You ask the wrong question if you wonder how many credit cards you should carry in your wallet. Instead, make sure you have the appropriate variety of credit cards.

Perhaps you want to maximize your credit card benefits, get a welcome bonus, or pay off high-interest loans over a protracted initial 0% APR period. A second credit card can help fill in the gaps and help you reach your financial objectives as long as your credit score is high, and you use your card responsibly (such as paying your debt in full and on time).

Here are some compelling reasons to think about carrying a second credit card in your wallet, along with some crucial criteria to consider, whether you are searching for a specific perk your existing card does not provide or you want to improve the value of your spending with diverse rewards:

Compelling reasons to go for a second credit card

Unfortunately, many people apply for another card when they max out their primary credit card, which could backfire. However, if you can evaluate your financials objectively, there are potentially many financial benefits of applying for a second credit card.

1. Access to more credit

That is the apparent advantage of having a second credit card. The lenders evaluate your creditworthiness as a credit profile. A single credit card may not yield you enough fast credit, in any case. So if you apply for a second credit card, your total immediate access to fiat money will be more than the total first card limit.

2. Improve your credit score

Having two or three cards is one way to demonstrate your ability to manage your debt and credit responsibly. For example, if you can manage your credit card payments on time, a second credit card will significantly help you improve your credit score.

One of the critical metrics in FICO scores is evaluating the clients’ credit mix and credit utilization ratio. Once you avail of more significant credit limits with two credit cards, your debt management portfolio will increase as long as you:

- Make sure not to miss the minimum payment deadlines.

- Pay as early as possible and utilize both cards to give it a good mix.

3. Have an emergency plan

Suppose you lose your credit card. Then, you can typically get a replacement card from your bank as quickly as 72 hours only. But what if your lost card also had reached the maximum limit, or you need some extra credit and do not have any emergency savings?

Either way, having a second credit card will create a cushion of safety for you and your family. In addition, your second credit card can be your best companion on family vacations or foreign trips.

4. Benefit diverse rewards and benefits

Many credit card companies and banks offer a second credit card with additional benefits. Do not go for the temptation, however. Instead, choose your second credit card wisely to maximize the rewards and benefits that would rightly benefit you.

If you have a points and rewards first card, it will be wiser to choose a cashback credit card this time. However, if your monthly spending is primarily on groceries and gas, you should look for credit cards with rewards from stores and gas stations.

Your rewards and benefits can yield true impact if you manage both cards well. But fail to meet the minimum payment deadlines, and there will be higher interest charges and late payment fees.

Reasons NOT to go for a second credit card

Although carrying an extra credit card in your wallet can be helpful, it is not a good idea for everyone.

For example, if you now fit into any of the following categories, it could be preferable for you to stick with just one credit card — at least temporarily:

1. You have a hard time paying your primary credit card bill

You can indeed spread payments and due dates with two cards, but you will also have twice the chance to rack up debt. If you are not managing your current credit card bill well enough, it is better to consider moving on to a new one once you’ve established the positive habit of paying off a credit card in full and on time.

2. Low introductory rates and 0% APR tempt you

When you have a balance on one card, an offer for another card with no interest (or a low introductory rate) for 12 or 18 months may catch your eye. However, even though it might seem appealing, hold off on applying for that second card if you know you won’t be able to pay the bill in full within the promotional time.

In fact, you risk getting into even more debt if you do not carefully read the details of the balance transfer agreement.

3. You want to apply for a car or mortgage loan within 12 months

It is recommended to put off getting a second credit card if your current top priorities involve an application for a house loan or purchasing a new car.

According to banking experts, the first year after applying for a credit card causes that card to appear in the “new credit” part of your credit report, negatively impacting your credit score.

However, if you wait at least a year after creating a new line of credit to qualify for a mortgage, that new account has an opportunity to season and not appear new anymore. At that point, it works in your favor.

What to look for when choosing a second credit card?

