If you have spent any amount of time around money, you have inevitably heard the terms financial independence vs. financial freedom.

In everyday life, one could typically use these terms of independence and freedom interchangeably. When it comes to financing, though, we can clearly distinguish the meaning of these terms in the usual finance concepts of achieving goals and objectives.

When we think about our financial planning for our current and future needs and plans, what crosses our minds is mainly income, debts, savings, and investments. We can talk about these critical success factors in terms of both financial independence and financial freedom.

What is the difference between Financial Stability and Financial Freedom?

In the simplest of financial terms, we can define both independence and freedom as both short-term and long-term objectives. Still, to put it simply, you could consider each as:

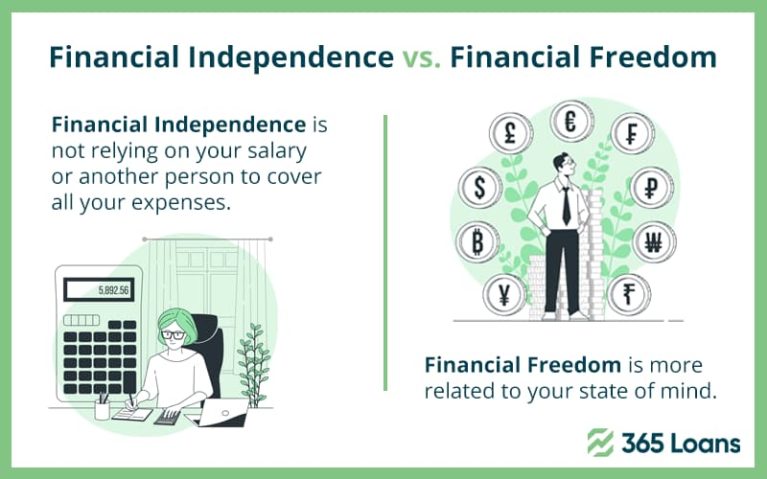

Financial Independence definition:

If you are free of all debts now, you are financially independent.

Financial Freedom definition:

If you wish to travel to Switzerland this summer and can afford it too, that is your financial freedom.

If you are still confused between the verbal meanings of the two terms, let us dig a little deeper to find the similarities and differences.

What is the meaning of Financial Independence?

Financial independence is a simple concept you can break down into many smaller components. The independency state is achieved when your residual or passive income meets or surpasses your money allotment. It’s the point at which you can finally claim you rely solely on yourself.

Your financial independence is an equation involving your current financial balance sheet and credit score. Ultimately, it is brought down to your net worth.

There are various paths to financial independence. For example, you can put your money into stocks, bonds, or real estate. However, you want enough passive income from your investments to meet your bills eternally.

You can consider yourself financially independent if your monthly income is good enough to pay for debt installments and necessities. At that point, you won’t need to work and will not run out of money if you keep your lifestyle at the same level.

Financial independence is a measurable goal. One standard piece of advice you will hear from financial advisors is to aim at earning as much as 25 times your annual costs.

What is the real meaning of Financial Freedom?

You can see financial freedom as the point at which money no longer dictates your decisions. As a result, it is no longer necessary to suffer constant worry and anxiety due to or concerning money. It is not about having a high net worth; it is about having confidence in your finances and feeling liberated.

When you are financially independent, your passive income covers all of your expenses as well as the lifestyle you desire. For some, it is living simply; therefore, it is easier to achieve financial independence sooner. Others want a life of luxury and have to work harder to maintain their standard of living. Finding your golden standard is precisely why financial freedom is so hazy and difficult to pin down. Yet, to be financially free, you don’t have to live like the rich.

What should you aim for: Financial Freedom or Financial Independence?

In your best-case scenario, chasing after financial confidence or freedom is all about living financially free to do what makes you happy without regard for the cost. You can spend your money in ways that are consistent with your aims and ideals. It also implies that if your life changes, you’ll be able to overcome financial difficulties easily.

Most people plan for early retirement with financial independence, confusing it with financial freedom. However, despite the common consideration amongst financial professionals that there are 8 levels of financial freedom, here is one thing you can take from this blog if anything.

Financial freedom is about having enough streams of passive income that you can sit back and enjoy life indefinitely. But the truth is, passive income is actually a myth because you never know when this state will end. Not only that, but you never even know what the inflation rates will be tomorrow.

Therefore, if you can set your life goals realistically and plan well, you can achieve financial independence that allows you to be confident enough that you can have income on-demand wherever you are, whenever that is.

What is your opinion on the subject?