Leaving your kids’ financial literacy to the educational system and life experience is acceptable. The modern education syllabus would surely inject some financial literacy into the courses that your children would pass. However, starting their financial awareness at home is an even better idea. Think of it as an added advantage over others. It will form a sound foundation of financial management skills and set them on the right path to financial success, even if their major turns out to be in finance.

Finance management starts with creating a responsible personality for everyone, not just your children. It can increase their awareness regarding responsibility and management skills in other facets of life. You cannot teach your kids financial literacy in a day, nor can you quickly create the skill of finance management.

Teach your kids the financial language

For kids, the financial language does not have to be the fancy or tangling stock market terms like spread, call or put options.

Start with the basics to create some awareness among them. Let them know the basic terminologies like savings, income, and debts. Then, teach your children the difference between spending enough money and big spending.

At this stage of their lives, it’s essential to clear the simple financial literacy concepts only. For example, teach them how you earn your money, then explain how you segment the income for grocery, utility, bank loans, and other necessities.

Teach your kids the worthiness of money

It should not just be the materialistic list of commodities you can buy with money. Clarify the very basics of earning money and turning it into wealth. Also, cover the importance of financial independence and being able to help others only if they are financially strong enough to afford it. Finally, let them understand the correlation between earnings, savings, and investments.

Debts remain part of our lives, so do not skip that part. No matter what we do or how much we earn, there are different types of loans for different situations, and financial literacy calls for such knowledge. So let your children ask questions like:

- Why are debts inevitable?

- And how can you manage the debts?

- Are debts that bad a thing?