A second credit remains an additional option for credit benefits for many people. If you have considered your options, made up your mind, and determined that the second card is still of interest to you, then keep the following in mind:

Low APR

Choose the second credit card with the minim annual percentage rate. You can evaluate different options that offer 0% interest for an extended period of credit utilization. Maximize the benefits with a low APR for the second credit card.

No annual fee

There are high annual charges with credit cards. In addition, some cards charge high credit transfer fees as well. These fees do not look substantial at first, but make up a large portion of your credit bill annually.

Compare some important fees schedule for annual fees, translation rates, late payment, and credit transfer fees.

Match the rewards to your lifestyle

Determine whether you are looking for the highest cashback percentage because you do lots of online shopping or want groceries and travel rewards. Cashback and earning points can save you significant amounts. However, they can only do so if you use them accordingly and pay your borrowed money within the grace period.

If you go with a credit card with a higher annual fee but also tempting rewards, consider if you can maximize the benefits from the rewards. If not, perhaps it will be best to stick with lower costs.

Read the fine print

Interest rates are significant and can differ between cards. Additionally, most cards offer a range of APRs, so be aware that any balance you carry on the card might be expensive if you don’t pay it off. You won’t know what your APR will be until you are authorized.

What’s more, look for the foreign transaction fees on your chosen credit card to know if you can rely on that card overseas.

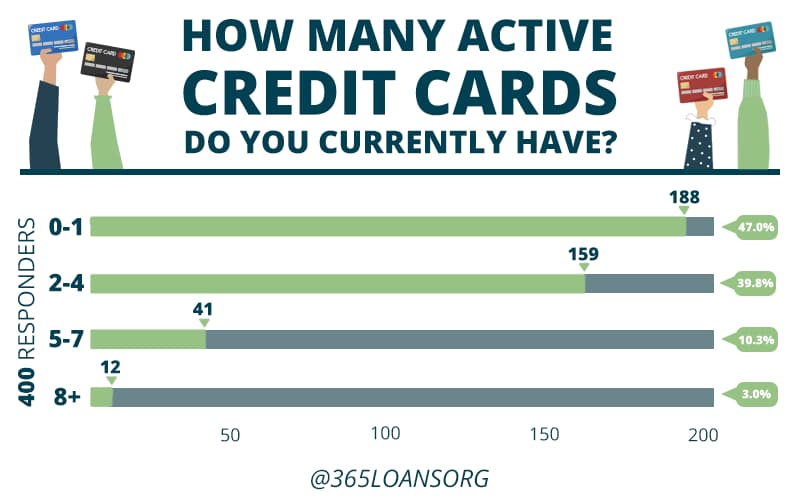

How many credit cards are too many?

Even two credit cards may be too many if you cannot pay your payments on time, do not need them, or do not intend to use them.

Still, two credit cards might be better than having only one if used with consideration. But having a third, a fourth one, or more, will probably not do you any good in the long run. Even the likelihood that the main benefits of your cards will overlap increases with the number of cards you have. And while regularly using a patchwork of several cards won’t help you accrue rewards, applying for cards to receive their sign-up incentives and closing them afterward might.

Multiple annual fees may deplete your rewards as your collection expands, making it more challenging to manage your finances. Furthermore, having many cards may make you appear dangerous to lenders, and lowering your credit score is another potential drawback. Even if you have paid them off, the simple fact that you have many open credit lines can make you appear to be a risk to the next lender.

It is therefore essential to only apply for and carry the cards you need and can justify using based on your credit score, ability to pay bills, and rewards objectives. Maintain a lean, mean, profit-generating array of credit cards, even though there is no specific amount that may be considered excessive. An excellent place to start is picking a second card that deserves a spot in your wallet.

Key Takeaway

Having several credit cards has many advantages, but only if you use them wisely. Do not try to game the system and burden yourself with thoughts of building credit scores and reaping maximum rewards.

“Credit is just a tool, not the ultimate goal.”

Know the advantages each card offers, your credit limit on each account, and especially your payment due dates to be sure that having many credit card accounts will help you, not hurt you.