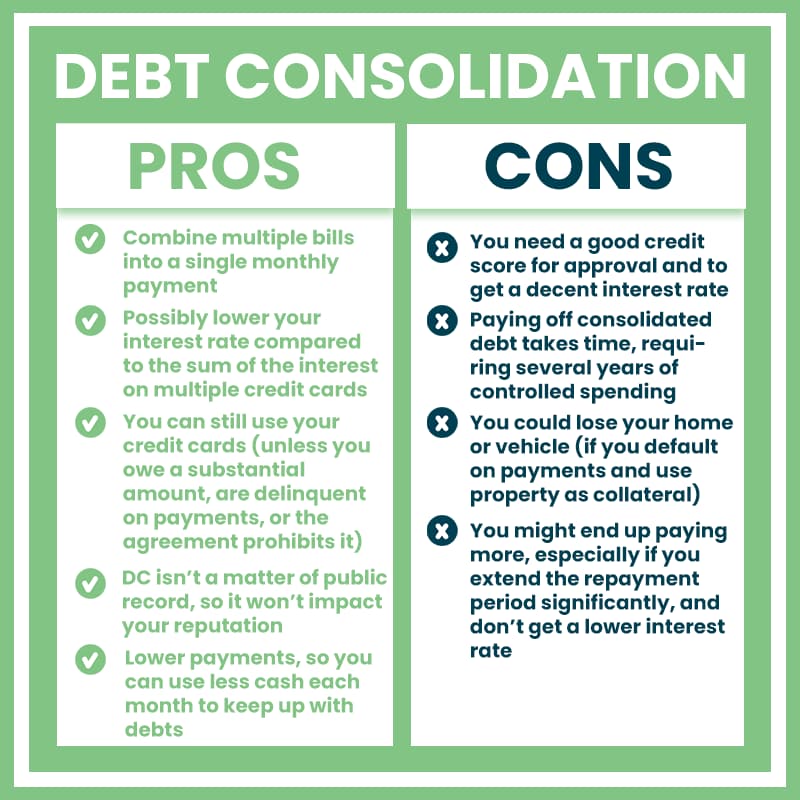

Debt consolidation can consolidate several debt sources, such as high-interest credit cards, personal loans, medical bills, or other debts, into a single fixed monthly payment. If it lowers your annual percentage rate, getting a debt consolidation loan or using a balance transfer credit card may make sense. However, even at a lower rate, refinancing debt has drawbacks to consider besides the good parts.

4 advantages of debt consolidation

- There is a chance you will pay less.

The main benefit of debt consolidation is paying off your debt at a lower interest rate, which can save money and help you pay off the debt more quickly.

For instance, if your total debt is $9,000 and your combined monthly payments are $500, your combined APR is 25%, you will accrue $2,500 in interest over nearly two years. However, your new monthly payment would only be $445, and you would save $820 in interest if you took out a debt consolidation loan with a 17% APR and a two-year payback period. You might use the money you save by making a smaller monthly payment to pay off the debt sooner.

If you are approved for a balance transfer card, the promotional period, which can run up to 18 months, will be interest-free for you. In addition, you will probably incur a 3% to 5% balance transfer fee.

Overall, we would advise you to view your total balance, total monthly payment, and overall interest rate for all of your obligations, using a debt consolidation calculator before you decide.

- There will be only one monthly payment.

By consolidating your debt, you can make one monthly payment with a set interest rate that will not change over the loan’s term rather than managing multiple payments and interest rates (or during the promotional period, in the case of a balance transfer card).

However, it goes beyond merely making your payments simpler. If you don’t already have a debt payback strategy in place, consolidating your debts can help you reach a goal that is both obvious and inspiring.

- You might improve your credit.

Hard credit inquiries are necessary when applying for new credit, and they temporarily reduce your score by a few points. The overall net effect, especially if you’re consolidating credit card debt, should be favorably provided you make your monthly payments on time and in full.

One of the main elements affecting your score is your credit usage ratio, which is decreased by paying off credit card bills.

- You might repay your debt faster.