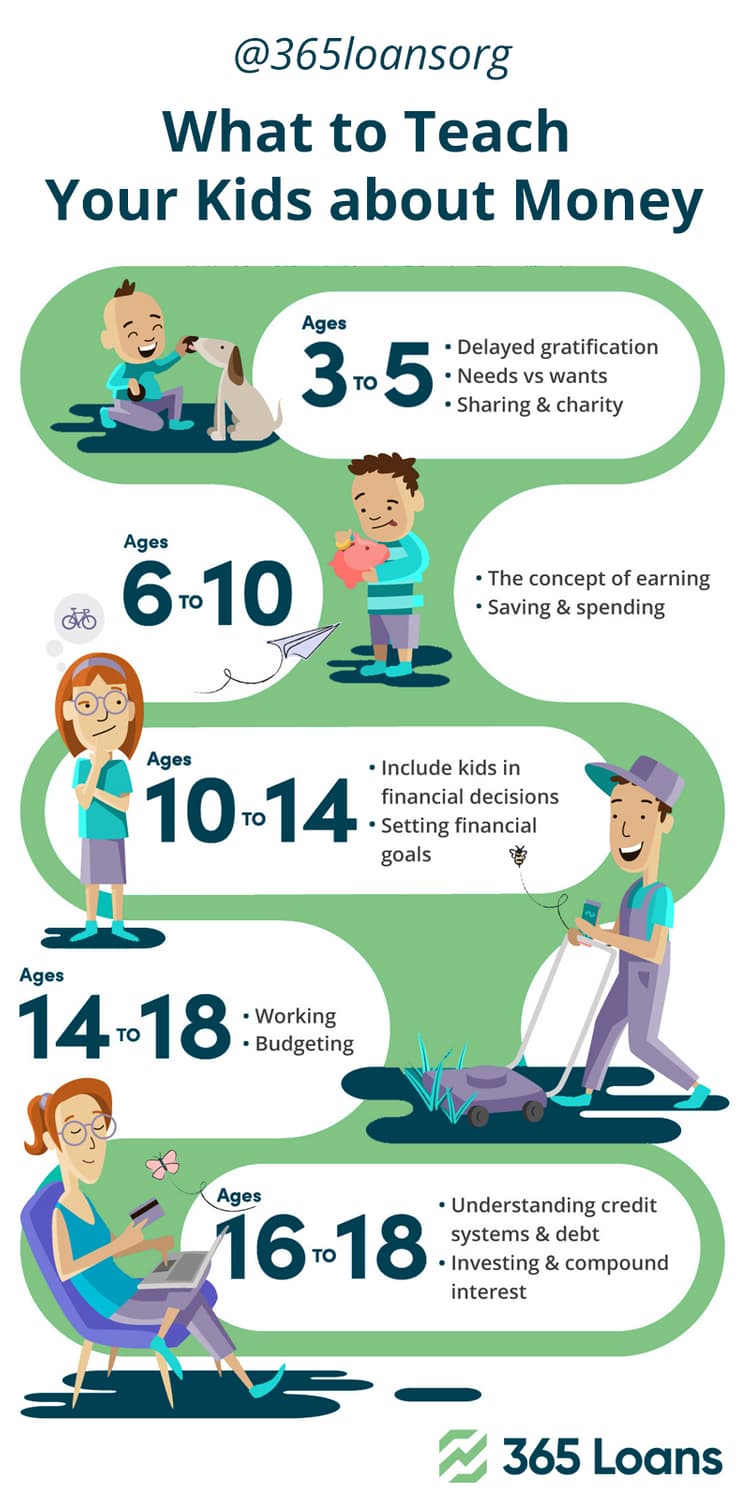

Here are some practical steps to let your children learn financial literacy. The more they handle it practically, the more they know and become responsible for managing finances.

Create budgets for your children with their participation

Let your kids participate in simple mathematics. Your budgeting lessons should include non-financial resources, like the importance of time management and remembering the time value of money. This will not be complicated and will help create a sense of responsibility and significance among them.

If they can learn how to match their spending with their allocated pocket money, it will make them good finance managers. Budgets often need revisits, for there is seldom a budget that does not get refinanced. Adapt that financial experience to explain budgetary control to your kids.

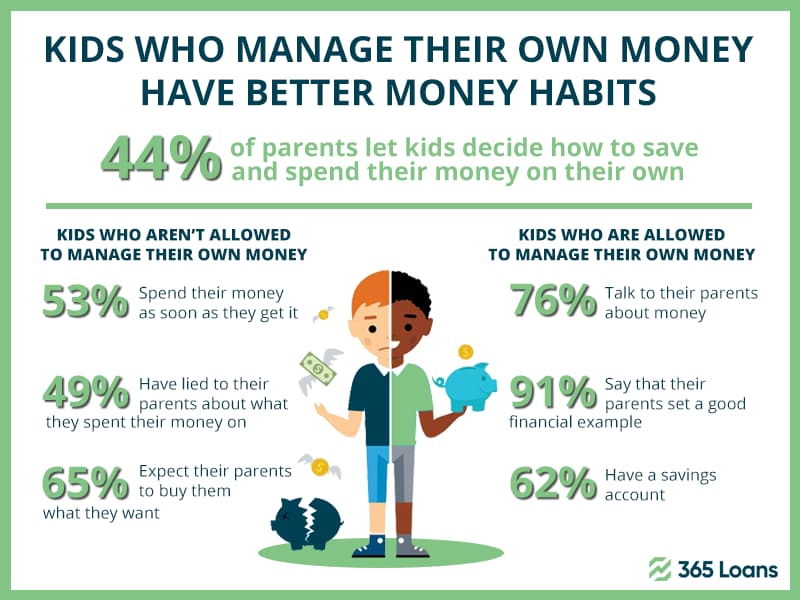

Give your children cash to handle

Giving your children cash to handle will make them realize the concepts into reality. They will learn budgeting, savings, and spending habits with cash management.

Once they start dealing with cash, take them to open a mini savings account at a bank or even at home. This slow transition is essential.

Let your children pay at the counters

Let them pay with your card, or give them cash to make the payments. Then, involve your kids with budgeting for groceries, paying at the counter, and matching the lists with actual spending. That is their practice of budgeting.

Open a minor bank account for your children

Take your children to the bank. A custodial or guardian bank account for children will practically set the tone of finance management. The institution is where they will learn the empirical correlation between earnings (their pocket money), spending (paying at counters), and savings (the remains of the income). So let them save some dollars each month and deposit them into their bank accounts. Then, slowly, the concepts of credit cards and debts will naturally emerge with their banking experience.

How to raise financially responsible children?

In a nutshell, raising children with financial responsibility is not just about teaching them about bank products. You can instruct your kids all day long about debt financing, but you must adapt the lessons with real-life examples, so they realize the power of each financial instrument. This way, they will learn the importance of debt financing and money earning, and you will make them responsible for their economic well-being. Let them know debts and credit cards incur costs and why we pay the interest on loans.

Nevertheless, personal finance management, in particular, relies more on human nature and habits than corporate finance. So let your children learn the art of finance management.