If you have a lot of credit card debt, getting a debt consolidation loan may help you reach total debt repayment sooner. While a consolidation loan has defined monthly payments and a distinct beginning and conclusion, credit cards don’t have a specific time limit for paying off a balance.

Your monthly payment amount and due date will be known to you in full if you take out a personal loan to pay off your debt. Even more, with a set repayment schedule, there are no unforeseen changes to your monthly debt payment and your payment and interest rate are fixed for the life of the loan. If you use a high-rate credit card and only make the minimum payment, it can take you years to pay it off completely.

4 drawbacks of debt consolidation

Before taking out a loan, you should think about the disadvantages of debt consolidation.

- You might not be entitled to a low rate.

It might be challenging to get approved for balance transfer cards, which normally demand strong to excellent credit (690 or higher on the FICO scale). Instead, debt consolidation loans are easier to obtain, and there are loans specifically designed for individuals with terrible credit (629 or lower on the FICO scale). However, the lowest rates are typically offered to borrowers with the greatest scores.

In this situation, think about using a different debt repayment plan, such as the debt avalanche or debt snowball techniques. With some lenders, borrowers who want to consolidate their debt with a loan can prequalify to evaluate possible rates without having their credit scores affected.

- You might forget to make payments.

You can find yourself in a worse situation than when you started if you don’t make payments on the new loan. For instance, you’ll be forced to pay your balance transfer card at a higher APR — which may be greater than the original debt — if you don’t pay it off during the zero-interest promotional period.

Your credit scores could be at risk if you default on a consolidation loan since late fines could accumulate and missing payments would be reported to the credit agencies. Make sure the new monthly payment will fit comfortably into your budget for the duration of the repayment period before consolidating.

- You are not dealing with the main issue.

Consolidation is a useful tool, but it does not guarantee relief from recurring debt, and it doesn’t deal with the habits that contributed to debt in the first place.

Consolidation might not be the best option if you frequently overspend. For instance, by taking out a loan to pay off credit cards, the balance on those cards will be zero once more. You might be tempted to utilize them before paying off the new debt, which would put you in an even worse situation.

In order to build up a debt management plan if you have too much debt, it may be preferable for you to speak with a credit counselor at a respected nonprofit organization rather than attempt to handle it on your own.

- There can be upfront expenses.

Some loans for debt consolidation have fees. Ask about any fees upfront, such as those for making late or early loan repayments, before taking up a debt consolidation loan. These costs could cost hundreds or even thousands of dollars, depending on your lender.

You should consider these costs when determining if debt consolidation is a good option for you, even though paying them can still be worthwhile.

Choosing whether to consolidate your debt

Depending on your situation, the decision to consolidate your debt or not will vary. There may be conditions that could push you for debt snowball or filing bankruptcy, rather than consolidation.

Having said that, the following situations are ones where you might be an excellent candidate:

- You desire a single monthly payment: If you dislike keeping track of many payments, getting a debt consolidation loan can be a good choice. Further, a debt consolidation loan may be the best option for you if you want your interest rate, payback period, and monthly payment to be fixed.

- You will be able to pay back the loan: Finally, if you can afford to repay the loan, a debt consolidation loan will only be advantageous to you. If you cannot, you run the risk of getting farther into debt.

- You have a high credit score: If your credit rating is high (at least 670) you will have a better chance of getting a loan with a lower interest rate than the one you already have on your debt. This might save you money.

Key Takeaway

Although debt consolidation may seem like a good idea, it has both advantages and disadvantages. Although you might be able to cut your interest rate and consolidate your monthly debt payments into a single payment, a consolidation loan might also come with costs. Additionally, the loan by itself won’t resolve your financial issues.

Review all of your minimum monthly payments, calculate how long it will take to pay off the debt, and compare it to the costs and time involved with a consolidation loan before accepting a debt consolidation offer. Use a debt consolidation calculator to understand how a loan for debt consolidation can impact your budget.

While debt consolidation may seem like an immediate solution, if problems like overspending are not addressed, they may not.